Key Takeaways

- Brownfield expansion aims to enhance production and revenue, while efficient operations and stable credit rating boost financial performance.

- Strong DI pipe demand from government initiatives and market diversification improves export prospects and future growth.

- Delays and fluctuating costs, alongside export challenges, threaten revenue stability and growth, compounded by stalled infrastructure spending impacting pipe demand.

Catalysts

About Electrosteel Castings- Manufactures and supplies ductile iron (DI) pipes, ductile iron fittings (DIF) and accessories, and cast iron (CI) pipes in India and internationally.

- The ongoing brownfield expansion to enhance DI pipe manufacturing capacity to 1 million tonnes is expected to be completed by March 2025. This expansion should significantly increase production capability and future revenue generation.

- Electrosteel's long-term credit rating upgrade by CRISIL from AA

- to AA indicates improved financial credibility, potentially leading to lower borrowing costs and better net margins.

- Robust demand for DI pipes driven by governmental initiatives such as river linking, Viksit Bharat Vision, Jal Jeevan Mission, and AMRUT 2.0 is likely to boost future revenue growth despite temporary pauses in government spending.

- An improved blast furnace efficiency and anticipated stability post-shutdown are expected to increase production efficiency and reduce operational costs, potentially improving net margins.

- Expanding international markets, particularly in the Middle East and exploring opportunities in Southeast Asia and Africa, could contribute to increased export revenue, influencing overall revenue positively.

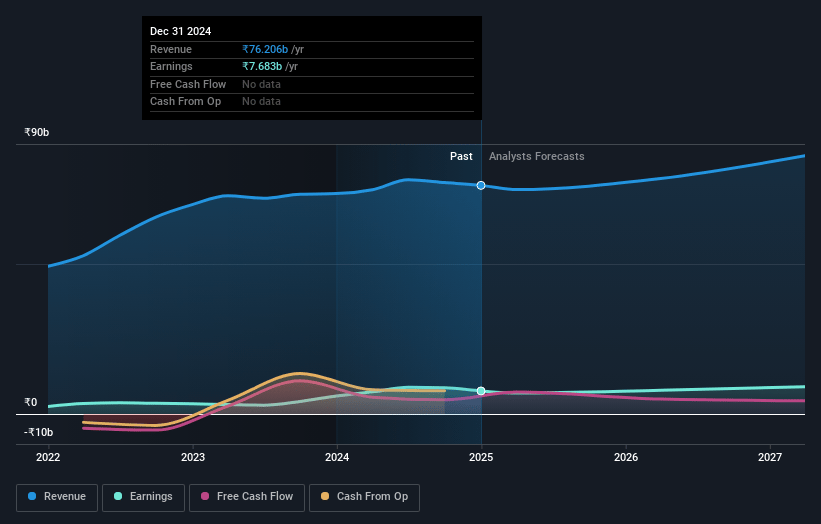

Electrosteel Castings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Electrosteel Castings's revenue will grow by 5.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.1% today to 10.8% in 3 years time.

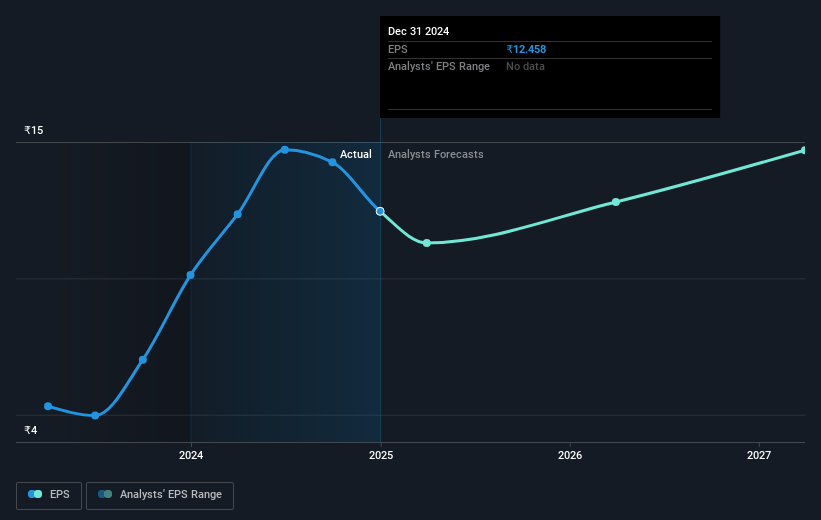

- Analysts expect earnings to reach ₹9.7 billion (and earnings per share of ₹15.58) by about May 2028, up from ₹7.7 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.6x on those 2028 earnings, up from 7.8x today. This future PE is lower than the current PE for the IN Building industry at 27.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.54%, as per the Simply Wall St company report.

Electrosteel Castings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The temporary government pause on infrastructure spending, specifically on the Jal Jeevan Mission, could impact future demand for DI pipes, affecting revenue projections.

- The shutdown of the blast furnace resulted in production delays and revenue losses of approximately ₹45 crores, which might affect year-on-year net margins and earnings stability.

- Manpower shortages and delays in equipment supply have caused minor delays in the company's ongoing brownfield expansion, potentially affecting future production capacity and revenue generation.

- Exposure to fluctuating raw material costs, such as coking coal and iron ore, and transportation costs, like ocean freight, could impact profit margins and overall cost management.

- A slowdown in the U.S. market and potential tariffs or biases towards local manufacturing could hinder export growth, affecting revenue diversification and overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹158.0 for Electrosteel Castings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹89.1 billion, earnings will come to ₹9.7 billion, and it would be trading on a PE ratio of 15.6x, assuming you use a discount rate of 15.5%.

- Given the current share price of ₹96.69, the analyst price target of ₹158.0 is 38.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.