Key Takeaways

- Strategic expansion into EV and semiconductor markets, alongside geographical diversification, will leverage emerging opportunities and drive revenue growth.

- Investment in capacity, order fulfillment, and R&D will optimize production efficiencies and support stable net margin expansion.

- Dependence on aerospace and capacity constraints create risks for future growth, as demand fluctuations and execution delays threaten revenue and diversification prospects.

Catalysts

About Jyoti CNC Automation- Manufactures and sells metal cutting computer numerical control (CNC) machines in India, Asia, Europe, North America, South America, the Middle East, Africa, and internationally.

- Jyoti CNC's revenue growth strategy includes expanding its capacity to produce an additional 10,000 machines per year, which will enhance revenue generation once operational by December 2026. This expansion is expected to impact future revenue growth as it addresses current bottlenecks.

- The introduction of new models, including a focus on products for the electric vehicle (EV) and semiconductor industries, positions Jyoti CNC to capture emerging market opportunities. This product development is likely to boost revenue and earnings by tapping into high-growth sectors.

- With a significant order book, Jyoti CNC plans to expedite order delivery by expanding its manufacturing capacity. This strategy aims to sustain and improve net margins by optimizing production efficiencies and meeting customer expectations more rapidly.

- The company is increasing its global footprint with a notable presence in Europe via its subsidiary, Huron, and is targeting market expansion in the U.S. and China. This geographical diversification is anticipated to contribute positively to revenue streams and overall earnings.

- Jyoti CNC is investing in people development and R&D, focusing on high precision and quality. This investment is expected to enhance operational efficiencies, supporting stable net margin growth while reinforcing the company's ability to innovate and adapt to technological advancements.

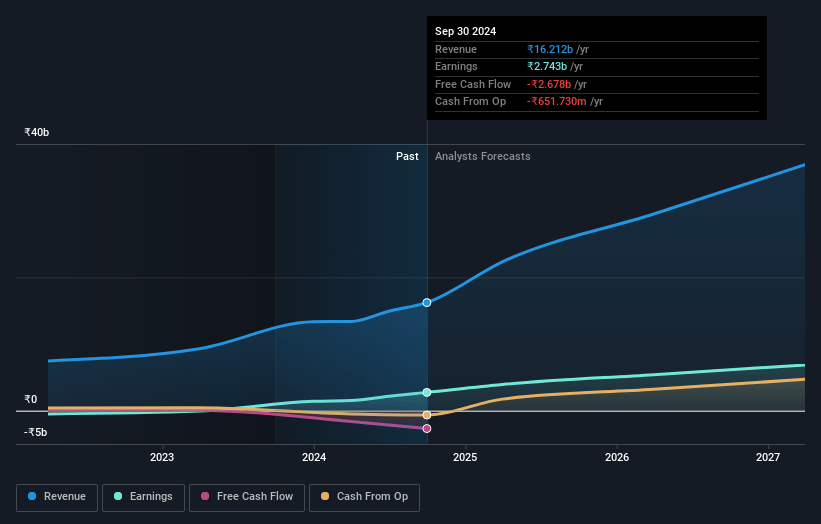

Jyoti CNC Automation Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Jyoti CNC Automation's revenue will grow by 35.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 18.1% today to 17.4% in 3 years time.

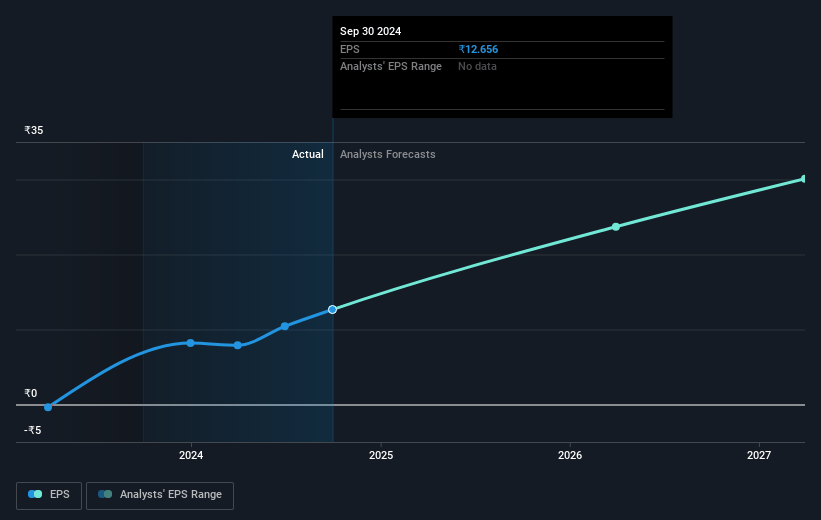

- Analysts expect earnings to reach ₹7.3 billion (and earnings per share of ₹32.01) by about May 2028, up from ₹3.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 56.6x on those 2028 earnings, down from 79.8x today. This future PE is greater than the current PE for the IN Machinery industry at 30.7x.

- Analysts expect the number of shares outstanding to decline by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.95%, as per the Simply Wall St company report.

Jyoti CNC Automation Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The slowdown in year-on-year revenue growth from 74% and 33% in the first two quarters to 19% in the third quarter indicates potential demand fluctuations and execution challenges, which could impact future revenue growth consistency.

- The company's current order book suggests a 2.5-year backlog at the present production run rate, revealing capacity constraints that may restrict revenue growth and delay order fulfillment.

- The lack of order intake in the EMS segment during the current quarter raises concerns about growth prospects and diversification, potentially impacting future revenue streams.

- Delays in capacity expansion and execution, such as those reported due to bottlenecks prior to September, may continue to impact revenue generation if additional infrastructure is not operational promptly.

- Heavy reliance on the aerospace sector, which constitutes a significant portion of the order book and revenue, poses a risk if there are downturns in this industry, potentially affecting EBITDA margins and overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1235.0 for Jyoti CNC Automation based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹42.1 billion, earnings will come to ₹7.3 billion, and it would be trading on a PE ratio of 56.6x, assuming you use a discount rate of 14.0%.

- Given the current share price of ₹1076.6, the analyst price target of ₹1235.0 is 12.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.