Last Update01 May 25

Key Takeaways

- Successful acquisitions and strategic expansions into new markets and technologies could enhance revenue, margins, and market positioning in precision components and alternative energy sectors.

- Investment in EVs, alternative fuels, and technological advancements aligns with market trends, potentially boosting future profitability and market share.

- Geopolitical tensions and slow EV adoption threaten international revenue growth, while new ventures and market competition risk margins and financial stability.

Catalysts

About Shriram Pistons & Rings- Manufactures and sells automotive components in India.

- The successful acquisition and integration of TGPEL Precision Engineering Limited is expected to complement existing capabilities and expand market reach in high-tech precision components, potentially boosting future revenues and margins.

- Strategic penetration into newer aftermarket territories, coupled with an expanded product offering, is set to strengthen domestic revenue streams and could improve net margins over time.

- Investment in electric vehicle (EV) and alternative fuel components, aligned with government initiatives and market trends towards greener solutions, positions the company for growth in emerging sectors, likely impacting future earnings positively.

- The continuous development of hydrogen and ethanol-compatible components presents an opportunity for first-mover advantage as these fuel solutions gain regulatory and market traction, potentially enhancing revenue growth and profitability.

- The expansion and technological advancements in precision plastic injection molding leverage synergies across acquired businesses, with the prospect of increased market share and improved EBITDA margins.

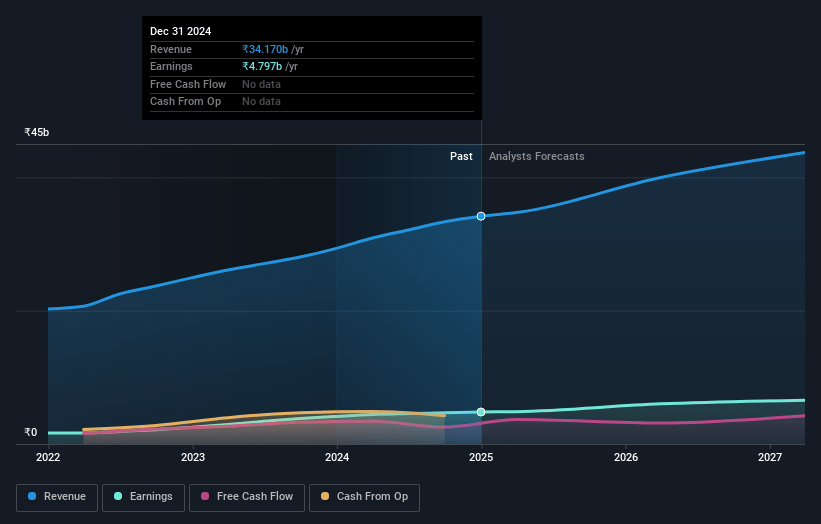

Shriram Pistons & Rings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Shriram Pistons & Rings's revenue will grow by 9.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.0% today to 15.3% in 3 years time.

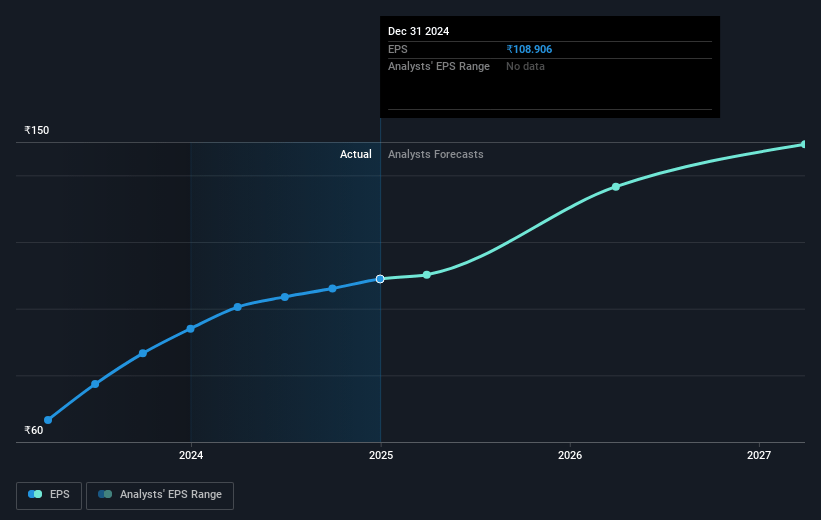

- Analysts expect earnings to reach ₹6.9 billion (and earnings per share of ₹156.26) by about May 2028, up from ₹4.8 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.0x on those 2028 earnings, up from 16.5x today. This future PE is lower than the current PE for the IN Auto Components industry at 28.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.89%, as per the Simply Wall St company report.

Shriram Pistons & Rings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing geopolitical tensions and high volatility in freight rates, particularly in Europe and other overseas markets, have put pressure on exports, posing a risk to the company's revenue growth from international markets.

- The transition to electric vehicles (EV) has been slow, with lackluster EV penetration. This poses a risk to long-term revenue and earnings if the market shifts rapidly towards EVs surpassing the company's current capabilities and product offerings.

- The emphasis on new ventures in precision plastic injection molds and EV powertrain components might demand significant capital expenditure and development time, which could strain financial resources and impact net margins if returns are slower than anticipated.

- Competitions from other players in the market producing hydrogen-related components and precision plastic parts could increase pressure on pricing, affecting profitability and overall margins.

- The company's optimism regarding geopolitical stabilization and market recovery could lead to overestimation of future earnings, exposing the business to potential revenue shortfalls if conditions do not improve as expected.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹2850.0 for Shriram Pistons & Rings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹45.0 billion, earnings will come to ₹6.9 billion, and it would be trading on a PE ratio of 27.0x, assuming you use a discount rate of 13.9%.

- Given the current share price of ₹1796.7, the analyst price target of ₹2850.0 is 37.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.