Key Takeaways

- RITES' focus on aggressive order inflows and international contracts aims to drive top-line growth and enhance revenue in future fiscal years.

- Diversification of client base and strategic project mix improvements are geared towards stabilizing revenue and maintaining favorable net margins.

- Challenges in project execution and increased competition pressure margins, while aggressive order strategies strain execution and capital requirements, impacting profitability.

Catalysts

About RITES- Provides design, engineering consultancy, and project management services in the field of railways, highways, airports, metros, ports, ropeways, urban transport, inland waterways, and renewable energy.

- RITES has implemented a focused strategy on improved execution and aggressive order inflows, with the company achieving an all-time high order book of ₹8,000 crores. This strategy is expected to lead to significant top-line growth, with aspirations for at least 20% growth in the coming fiscal year, impacting future revenue positively.

- The company's successful bid for numerous turnkey and export orders, including significant contracts with Bangladesh and Mozambique, is anticipated to contribute substantially to revenue generation in the upcoming fiscal years, despite initial Y-o-Y declines, impacting earnings positively in FY '25-'26.

- RITES has been diversifying its client base in quality assurance, which is now 60% non-Indian Railways, indicating a more stable revenue source in the future despite increased competition, aimed at sustaining revenue and maintaining net margins.

- The company is aiming to maintain a blended EBITDA margin of around 20% and a PAT margin of 15-16% on a consolidated basis by optimizing the mix of consultancy and turnkey projects and focusing on high-margin projects, likely impacting net margins positively.

- The commitment to securing a new export order every quarter and the proactive steps taken in international markets, such as the setup in UAE to capture IMEC corridor opportunities, are forward-looking initiatives expected to drive revenue growth and support earnings expansion.

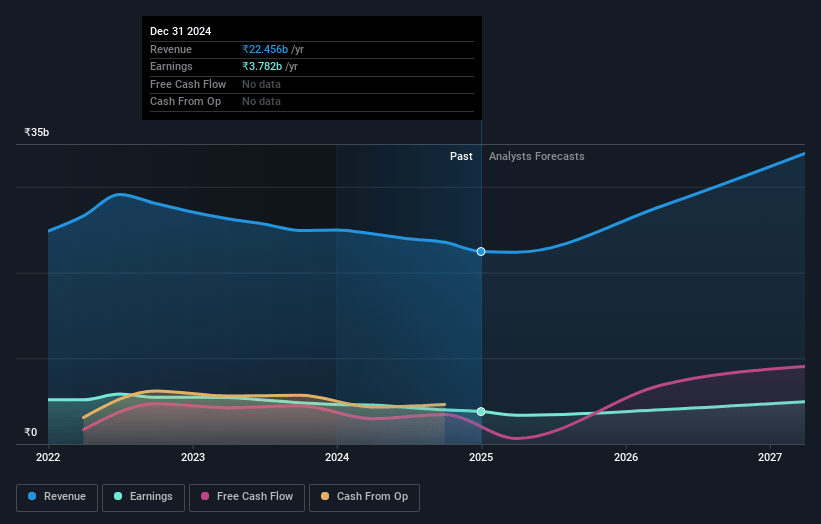

RITES Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming RITES's revenue will grow by 20.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 16.8% today to 13.9% in 3 years time.

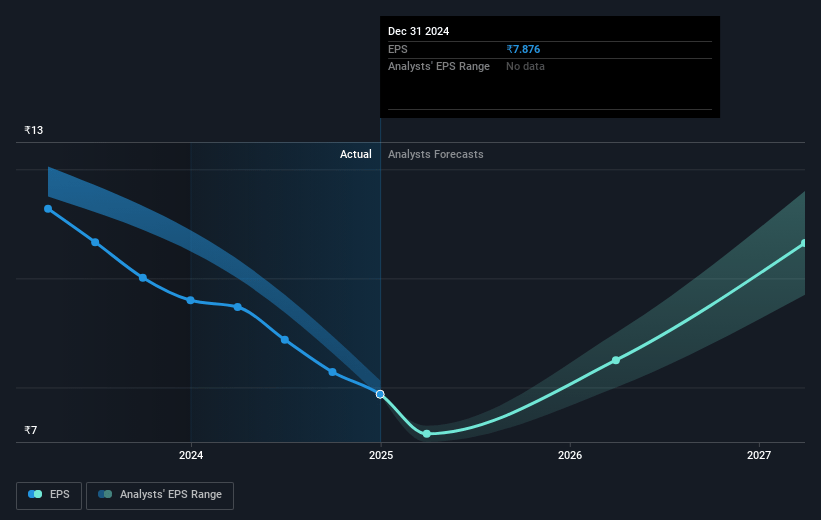

- Analysts expect earnings to reach ₹5.4 billion (and earnings per share of ₹11.74) by about May 2028, up from ₹3.8 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹4.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.1x on those 2028 earnings, up from 28.6x today. This future PE is greater than the current PE for the IN Professional Services industry at 27.0x.

- Analysts expect the number of shares outstanding to grow by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.84%, as per the Simply Wall St company report.

RITES Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The dip in year-over-year revenues, particularly in turnkey projects, highlights potential challenges in project execution, which could impact future revenue growth expectations.

- The shift in revenue sources, with quality assurance facing increased competition and reduced contribution, could pressurize net margins if not offset by other segments.

- Export orders, while promising for revenue generation, face uncertainties and have historically shown slow lead times before revenue realization, affecting earnings projections.

- The company's aggressive order inflow strategy, while beneficial, may put strain on execution capabilities and working capital requirements, potentially impacting net margins and overall profitability.

- Changes in export market dynamics, such as the shift from line of credit opportunities to global competitive tenders, have resulted in decreased margins in the export business, which could adversely affect earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹266.0 for RITES based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹301.0, and the most bearish reporting a price target of just ₹237.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹39.0 billion, earnings will come to ₹5.4 billion, and it would be trading on a PE ratio of 34.1x, assuming you use a discount rate of 12.8%.

- Given the current share price of ₹225.12, the analyst price target of ₹266.0 is 15.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.