Key Takeaways

- Improvements in order execution and project completion are expected to boost revenue recognition, profit margins, and earnings.

- Growth in industrial and BioCNG segments, alongside new orders, signals potential for increased revenue and profitability.

- Thermax faces challenges with project execution, revenue collection issues, BioCNG investment returns, inconsistent order inflow, and domestic product line reliance affecting profitability and growth.

Catalysts

About Thermax- Provides energy, environment, and chemical solutions in India and internationally.

- Thermax's recent backlog in revenue and profitability was cleared at the start of January '25. Improvements in order management and execution are expected to drive better revenue recognition and increase earnings.

- Challenges in project execution, specifically the completion of complex FGD projects, have been a drag on profitability. With these projects nearing completion, future quarters should benefit from unlocking retention money and releasing claims, which will potentially improve net margins.

- Thermax’s investment in BioCNG, despite past challenges, is starting to show potential as the company anticipates increased stability and performance. This progress could eventually translate into increased revenue and improved earnings as market conditions normalize.

- The company sees strong growth potential in its order pipeline, particularly with large industrial projects anticipated to begin shortly. The increased volume of orders, including international projects, should drive top-line growth and eventually improve overall earnings.

- Despite losses in some projects, the industrial products segment, particularly with newer and profitable services like heat pumps and water solutions, is showing robust order book growth and export potential. This trajectory is likely to drive consistent revenue growth and improve margins over time.

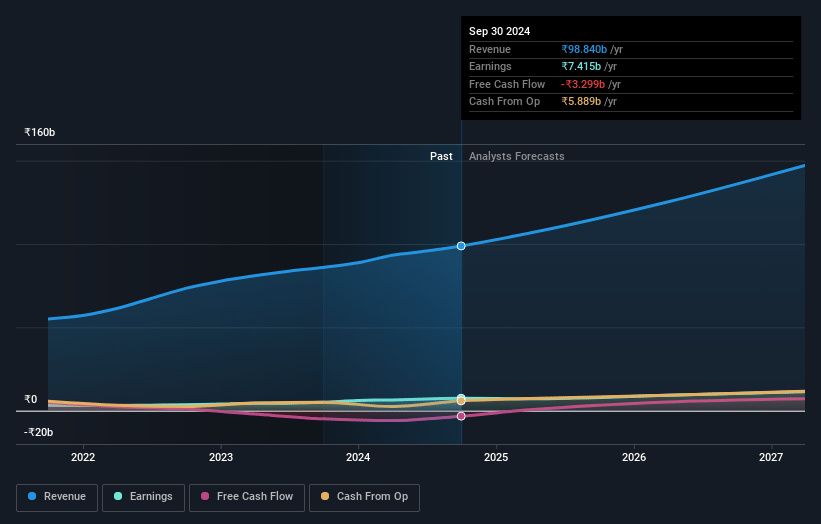

Thermax Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Thermax's revenue will grow by 13.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.1% today to 8.0% in 3 years time.

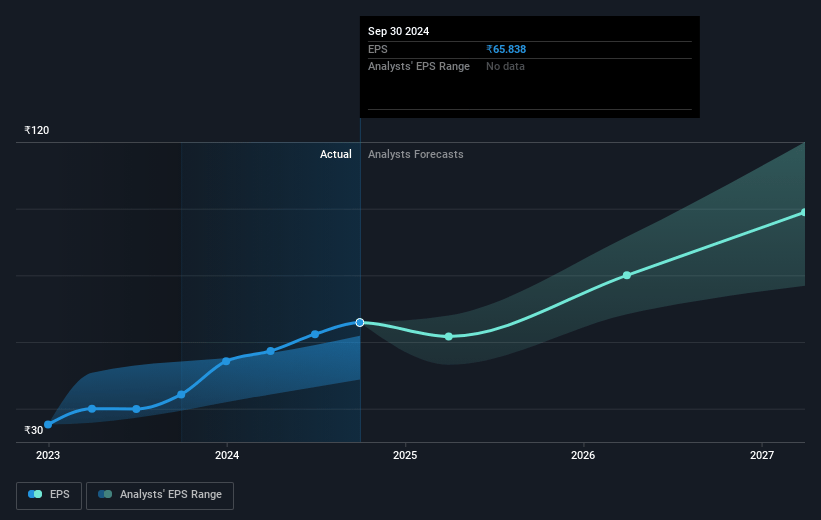

- Analysts expect earnings to reach ₹11.7 billion (and earnings per share of ₹103.15) by about March 2028, up from ₹6.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹8.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 52.5x on those 2028 earnings, down from 59.3x today. This future PE is greater than the current PE for the IN Machinery industry at 28.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.18%, as per the Simply Wall St company report.

Thermax Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Thermax faced significant project execution challenges. Specifically, the FGD projects and their Maithon unit resulted in unexpected cost overruns. If similar issues persist, they could negatively impact future profitability and net margins.

- There were issues with uncollected revenues, indicating possible operational inefficiencies or customer disputes, which could affect cash flows and earnings.

- The BioCNG segment has required substantial investment without immediate return, leading to financial hits. Continued underperformance from this area could hurt net margins and overall profitability.

- A substantial chunk of expected orders, particularly in large projects, has failed to materialize. This inconsistent order inflow could lead to volatility in revenue and long-term financial stability.

- The company's increased reliance on the domestic industrial product line, which shows slower growth compared to previous periods in other sectors, may impact the revenue growth rate and impose further strain on the company's expansion strategies.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹3677.238 for Thermax based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹5481.0, and the most bearish reporting a price target of just ₹2400.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹146.3 billion, earnings will come to ₹11.7 billion, and it would be trading on a PE ratio of 52.5x, assuming you use a discount rate of 14.2%.

- Given the current share price of ₹3262.2, the analyst price target of ₹3677.24 is 11.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives