Last Update 06 Sep 25

With no change in key valuation metrics such as the discount rate (14.53%) and future P/E (53.86x), the consensus analyst price target for Timken India remains steady at ₹3392.

What's in the News

- Board meeting scheduled to consider and approve unaudited financial results for the quarter ending June 30, 2025.

Valuation Changes

Summary of Valuation Changes for Timken India

- The Consensus Analyst Price Target remained effectively unchanged, at ₹3392.

- The Discount Rate for Timken India remained effectively unchanged, at 14.53%.

- The Future P/E for Timken India remained effectively unchanged, at 53.86x.

Key Takeaways

- Expansion of domestic manufacturing and entry into higher-value products is set to boost margins and reduce reliance on imports.

- Diversifying into new markets and leveraging advanced parent technology will help stabilize earnings and drive multi-year growth opportunities.

- Dependence on cyclical sectors, limited diversification, and export risks threaten stable growth, with margin pressures and challenges in scaling new capacities weighing on profitability.

Catalysts

About Timken India- Manufactures, sells, and distributes tapered and other roller bearings, components, accessories, and mechanical power transmission products in India, the United States, and internationally.

- Ramp-up of the new Bharuch plant, with target utilization of 45–50% by year-end and a strong pipeline of customer qualifications, positions Timken India for substantial incremental revenue and operating leverage benefits as domestic and export volumes scale.

- Ongoing urban infrastructure investments-railways, metros, and highways-and policy continuity are sustaining long-term demand for bearings, with Timken India well-placed to tap multi-year growth in rail, process, and industrial segments, supporting stable top-line and order book visibility.

- The company's push into higher-value product categories (e.g., plain bearings, sealed tapered roller bearings) and efforts to expand the indigenous manufacturing footprint (Jamshedpur, Bharuch) will drive margin expansion by reducing import dependence and capturing localization incentives.

- Diversification into non-traditional end-markets and global geographies-including new applications in energy, cement, and overseas markets beyond North America-are expected to mitigate export concentration risks and smooth earnings volatility as global supply chains shift toward India.

- Access to advanced technologies and product lines from the parent (e.g., lubrication, chains, couplings) offers a pipeline of future portfolio additions, enabling Timken India to participate in the broader trend of integrated motion solutions, which may result in higher revenue growth and improved net margins over the medium to long term.

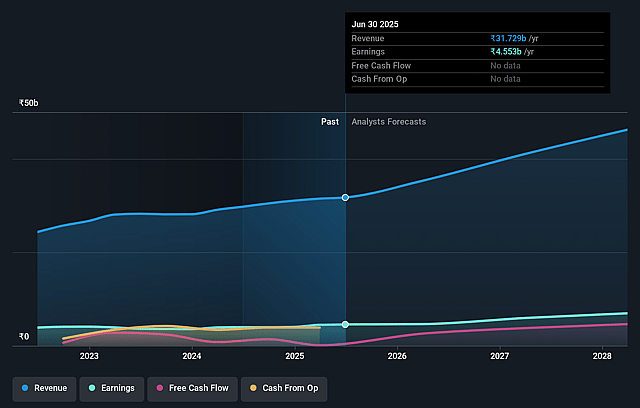

Timken India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Timken India's revenue will grow by 14.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.3% today to 14.9% in 3 years time.

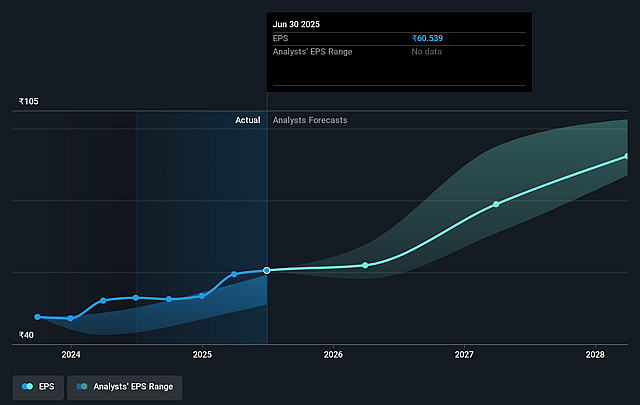

- Analysts expect earnings to reach ₹7.1 billion (and earnings per share of ₹94.32) by about September 2028, up from ₹4.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 53.9x on those 2028 earnings, up from 48.4x today. This future PE is greater than the current PE for the IN Machinery industry at 32.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.53%, as per the Simply Wall St company report.

Timken India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent macroeconomic uncertainty and cyclical demand weakness in key end-user sectors such as railways, steel, cement, and mining could lead to inconsistent volume growth, directly impacting revenue stability and lowering earnings predictability over the long term.

- Heavy reliance on exports, especially to North America and a few other regions, exposes the company to risks from tariff changes and demand fluctuations in international markets; protracted weakness in the U.S. truck and rail industries or persistent high tariffs could compress export revenues and profit margins.

- Timken India's current portfolio remains deeply tied to traditional bearings, and although there is some movement towards plain bearings and potential non-bearing segments, any lag in expanding solutions compared to global peers may limit participation in the growing market for integrated motion solutions, thereby risking both revenue growth and margin enhancement.

- Margin compression is evident due to fluctuating input costs, weaker product mix, and underutilization of new capacities; absent a significant rebound in volume or operational leverage, gross margin and EBITDA may remain below historical highs, potentially impacting net margins and long-term earnings growth.

- CapEx of ₹150+ crores for capacity expansion increases fixed overheads and depreciation pressures; if volume ramp-up or customer qualification for new products is slower than expected, return on capital and asset turn targets may fall short, further straining bottom-line performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹3392.0 for Timken India based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹3934.0, and the most bearish reporting a price target of just ₹2629.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹47.7 billion, earnings will come to ₹7.1 billion, and it would be trading on a PE ratio of 53.9x, assuming you use a discount rate of 14.5%.

- Given the current share price of ₹2931.45, the analyst price target of ₹3392.0 is 13.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.