Key Takeaways

- Mergers and strategic realignment initiatives aim to enhance operational efficiency and drive revenue growth through better business structure and focused segment growth.

- Capacity expansion and improved supply chain logistics underscore efforts to meet growing demand, enhancing production capabilities and potentially boosting revenue and margins.

- Geopolitical challenges and supply chain constraints pose risks to revenue and margins, while strategic reorganizations could impact financial outcomes and growth stability.

Catalysts

About Texmaco Rail & Engineering- Manufactures, sells, and provides services for rail and rail related products in India and internationally.

- The acquisition and merger of Texmaco West with Texmaco Rail & Engineering Limited, anticipated to conclude in 6 to 8 months, is expected to enhance operational efficiency and streamline the business structure, potentially leading to increased revenue and better net margins.

- The strategic transfer of the Infra-Rail and Green Energy segments into a 100% subsidiary within 12 to 15 months aims to focus on future growth in the EPC business, which could drive revenue and improve earnings.

- Texmaco Rail's plan to enhance capacity with a new foundry in Odisha by mid-next year, increasing total capacity to 80,000 metric tonnes, could meet both domestic and international demand more effectively, potentially boosting revenue.

- With India's government focus on logistics shifts, Texmaco anticipates steady demand for rail freight cars. Expansion in the private sector for specific rail freight solutions could provide meaningful revenue growth.

- The introduction of imported wheelsets by April 2026 is expected to resolve supply chain issues, which should allow for uninterrupted production and delivery of orders, positively impacting revenue and potentially improving net margins.

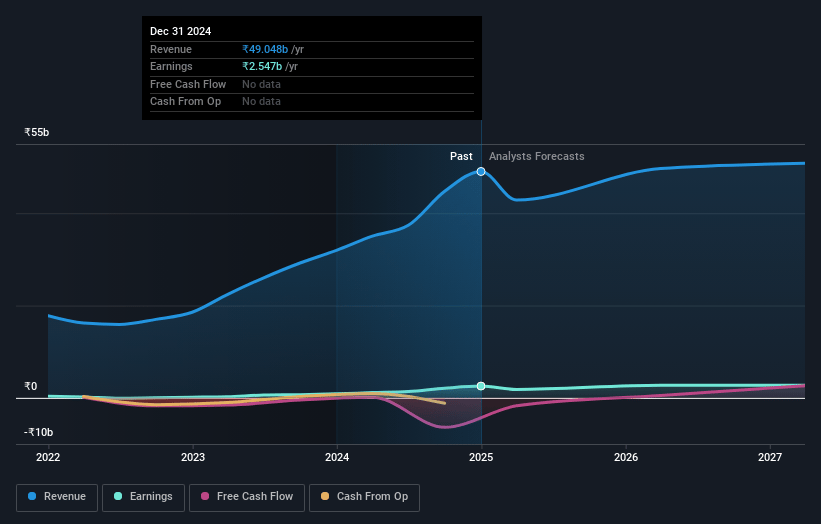

Texmaco Rail & Engineering Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Texmaco Rail & Engineering's revenue will grow by 1.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.2% today to 5.5% in 3 years time.

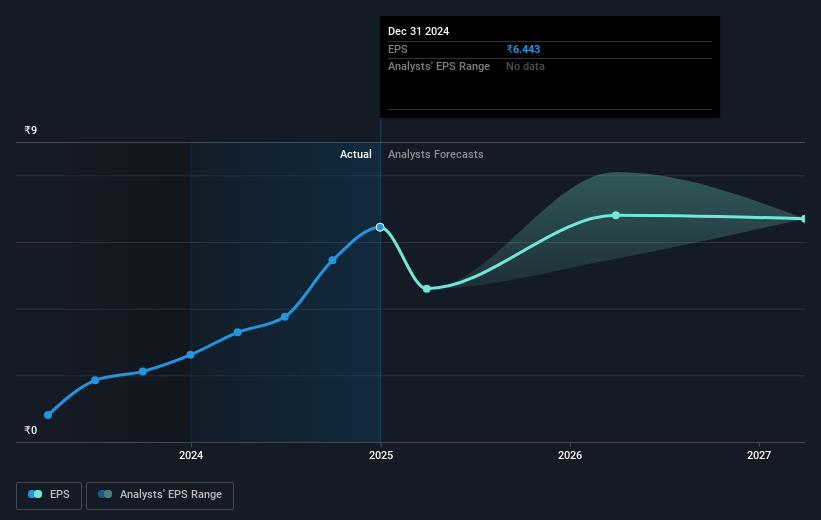

- Analysts expect earnings to reach ₹2.8 billion (and earnings per share of ₹6.86) by about May 2028, up from ₹2.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 45.2x on those 2028 earnings, up from 21.1x today. This future PE is greater than the current PE for the IN Machinery industry at 30.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.51%, as per the Simply Wall St company report.

Texmaco Rail & Engineering Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The shortage of wheelsets from Indian Railways impacted production in Q3 FY '25, which reflects supply chain risks that could affect revenue and earnings if persistent.

- The absence of an increase in the railway stock budget for the year suggests limited expansion in the TAM (Total Addressable Market) for freight wagons, which could potentially stagnate future revenue growth.

- Dependency on imports for wheelsets, mainly from China, and geopolitical factors like tariffs or supply disruptions could increase costs and impact net margins.

- Although there's an endeavor to improve, fluctuating financial expenses from interest rates have shown inconsistencies that could continue to affect net margins and earnings stability.

- The reorganization processes like the merger with Texmaco West Rail Limited and the transfer of the Infra-Rail and Green Energy business could bring about regulatory or execution risks, possibly affecting financial forecasts and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹214.0 for Texmaco Rail & Engineering based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹51.9 billion, earnings will come to ₹2.8 billion, and it would be trading on a PE ratio of 45.2x, assuming you use a discount rate of 14.5%.

- Given the current share price of ₹134.75, the analyst price target of ₹214.0 is 37.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.