Key Takeaways

- Diversification into oil, gas, and other industries aims to boost revenue growth and reduce sector dependency.

- Operational efficiency improvements and cost optimization in manufacturing are expected to enhance net and EBITDA margins.

- GMM Pfaudler's reliance on cyclical markets and rising competition pressures margins, highlighting the necessity for diversification and effective cost management for sustained growth.

Catalysts

About GMM Pfaudler- Designs, manufactures, installs, and services corrosion-resistant glass lined equipment used in the chemical, pharmaceutical, and other industries in India and internationally.

- GMM Pfaudler is focusing on diversification to reduce its reliance on the chemical and pharma sectors, aiming to enter new industries such as oil and gas, petrochemicals, and semiconductors which have a larger market and potential for higher growth. This diversification strategy is expected to impact revenue growth positively.

- The company is working on programs to optimize and rationalize its manufacturing footprint, including moving production from high-cost regions to lower-cost countries like Poland and India. This strategy is likely to enhance operational efficiency, positively impacting net margins.

- GMM Pfaudler is intensifying its emphasis on expanding its service business, with expectations that service revenue will contribute significantly as it has higher margins compared to original equipment. This expansion is anticipated to improve overall earnings.

- There is an ongoing investment in improving cost structures through initiatives and projects in India and internationally, such as rationalizing production facilities, which should help improve EBITDA margins over the coming quarters.

- The company is witnessing increased order intake and backlog, particularly from non-glass lined businesses and newer industry segments, positioning them for revenue growth as the orders convert to future revenue streams in the upcoming quarters.

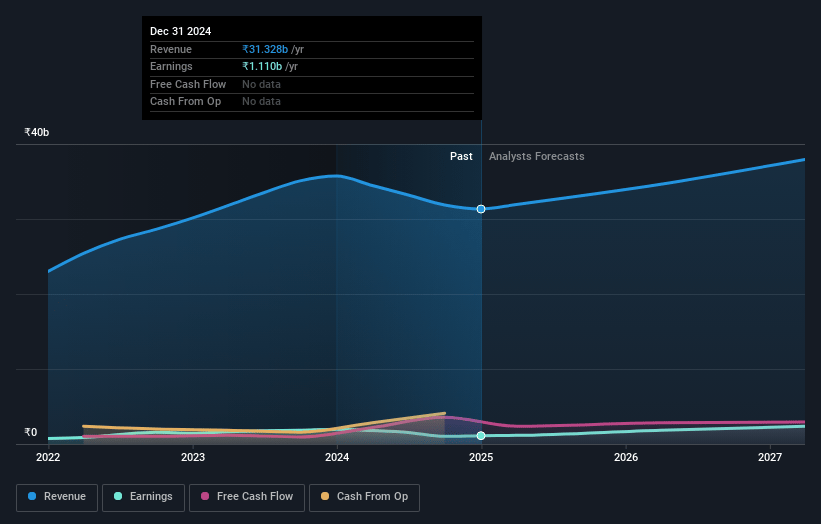

GMM Pfaudler Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming GMM Pfaudler's revenue will grow by 8.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.5% today to 7.5% in 3 years time.

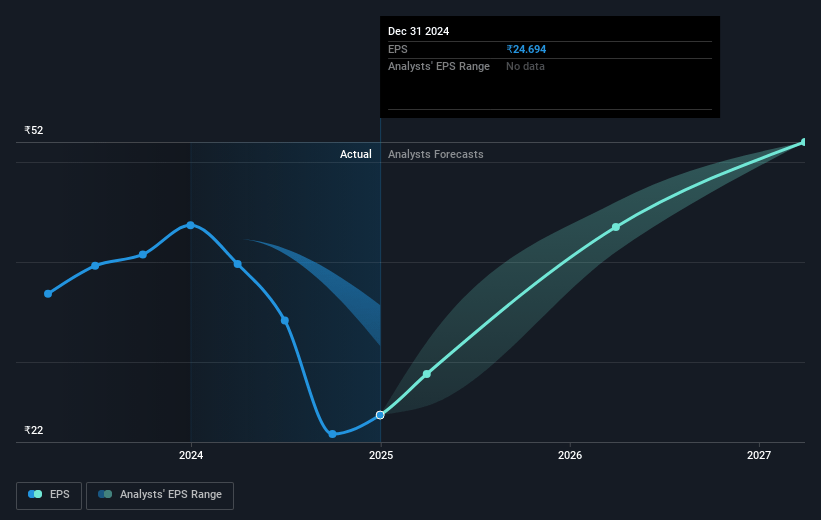

- Analysts expect earnings to reach ₹3.0 billion (and earnings per share of ₹66.98) by about February 2028, up from ₹1.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.7x on those 2028 earnings, down from 44.6x today. This future PE is greater than the current PE for the IN Machinery industry at 30.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.66%, as per the Simply Wall St company report.

GMM Pfaudler Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The chemical industry, a major part of GMM Pfaudler's order intake, is experiencing a slowdown, especially in the agrochemical sector, which could negatively impact revenue growth.

- The company acknowledges that its heavy reliance on the cyclical chemical and pharmaceutical markets may require diversification, suggesting a risk to sustained revenue and earnings without successful expansion into other sectors.

- Increased competition in India's glass line business is affecting pricing and potentially squeezing margins, which could pose a risk to maintaining or growing net margins.

- The international business is experiencing a slowdown, particularly in high-cost regions like China and Europe, raising concerns about potential revenue declines and margin compression unless cost rationalization strategies are effectively implemented.

- GMM Pfaudler’s strategy to consolidate manufacturing and shift production to lower-cost regions like Poland and India involves execution risk, which, if not managed well, could impact operational efficiency and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1950.0 for GMM Pfaudler based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹2300.0, and the most bearish reporting a price target of just ₹1600.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹40.3 billion, earnings will come to ₹3.0 billion, and it would be trading on a PE ratio of 42.7x, assuming you use a discount rate of 14.7%.

- Given the current share price of ₹1101.7, the analyst price target of ₹1950.0 is 43.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives