Key Takeaways

- Expansion into LNG and specialized cryogenic solutions leverages clean fuel trends, unlocking new high-margin verticals and supporting operational performance.

- Strong order wins and policy-driven domestic advantages enhance revenue stability, market share, and resilience against international competition.

- Intensifying global competition, volatile input costs, policy risks, and unproven new segments challenge sustainable growth and margin stability for INOX India.

Catalysts

About INOX India- Manufactures and supplies cryogenic liquid storage and transport tanks for gas companies and engineering, procurement, and construction (EPC) companies in India and internationally.

- INOX India's expansion in LNG fuel tank capacity and streamlined production processes-supported by regulatory changes and increasing adoption of LNG as a clean industrial and transport fuel-position the company to capture accelerated demand, which should drive revenue growth and improved operational leverage (impact: topline and EBITDA margin expansion).

- Entry and strong momentum in specialized, high-spec cryogenic solutions (e.g., ultra-high purity ammonia ISO containers and CO2 battery systems) align with the global transition toward clean fuels, semiconductors, and advanced storage, opening new high-margin verticals and diversifying future revenue streams (impact: higher net margins and revenue growth).

- Significant order wins in cryogenic infrastructure for international scientific projects (e.g., ITER, potential ISRO/space contracts) and continued preference from global clients highlight INOX India's ability to capitalize on rising R&D and space sector investments-providing long-term order visibility and revenue diversification (impact: revenue stability and order book growth).

- Ongoing success in expanding global approvals and distribution for the Keg business, along with potential scaling from major customers like Heineken and ABInBev, set the stage for exponential volume growth in a segment with cost advantages and margin improvement potential as capacity utilization rises (impact: revenue acceleration and margin improvement).

- Indian government's 'Make in India' and infrastructure development policies, combined with rising localization and anti-dumping measures against imports (especially from China), provide structural advantages for INOX India to gain domestic market share, support steady replacement demand, and further de-risk against global competition (impact: sustained domestic revenue and margin resilience).

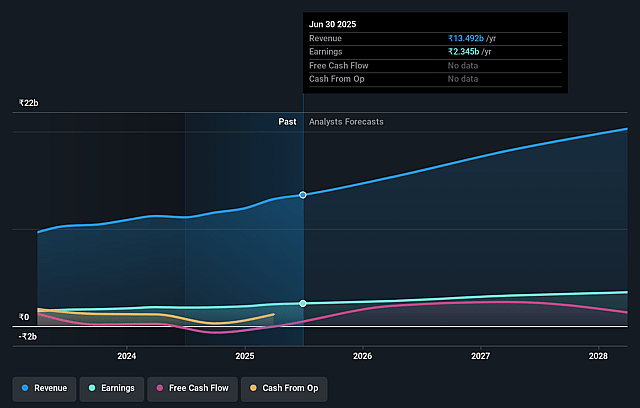

INOX India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming INOX India's revenue will grow by 16.7% annually over the next 3 years.

- Analysts are assuming INOX India's profit margins will remain the same at 17.4% over the next 3 years.

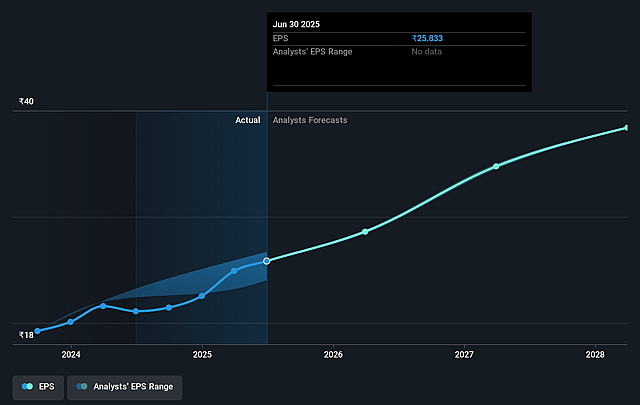

- Analysts expect earnings to reach ₹3.7 billion (and earnings per share of ₹37.48) by about August 2028, up from ₹2.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 50.3x on those 2028 earnings, up from 41.5x today. This future PE is greater than the current PE for the IN Machinery industry at 32.2x.

- Analysts expect the number of shares outstanding to grow by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.56%, as per the Simply Wall St company report.

INOX India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing global competition-especially from Chinese and European cryogenic equipment manufacturers-poses a risk of price wars and market share erosion, which could compress margins and pressure long-term revenue growth.

- Margins could be at risk if raw material costs (notably stainless steel) rise and INOX India has limited ability to pass on cost increases to customers in its highly competitive export markets, as management indicated a commitment to fixed margins amid global competition.

- The company's expansion into new segments like CO2 battery storage and ultra high-purity ammonia containers, while promising, is early stage and represents unproven revenue and earning streams; initial orders are small, so outsized expectations may not materialize and could impact future growth rates if adoption is slower than anticipated.

- Dependence on antidumping duties and favorable tariffs-especially in the beverage Keg segment-means that adverse policy shifts or the removal of such protections could significantly impact the company's competitiveness and export-derived revenues.

- The slow pace of government-driven LNG fueling station rollouts and the need for major regulatory/policy support suggest that ambitious capacity expansions could lead to underutilization or slower revenue realization if LNG adoption as a transport fuel does not proceed as quickly as forecasted, impacting both top-line growth and return on capital.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1385.0 for INOX India based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹21.4 billion, earnings will come to ₹3.7 billion, and it would be trading on a PE ratio of 50.3x, assuming you use a discount rate of 14.6%.

- Given the current share price of ₹1071.8, the analyst price target of ₹1385.0 is 22.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.