Key Takeaways

- Significant order inflow and redevelopment projects are expected to substantially boost revenue and margin growth.

- Successful resolution of stressed real estate projects and aggressive order execution indicate strong earnings and profit margin potential.

- Reliance on large redevelopment and government projects exposes NBCC to regulatory, market, and policy risks, impacting revenue and project timelines.

Catalysts

About NBCC (India)- Engages in project management consultancy, engineering procurement and construction, and real estate development businesses in India and internationally.

- The significant order inflow, including the ₹9,137 crores for Amrapali Phase 2 and ₹9,445 crores for Supertech projects, is expected to contribute substantially to revenue growth in the coming years.

- The completion of major redevelopment projects such as Nauroji Nagar and Sarojini Nagar is anticipated to boost revenues and margins due to sales and leasing opportunities at these sites.

- The company’s successful foray into resolving stressed real estate projects, like Amrapali, indicates potential for increased PMC charges leading to higher net margins and earnings.

- Under its existing land bank, specifically the Ghitorni project, there is substantial potential for realizing revenues of ₹8,000 crores, which could significantly enhance future earnings and profit margins upon development.

- The focus on aggressive order awarding and execution, alongside historical business secured worth ₹39,600 crores stand-alone, suggest a strong pipeline to drive top-line and margin expansion through economies of scale.

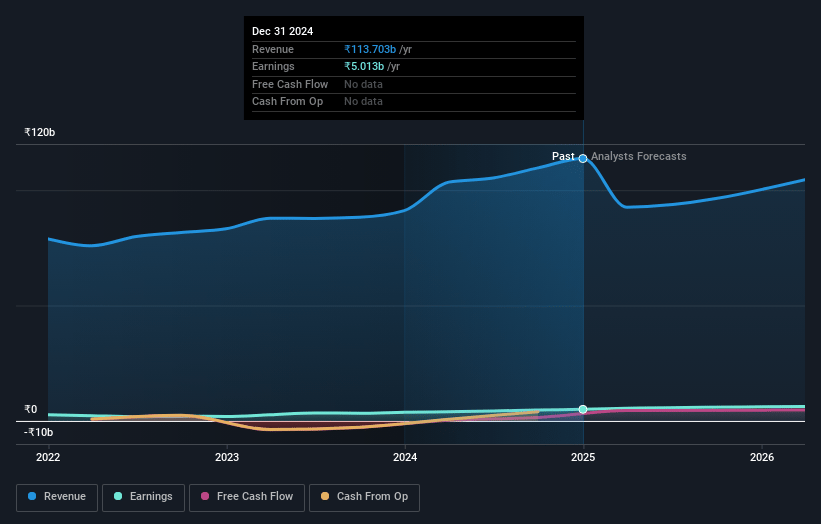

NBCC (India) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NBCC (India)'s revenue will decrease by 6.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.4% today to 8.9% in 3 years time.

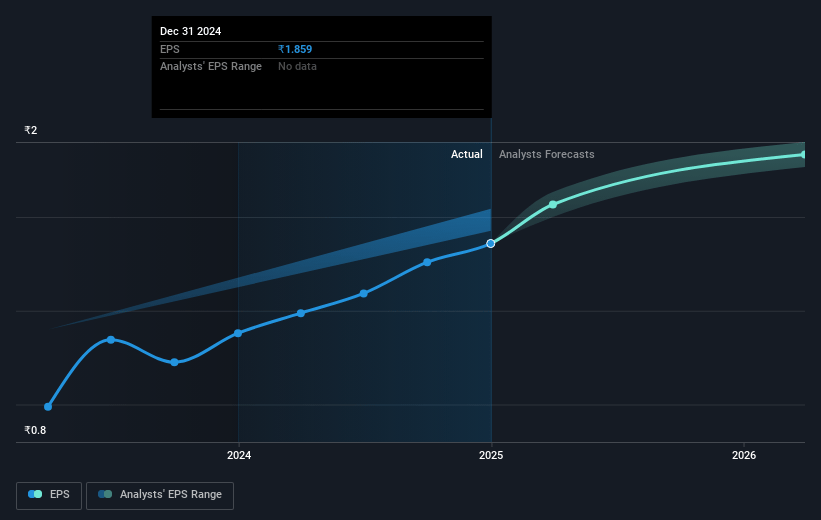

- Analysts expect earnings to reach ₹8.3 billion (and earnings per share of ₹3.09) by about April 2028, up from ₹5.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 57.6x on those 2028 earnings, up from 46.9x today. This future PE is greater than the current PE for the IN Construction industry at 20.2x.

- Analysts expect the number of shares outstanding to grow by 0.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.92%, as per the Simply Wall St company report.

NBCC (India) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Execution delays and slower growth in key projects due to environmental and regulatory challenges, such as the NGT ban affecting construction in Delhi, could impact revenue recognition and project timelines.

- The ongoing dispute over the Ghitorni land parcel, affecting 10 out of 32 acres, may delay potential revenue generation and real estate development profits if not resolved promptly.

- Heavy reliance on large-scale redevelopment projects could expose NBCC to market fluctuations and financing challenges, potentially impacting net margins and earnings stability.

- Dependence on government contracts and publicly funded projects may expose NBCC to risks associated with policy shifts and budgetary constraints, impacting revenue streams.

- A significant portion (38%) of NBCC's order book is tied to redevelopment projects which follow a self-sustainable model; any delay in securing sales or funding for these projects could adversely affect cash flows and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹118.333 for NBCC (India) based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹94.2 billion, earnings will come to ₹8.3 billion, and it would be trading on a PE ratio of 57.6x, assuming you use a discount rate of 13.9%.

- Given the current share price of ₹87.03, the analyst price target of ₹118.33 is 26.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.