Key Takeaways

- Expansion into emerging markets and localization efforts are expected to drive future revenue growth in India.

- Focus on sustainability and ESG leadership could enhance brand value and boost earnings.

- ABB India's revenue growth could be constrained by reliance on domestic markets and government spending amid competitive pressures and potential demand easing.

Catalysts

About ABB India- Develops and sells products and system solutions to utilities, industries, channel partners, and original equipment manufacturers in India and internationally.

- ABB India's strategy to continually expand and localize its product portfolio in the Indian market to meet the rising demand for sophisticated and premium products suggests potential future revenue growth.

- The company’s plan to penetrate emerging market segments and geographical expansion into Tier 2 and Tier 3 cities is expected to drive future revenue growth, aided by increased aspirations for quality products in these areas.

- ABB India's strong focus on future-oriented sectors such as data centers, renewable energy projects, and transportation infrastructure (including metros and railways) is anticipated to bolster future revenues.

- With ongoing efforts to enhance operational efficiencies and optimize capacity utilization, ABB India aims to improve net margins over time.

- ABB India's commitment to sustainability and a growing local and international reputation as a leader in ESG practices could enhance the company's brand value and attract more business, potentially boosting future earnings.

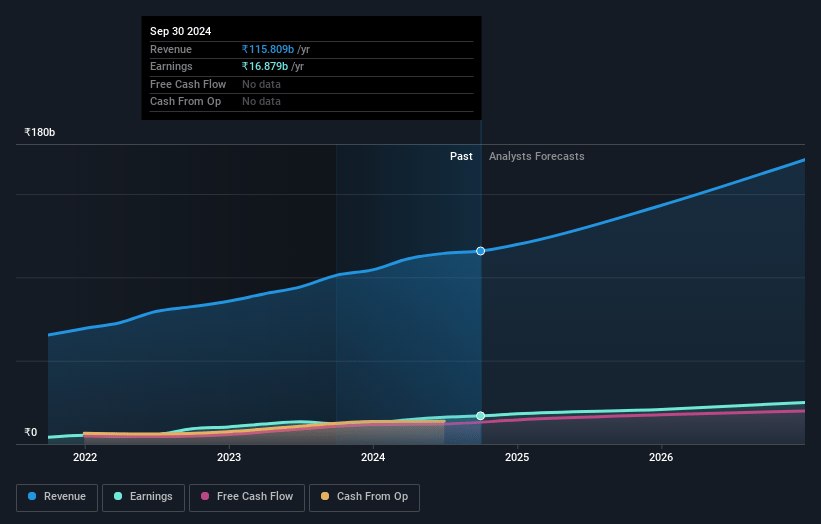

ABB India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ABB India's revenue will grow by 12.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 15.4% today to 14.7% in 3 years time.

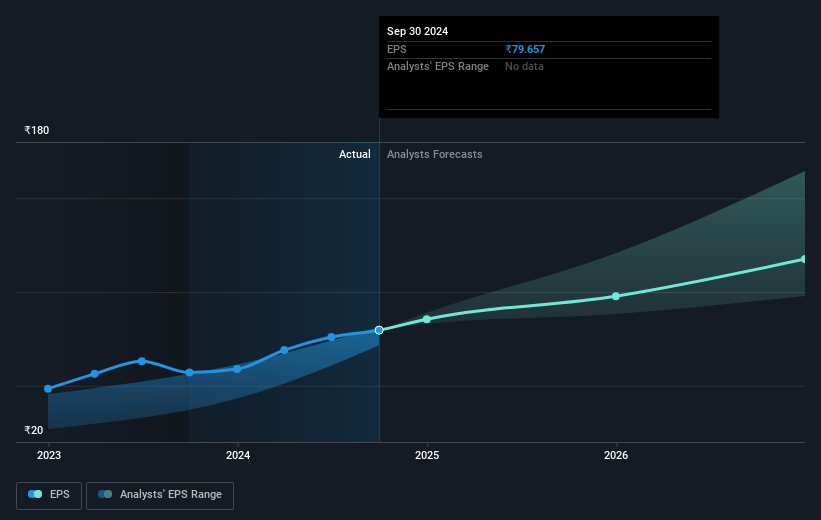

- Analysts expect earnings to reach ₹25.6 billion (and earnings per share of ₹118.99) by about March 2028, up from ₹18.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹30.3 billion in earnings, and the most bearish expecting ₹22.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 77.4x on those 2028 earnings, up from 61.9x today. This future PE is greater than the current PE for the IN Electrical industry at 33.6x.

- Analysts expect the number of shares outstanding to grow by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.89%, as per the Simply Wall St company report.

ABB India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Concerns were raised about the sustainability of ABB India's high profit margins, noting that market prices and demand are expected to ease, potentially impacting net margins and revenue growth.

- ABB India's order backlog showed only a 12% year-over-year growth, a deceleration compared to previous quarters, which could suggest potential slowdown in revenue growth if order inflow does not pick up.

- The company's reliance on domestic market growth, particularly with 35-40% of its orders indirectly linked to government-led investments, could be at risk due to potential fluctuations in government spending and infrastructure investments affecting future revenue.

- ABB India's limited exposure to exports (10% of business mix) and the uncertain global trade dynamics may constrain revenue growth opportunities if domestic market conditions become less favorable.

- There are potential competitive pressures and risks from Chinese competitors, especially in segments like Robotics and certain process automation markets, which could impact pricing power and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹6171.182 for ABB India based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹8450.0, and the most bearish reporting a price target of just ₹4970.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹174.6 billion, earnings will come to ₹25.6 billion, and it would be trading on a PE ratio of 77.4x, assuming you use a discount rate of 14.9%.

- Given the current share price of ₹5474.6, the analyst price target of ₹6171.18 is 11.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.