Key Takeaways

- Securing exclusivity with major OEMs for new models expands market share and aligns strategically for higher future earnings.

- Localization and collaborative cost-sharing improve margins and profitability amidst new model launches and greenfield site expansions.

- Challenges include initial profitability issues, reliance on OEM agreements, competitive technology shifts, growth deceleration, and currency fluctuations impacting financial stability.

Catalysts

About Motherson Sumi Wiring India- Manufactures and sells components to automotive original equipment manufacturers in India and internationally.

- The company has an advanced pipeline of new model launches by OEMs across electric and internal combustion engine platforms, which are expected to drive future revenue growth as Motherson supplies these new platform solutions.

- Three new greenfield sites in different stages of completion are projected to cumulatively boost annual revenues by approximately ₹2,100 crores, translating to around 25% growth over FY '24, positively impacting revenue.

- Securing business with major OEMs like Maruti Suzuki, Mahindra, and Tata Motors exclusively for new models indicates an expansion in market share and strategic product alignment, leading to higher future earnings.

- Localization efforts and conversations with OEMs about sharing startup costs are expected to mitigate input costs and improve margins over time, enhancing net margins as production stabilizes.

- The anticipated stabilization of negative net greenfield startup costs with the commencement of full production in new facilities will alleviate profit drag, thereby improving future EBITDA and profitability.

Motherson Sumi Wiring India Future Earnings and Revenue Growth

Assumptions

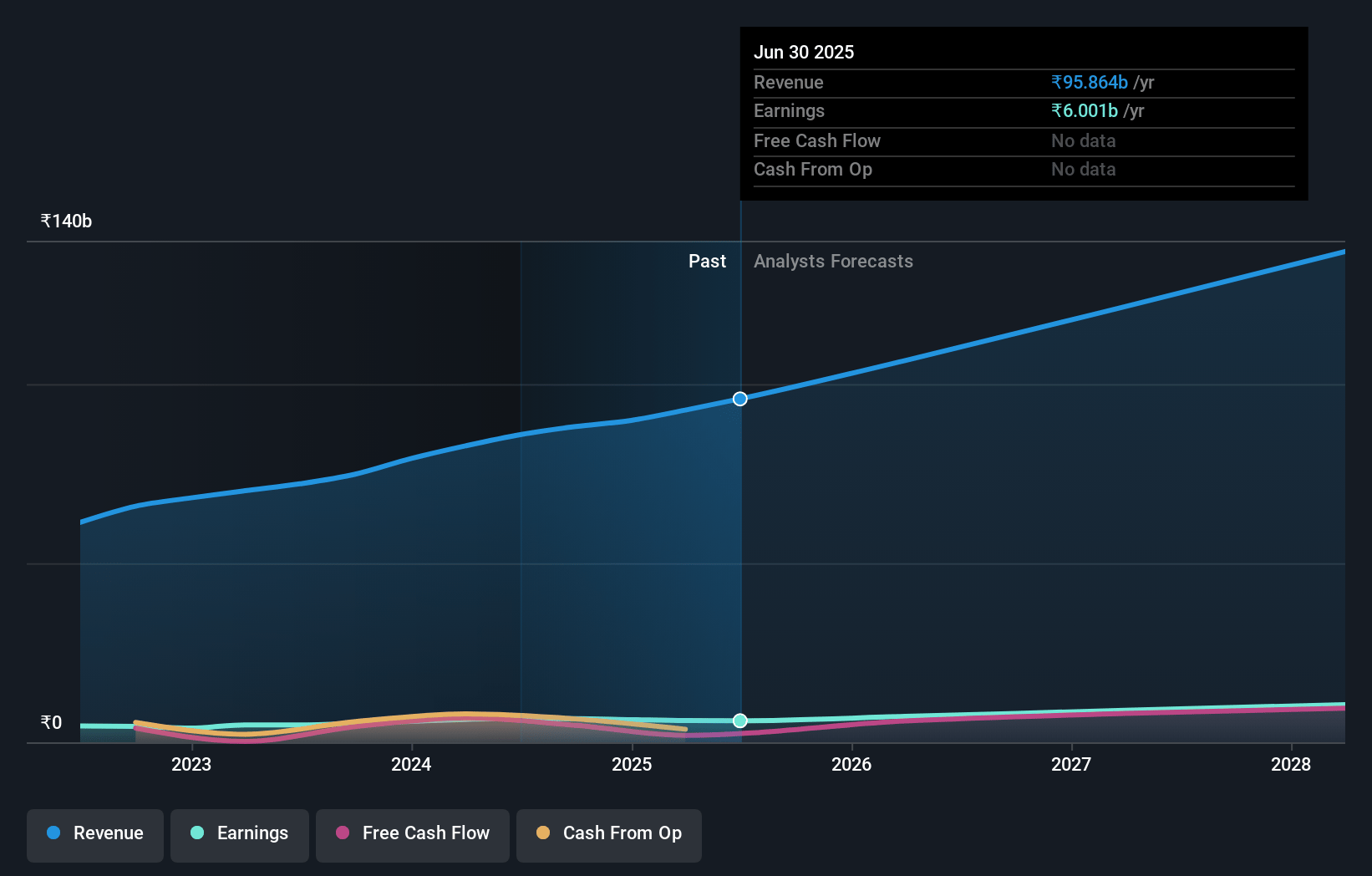

How have these above catalysts been quantified?- Analysts are assuming Motherson Sumi Wiring India's revenue will grow by 14.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.0% today to 7.9% in 3 years time.

