Key Takeaways

- Relying on new contracts in Healthcare may not yield immediate revenue due to regulatory approvals and market readiness, risking stock overvaluation.

- Expansion efforts face delays in profitability and revenue growth due to low current machine utilization, geopolitical risks, and dependency on future market acceptance.

- Shaily Engineering Plastics' robust growth across segments, with strategic expansion and strong financial metrics, sets the stage for sustained revenue and earnings improvements.

Catalysts

About Shaily Engineering Plastics- Engages in the manufacture and sale of precision injection moulded plastic components/products in India.

- The recent 25% increase in quarterly revenue and improved gross and EBITDA margins largely stem from the Healthcare segment, particularly through new contracts for pen and auto-injectors. However, expectations of aggressive capacity expansion, such as 50 to 60 million additional units over the next few years, may not immediately reflect in revenue due to dependencies on regulatory approvals, customer launch readiness, and market capture. Investors assuming instant revenue spikes could be overvaluing the stock despite the forward-looking growth plans.

- Despite a robust outlook in expanding manufacturing capacities, the current machine utilization rate is around 45%, with plans to increase this to 80% over 2-3 years. This implies that operational gearing might take longer to translate into profitability improvements. If investors expect rapid margin expansion, the stock could be considered overvalued in the short term due to the time needed for utilization improvements to materially impact earnings.

- The company's strategic focus on developing novel intellectual property and expanding into new markets through subsidiaries like Shaily Innovations in Dubai may involve significant upfront investments with uncertain payoffs. This could strain net margins if the anticipated innovations or market acceptance are delayed, affecting future profit estimates.

- Recent geopolitical challenges and tariff uncertainties in large markets, such as the U.S., pose potential risks to the current earnings trajectory. As Shaily sources 79% of its revenue from exports, any adverse changes could compress net margins and revenue growth, leading analysts forecasting these risks to adjust expectations and potentially deem the stock overvalued.

- New business awards in the Consumer segment from two global retail chains are on the horizon, but initial supplies and revenue realization are scheduled to start from FY '26. If market expectations on immediate revenue transformations are built into current valuations, there could be a mismatch with real cash flow timelines, suggesting overvaluation if the market has priced in near-term revenue growth that may not materialize quickly.

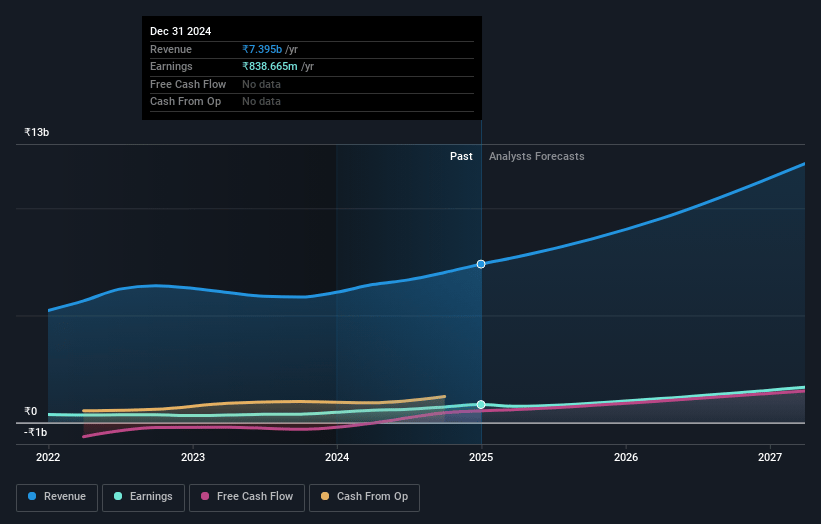

Shaily Engineering Plastics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Shaily Engineering Plastics's revenue will grow by 23.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.3% today to 14.4% in 3 years time.

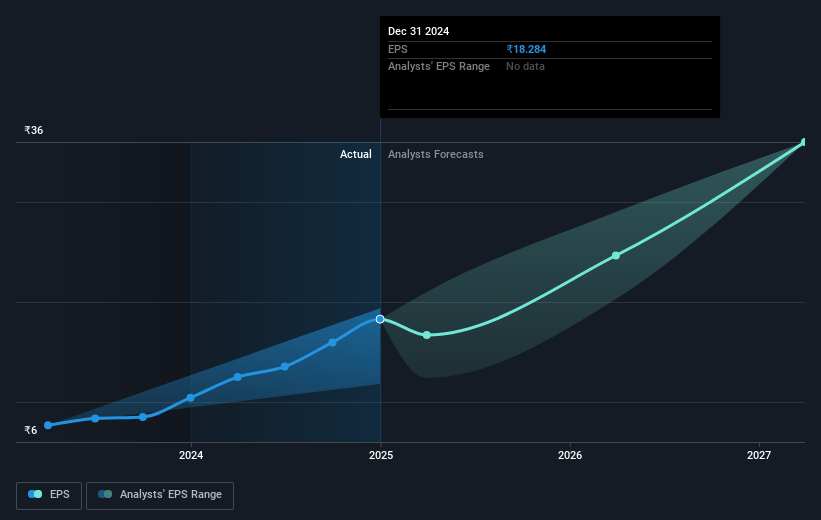

- Analysts expect earnings to reach ₹2.0 billion (and earnings per share of ₹44.18) by about March 2028, up from ₹838.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 50.2x on those 2028 earnings, down from 99.0x today. This future PE is greater than the current PE for the IN Machinery industry at 28.4x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.12%, as per the Simply Wall St company report.

Shaily Engineering Plastics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Shaily Engineering Plastics has delivered a robust top line growth of 25% in Q3 FY '25, with improved gross and EBITDA margins at 47.5% and 23.4%, respectively, indicating strong revenue growth and efficient cost management.

- The healthcare segment grew by 52% year-on-year, with six additional contracts signed for pen injectors and auto-injectors, potentially leading to significant revenue contributions and enhancing organizational value over the next three years.

- The company's global reach expansion through subsidiaries in the UK and Dubai, focusing on IP-led platforms and contract manufacturing for medical devices, could support revenue growth and margin expansion.

- Strong financial performance is demonstrated by a PAT growth of 73% year-on-year and an increase in PAT margins, suggesting an overall improvement in earnings.

- Sound financial health, with a disciplined use of capital and a debt-to-equity ratio of 0.43x, provides a stable platform for future investments and growth, supporting sustained performance in revenue and profitability metrics.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1479.5 for Shaily Engineering Plastics based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹14.0 billion, earnings will come to ₹2.0 billion, and it would be trading on a PE ratio of 50.2x, assuming you use a discount rate of 14.1%.

- Given the current share price of ₹1806.9, the analyst price target of ₹1479.5 is 22.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.