Key Takeaways

- Strategic focus on retail and direct-to-corporate advances could boost revenue growth, with significant improvements in top line and loan yields anticipated.

- Technological transformations and enhanced asset quality are expected to improve efficiency, lower costs, and boost profitability and earnings stability.

- Rising costs and changes in strategies are pressuring Karnataka Bank's margins, impacting profitability and growth in a competitive environment.

Catalysts

About Karnataka Bank- Provides various banking and financial services in India.

- Karnataka Bank is focusing on retail and direct-to-corporate advances, which could lead to higher revenue growth from these segments. Improvements in top line growth are anticipated as these strategies play out.

- The bank is significantly transforming its operations with new retail asset centers and a national back office, which are expected to enhance efficiency, potentially leading to improved net margins.

- Investments in digital initiatives and technology have been recognized with awards, and these advancements may streamline operations and lower costs, positively impacting future earnings.

- The bank’s strategic churn from low-yielding large corporate loans to high-yielding direct-to-corporate and retail advances is expected to boost loan yields, potentially improving net interest margins.

- Karnataka Bank has been improving its asset quality with declining gross and net NPAs, and continuing this trend could enhance credit costs, supporting better profitability and increasing earnings stability.

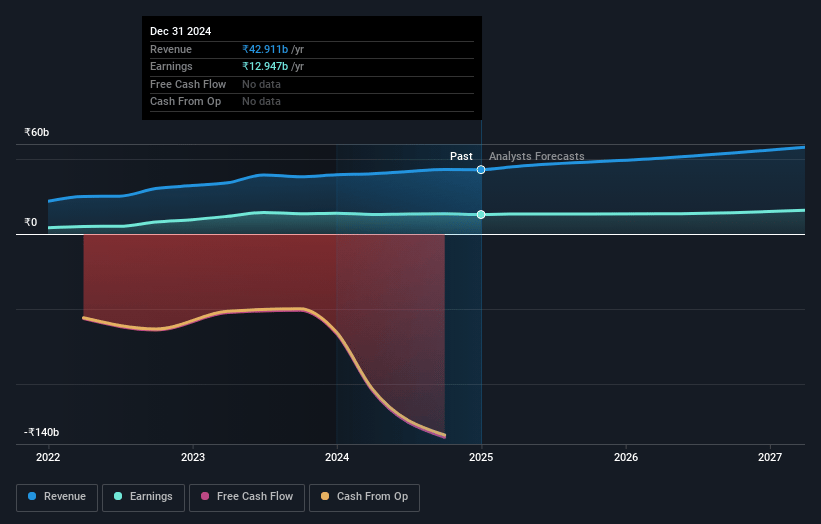

Karnataka Bank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Karnataka Bank's revenue will grow by 13.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 30.2% today to 26.0% in 3 years time.

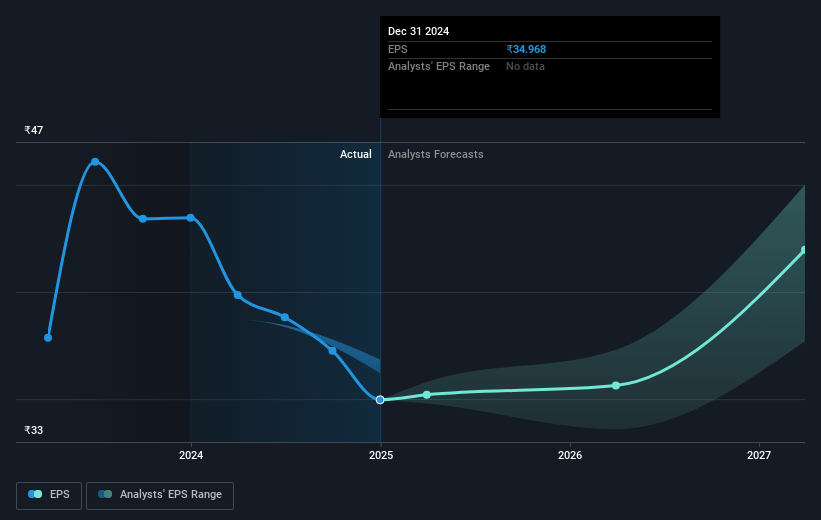

- Analysts expect earnings to reach ₹16.5 billion (and earnings per share of ₹43.6) by about May 2028, up from ₹12.9 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹14.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.8x on those 2028 earnings, up from 5.7x today. This future PE is lower than the current PE for the IN Banks industry at 10.7x.

- Analysts expect the number of shares outstanding to grow by 0.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.01%, as per the Simply Wall St company report.

Karnataka Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decrease in PAT from ₹331 crores to ₹283 crores due to changes in accounting policies and accelerated provisioning could impact earnings, as it suggests higher costs and lower profitability.

- The rising cost of funds and cost of deposits, coupled with a decline in net interest margin (NIM) from 3.59% to 3.26%, could pressure net margins, especially if the cost pressures persist or intensify with increased competition.

- Lower GDP projections and pressure in the banking industry affecting credit growth and slower CASA (Current Account Savings Account) growth could hinder revenue growth and impact the overall financial health of the bank.

- The replacement of low-yielding corporate loans with higher-yielding direct-to-corporate advances is still underway, but if the transition period takes longer than expected, it could negatively affect short-term revenue and profitability.

- The transition from high-value bulk deposits to retail granular deposits, while strategically sound, can lead to increased cost of deposits in the short term, potentially affecting net interest income and overall profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹288.333 for Karnataka Bank based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹325.0, and the most bearish reporting a price target of just ₹265.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹63.4 billion, earnings will come to ₹16.5 billion, and it would be trading on a PE ratio of 9.8x, assuming you use a discount rate of 14.0%.

- Given the current share price of ₹195.87, the analyst price target of ₹288.33 is 32.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.