Key Takeaways

- Introduction of new business verticals and easing supply constraints boost production capacity and diversify income, enhancing revenue potential.

- Continued order fulfillment with extended timelines and robust orders from Indian Railways support stable future revenue and improved production efficiency.

- Ongoing supply issues and project delays may impact production capacity, dampening revenue and earnings in the short term.

Catalysts

About Titagarh Rail Systems- Engages in the manufacture and sale of freight and passenger rail systems in India and internationally.

- The easing of wheel set supply constraints and the permission to use imported wheels could lead to increased production capacity, positively impacting revenue and earnings as the company overcomes previous production bottlenecks.

- The introduction of new business verticals in signaling and safety systems and shipbuilding is intended to capture growth in these sectors, potentially boosting future revenue and diversifying income streams.

- The extension of the delivery timeline for Vande Bharat trains without financial penalties allows for continued order fulfillment and potential revenue recognition and project execution throughout FY '26 and beyond.

- The Indian Railways' consistent push towards its 3 billion tonnes target by 2030 encourages further tenders, which could facilitate a robust order pipeline, contributing to stable or higher future revenue.

- The ramp-up in production capacity for metro coaches to 20 cars per month by FY '26 increases production efficiency and scale, potentially improving margins as fixed costs are spread over a larger production volume.

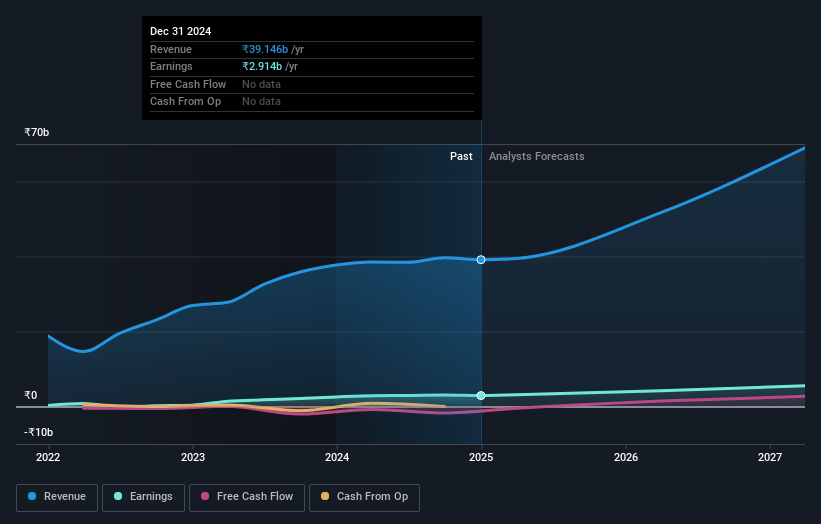

Titagarh Rail Systems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Titagarh Rail Systems's revenue will grow by 27.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.4% today to 8.1% in 3 years time.

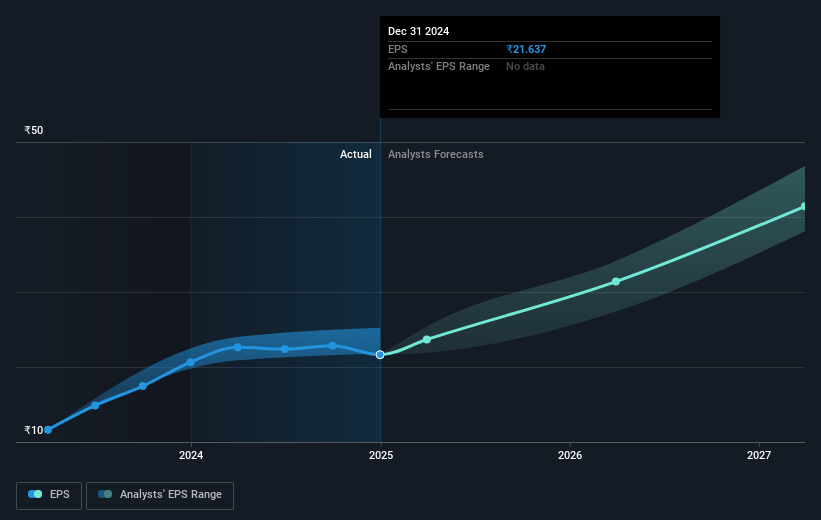

- Analysts expect earnings to reach ₹6.7 billion (and earnings per share of ₹50.2) by about May 2028, up from ₹2.9 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.9x on those 2028 earnings, up from 34.5x today. This future PE is greater than the current PE for the IN Machinery industry at 30.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.09%, as per the Simply Wall St company report.

Titagarh Rail Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faced production issues due to a shortage in wheel set availability from the rail wheel factory, impacting production rates and potentially affecting revenue in the short term.

- Delays in the Vande Bharat project execution could impact financial performance, particularly delayed revenue recognition, which may affect earnings.

- The general CapEx cycle mentioned was subdued, which could dampen future private sector wagon orders, impacting overall revenue.

- The ongoing wheel set supply issues, even after mitigation efforts, could continue to constrain wagon production capacity, affecting potential revenue.

- The ramp-up in the Passenger Coaches segment is dependent on capabilities and infrastructure development, such as the aluminum coach line, which could affect future profitability and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1200.0 for Titagarh Rail Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1425.0, and the most bearish reporting a price target of just ₹1050.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹81.8 billion, earnings will come to ₹6.7 billion, and it would be trading on a PE ratio of 35.9x, assuming you use a discount rate of 14.1%.

- Given the current share price of ₹747.1, the analyst price target of ₹1200.0 is 37.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.