Key Takeaways

- Expansion of the Bathware segment and new manufacturing facilities drive revenue growth and improve margins through optimized operations and increased demand.

- Government initiatives and strong brand recognition enhance volume growth, attract talent, and strengthen brand loyalty, boosting revenue and margins.

- Volatility in PVC prices and inventory inefficiencies pressure margins, while the unprofitable Bathware division and aggressive pricing strategies threaten long-term profitability.

Catalysts

About Prince Pipes and Fittings- Manufactures and sells piping solutions in India.

- Prince Pipes is leveraging its distributor management system to enhance demand forecasting, which should improve inventory management and consequently increase revenue and margins by optimizing stock levels.

- The company's Bathware segment, Aquel by Prince, is expanding with new showrooms and significant growth potential, which is anticipated to drive substantial revenue growth over the medium term.

- The commissioning of a new manufacturing facility in Begusarai, Bihar, with a capacity of 40,000 metric tons, is expected to cater to rising demand in East India, likely boosting revenue and improving operating margins due to economies of scale.

- The government's extension of the Jal Jeevan Mission should increase demand for pipes and fittings, providing a catalyst for volume growth, which can enhance revenue and margins as higher volumes lead to better fixed cost absorption.

- Recognition as a Great Place to Work and as a top brand in the pipes category can attract top talent and strengthen brand loyalty, potentially improving sales and net margins through enhanced productivity and brand-driven pricing power.

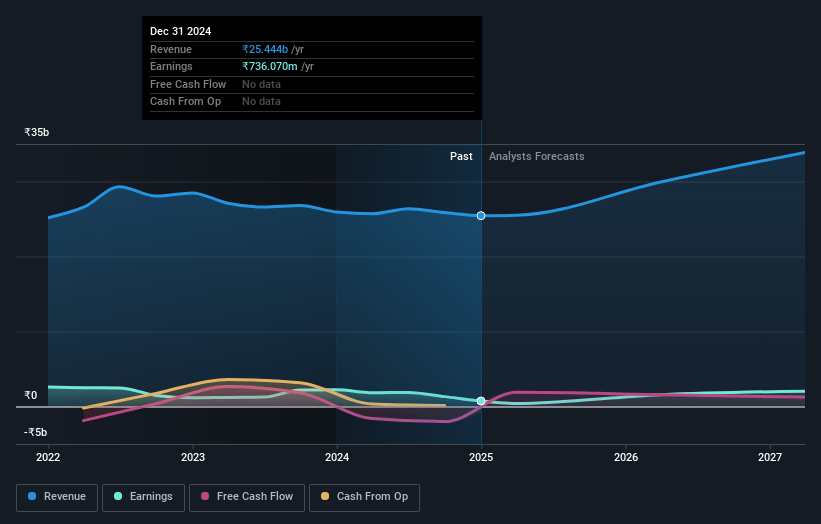

Prince Pipes and Fittings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Prince Pipes and Fittings's revenue will grow by 12.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.9% today to 8.0% in 3 years time.

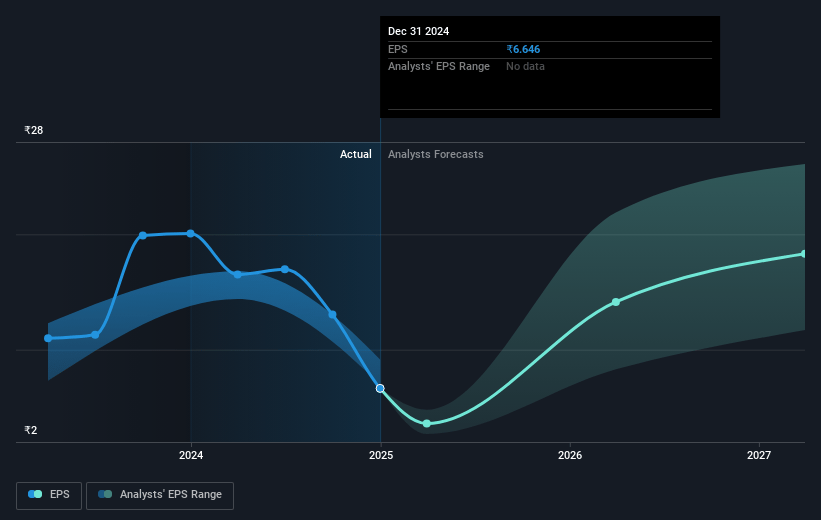

- Analysts expect earnings to reach ₹2.9 billion (and earnings per share of ₹25.58) by about May 2028, up from ₹736.1 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹1.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.9x on those 2028 earnings, down from 37.7x today. This future PE is lower than the current PE for the IN Building industry at 27.3x.

- Analysts expect the number of shares outstanding to decline by 0.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.59%, as per the Simply Wall St company report.

Prince Pipes and Fittings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Volatility in PVC prices and inventory losses have significantly impacted margins, with the company reporting an inventory loss of approximately ₹30 crores in the recent quarter and facing pressure due to lower volumes, which negatively affects gross and EBITDA margins.

- The company's high inventory days, increased to 102 days, suggest potential inefficiencies in inventory management that can strain working capital and increase financial risk.

- Aggressive pricing strategies to maintain market share during challenging times have led to a decrease in gross margins, indicating potential risks in sustaining profitability if competitive pressures continue.

- The new Bathware division, although a potential growth area, currently incurs losses of around ₹5-6 crores per quarter, which can negatively affect overall profitability if the division fails to scale up successfully.

- The company's reliance on the timely implementation of protective duties and improvement in market sentiment poses external risks that could delay expected volume and margin recovery, impacting revenue and earnings projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹398.667 for Prince Pipes and Fittings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹675.0, and the most bearish reporting a price target of just ₹246.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹36.2 billion, earnings will come to ₹2.9 billion, and it would be trading on a PE ratio of 22.9x, assuming you use a discount rate of 14.6%.

- Given the current share price of ₹251.21, the analyst price target of ₹398.67 is 37.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.