Key Takeaways

- Operational efficiency from consolidated manufacturing and increasing production could enhance margins and support revenue growth.

- Expanding international and high horsepower segments indicates potential long-term revenue boost with focused operational strategies.

- Transition to CPCB IV norms and operational consolidation pose short-term revenue risks due to market contraction and impacted production, with international sales volatility also evident.

Catalysts

About Kirloskar Oil Engines- Manufactures and distributes diesel engines, agricultural pump sets, electric pump sets, power tillers, generating sets, and spares in India and internationally.

- The demand for low and medium horsepower (LMHP) segments in the PowerGen business is expected to recover in the coming quarters, which could positively impact revenue as it returns to pre-emission norm change levels.

- Progress in the high horsepower (HHP) market, with an improving market share and confirmed orders, indicates potential revenue growth as the company strengthens its product portfolio in this segment.

- The consolidation of manufacturing plants into a single facility in Sanand is now complete, leading to operational efficiencies that can improve net margins as production levels are planned to increase.

- The international B2C segment showed an 18% growth driven by exports to regions like the Middle East and North Africa, indicating potential international revenue growth as the company focuses on setting up sustainable operations overseas.

- Improvement in the distribution and aftermarket segment, with a 15% growth for the quarter, suggests efforts to drive service penetration and enhance capabilities of service dealers could boost net margins through higher service-oriented revenues.

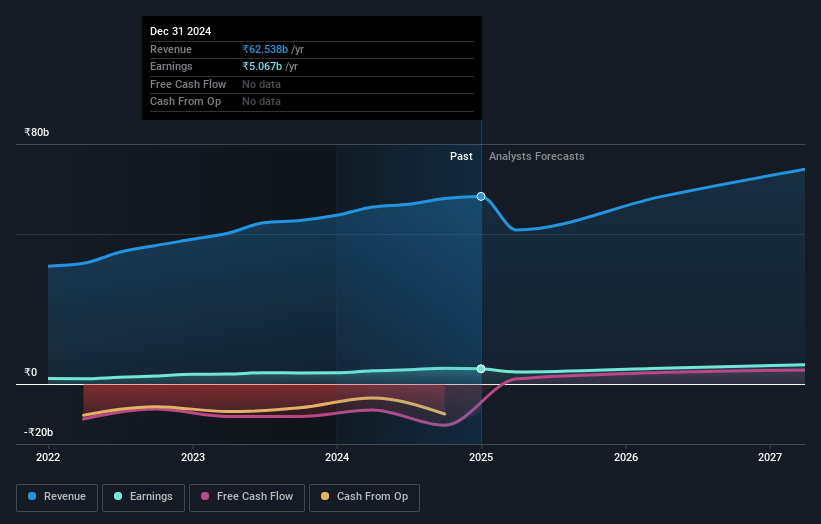

Kirloskar Oil Engines Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kirloskar Oil Engines's revenue will grow by 5.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.1% today to 9.0% in 3 years time.

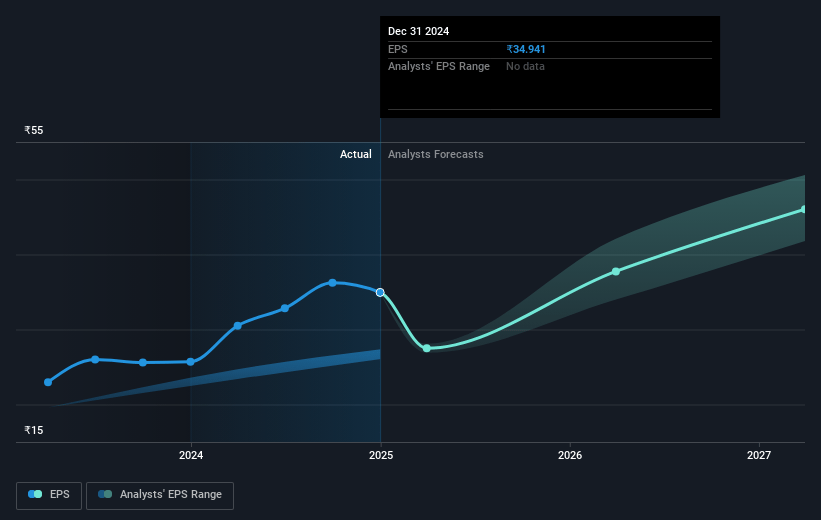

- Analysts expect earnings to reach ₹6.5 billion (and earnings per share of ₹45.43) by about April 2028, up from ₹5.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.0x on those 2028 earnings, up from 21.7x today. This future PE is greater than the current PE for the IN Machinery industry at 32.2x.

- Analysts expect the number of shares outstanding to grow by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.53%, as per the Simply Wall St company report.

Kirloskar Oil Engines Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The transition to CPCB IV norms has led to a market contraction of around 40% in the low and medium horsepower segments, which has impacted revenues in these categories. The company expects the demand to normalize, but this introduces short-term revenue risks.

- The consolidation of manufacturing units to a single plant affected production levels and numbers in Q3, highlighting operational risks that could negatively impact net margins if similar transitions occur in the future.

- Decline in market share within the low and medium horsepower segments due to CPCB IV changes poses a risk to revenue and profitability if not recaptured quickly.

- A 17% decline in international B2B sales, attributed to a lack of large one-time orders that impacted last year's performance, shows potential volatility in earnings from international operations.

- The Farm Mechanization business has seen sales halve due to a conscious pause and reevaluation of strategy, risking future revenues if the new strategy is delayed or ineffective.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1168.8 for Kirloskar Oil Engines based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1303.0, and the most bearish reporting a price target of just ₹1071.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹72.5 billion, earnings will come to ₹6.5 billion, and it would be trading on a PE ratio of 40.0x, assuming you use a discount rate of 15.5%.

- Given the current share price of ₹757.85, the analyst price target of ₹1168.8 is 35.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.