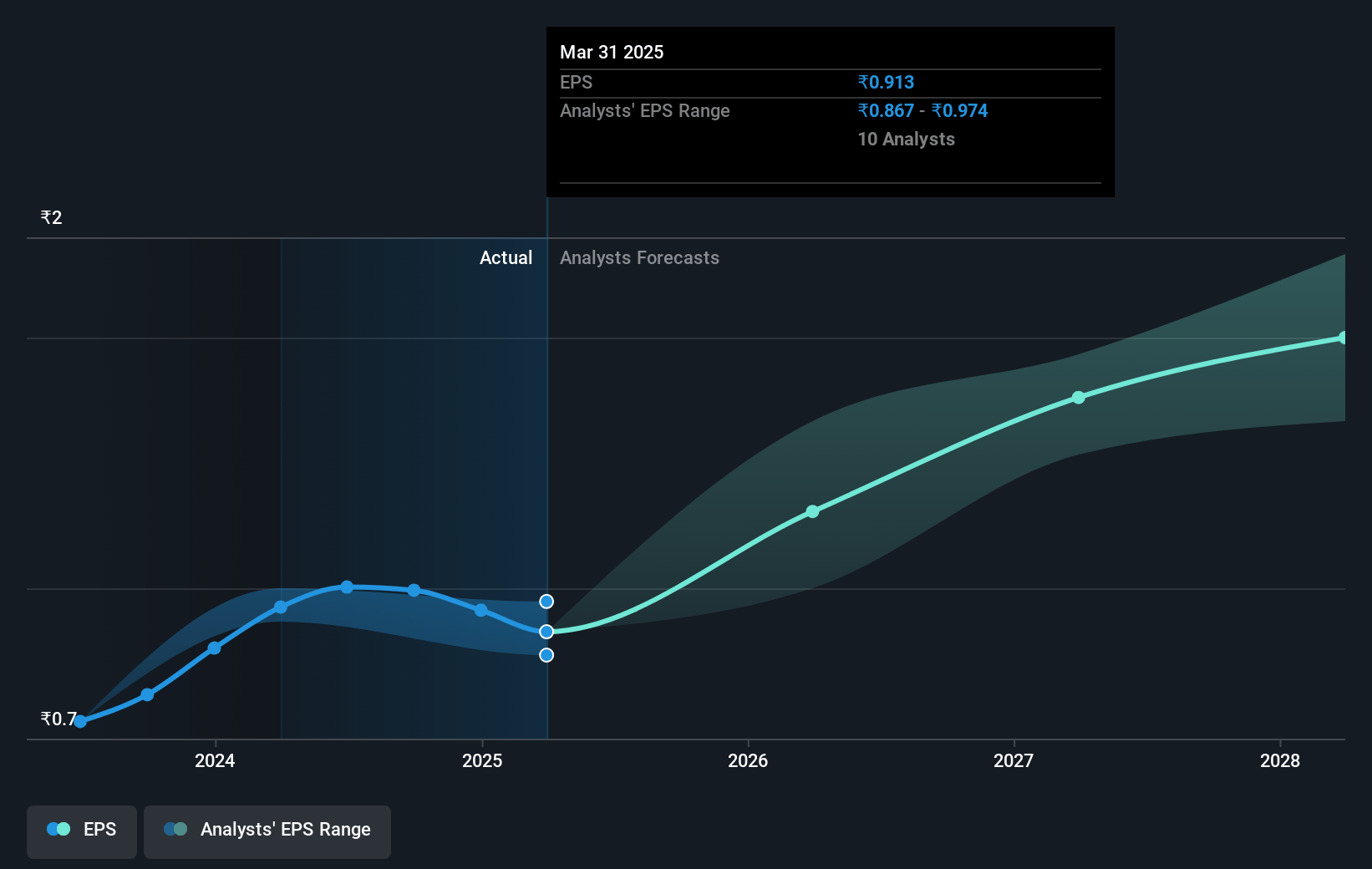

- Analysts expect earnings to reach ₹10.5 billion (and earnings per share of ₹2.36) by about May 2028, up from ₹6.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.7x on those 2028 earnings, up from 39.0x today. This future PE is greater than the current PE for the IN Auto Components industry at 28.3x.

- Analysts expect the number of shares outstanding to decline by 1.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.72%, as per the Simply Wall St company report.

Motherson Sumi Wiring India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The negative net greenfield start-up costs of approximately ₹40 crores on EBITDA and ₹32 crores on the PAT suggest initial profitability challenges as new facilities are being ramped up, which can impact earnings negatively in the short term.

- The dependency on securing cost-sharing agreements with OEMs for some of the expenses associated with expansions introduces uncertainty and could lead to unexpected costs on net margins if not successful.

- The potential shift to advanced technologies by competitors, like lighter cable-based wiring harnesses, poses a risk to Motherson Sumi Wiring India’s competitive position and innovation strategy, potentially impacting future revenues if not adequately addressed.

- The observed deceleration in growth relative to the industry, particularly when accounting for year-on-year industry growth and copper price inflation, raises concerns on market share stability, which may hinder revenue growth.

- Given the depreciation of the INR against the USD, any fluctuations in currency could impact the profitability negatively unless adequately covered by pass-through agreements with customers.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹68.083 for Motherson Sumi Wiring India based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹83.0, and the most bearish reporting a price target of just ₹56.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹133.0 billion, earnings will come to ₹10.5 billion, and it would be trading on a PE ratio of 40.7x, assuming you use a discount rate of 13.7%.

- Given the current share price of ₹55.76, the analyst price target of ₹68.08 is 18.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.