Key Takeaways

- Strong order pipeline and bid book suggest significant near-term and future revenue growth opportunities, enhancing overall business prosperity.

- Expansion projects and new market entries indicate potential revenue streams and increased market reach, contributing to substantial top-line growth.

- Logistical and geopolitical issues, unproven projects, rising debt, and raw material cost fluctuations threaten revenue growth and margins.

Catalysts

About Man Industries (India)- Manufactures, processes, and trades in submerged arc welded pipes and steel products in India.

- Man Industries has a strong order pipeline of ₹2,900 crores to be executed within the next 6 to 12 months, which can drive significant revenue growth in the near term as these orders are fulfilled.

- The company's bid book pipeline of ₹15,000 crores indicates a strong potential pipeline for future orders, which could significantly increase future revenue and overall business growth.

- The upcoming projects in Saudi Arabia and Jammu are progressing on schedule, with production expected to start in Q3 of FY '26. These projects are expected to contribute substantial additional revenues, boosting overall top-line growth.

- The ERW plant has started exporting ERW pipes, potentially opening new revenue streams and increasing the company's market reach, which can have a positive effect on net earnings.

- Man Industries is anticipating a 25% growth in standalone business for FY '26, projecting total revenues of around ₹4,000 crores driven by increased production capacity and order execution, which suggests potential earnings growth and improved net margins.

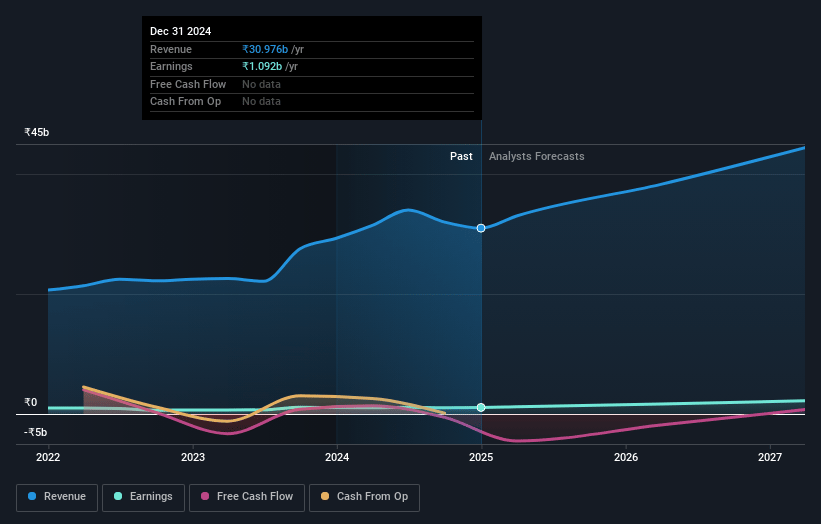

Man Industries (India) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Man Industries (India)'s revenue will grow by 17.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.5% today to 5.5% in 3 years time.

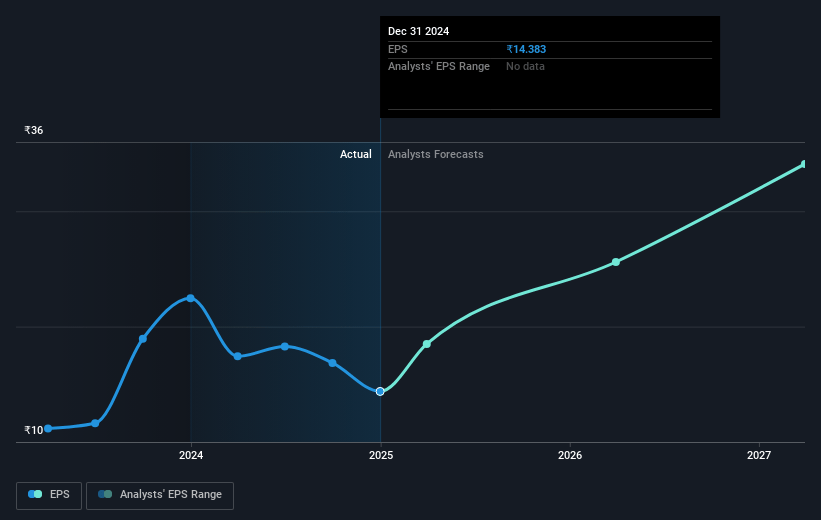

- Analysts expect earnings to reach ₹2.7 billion (and earnings per share of ₹43.6) by about May 2028, up from ₹1.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.7x on those 2028 earnings, down from 16.2x today. This future PE is lower than the current PE for the IN Construction industry at 21.1x.

- Analysts expect the number of shares outstanding to decline by 1.64% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.44%, as per the Simply Wall St company report.

Man Industries (India) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's standalone and consolidated total revenue for Q3 FY '25 declined by 12% and 13% respectively on a Y-o-Y basis, partly due to delayed shipments owing to non-availability of vessels, which could continue to impact revenue and profitability if logistical issues persist.

- The new projects in Saudi and Jammu, which are anticipated to significantly contribute to future revenues, are still in their early stages and any delays or execution issues could impact projected revenue growth and net margins in FY '26 and beyond.

- The company plans to raise a substantial amount of debt (₹815 crore) to finance its expansion projects, which could impact future net margins if not managed efficiently, especially if the new plants do not generate expected revenues timely.

- There is a dependency on international markets, particularly the Middle East, which constitute a significant portion of their revenue. Any geopolitical or economic disruptions in these regions could adversely affect revenue and earnings.

- Fluctuations in raw material prices, particularly steel, have previously impacted revenue figures and remain a risk to future revenue stability and net profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹409.0 for Man Industries (India) based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹49.7 billion, earnings will come to ₹2.7 billion, and it would be trading on a PE ratio of 13.7x, assuming you use a discount rate of 14.4%.

- Given the current share price of ₹272.7, the analyst price target of ₹409.0 is 33.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.