Key Takeaways

- Strategic moves like new model launches and exports are set to enhance revenue and sales volumes, boosting overall financial performance.

- Cost-saving measures, including solar power use and a new plant, aim to improve operational efficiencies and net margins.

- Declining growth in the PV industry and shifting consumer preferences toward SUVs are challenges that may hinder Maruti Suzuki's revenue and profitability.

Catalysts

About Maruti Suzuki India- Engages in the manufacture, purchase, and sale of motor vehicles, components, and spare parts primarily in India.

- Establishing the Osamu Suzuki Center of Excellence in India could drive operational efficiencies and lower costs by propagating advanced Japanese manufacturing practices. This might positively impact net margins.

- Launching two new models, including the electric SUV e Vitara, along with continued growth in exports (projected at 20% growth for FY '26), could significantly boost revenue and overall sales volume.

- The acceleration of solar power generation capacity and increased use of rail for domestic dispatches may result in cost savings and environmental benefits, potentially enhancing net margins.

- The commencement of a new greenfield plant at Kharkhoda and the subsequent economies of scale and flexibility in production may lead to reduced overheads per unit and improved net margins over time.

- Strategic initiatives to expand in the hybrid vehicle segment alongside CAFE (Corporate Average Fuel Efficiency) standards compliance can drive competitive advantage and foster revenue growth amidst evolving consumer preferences.

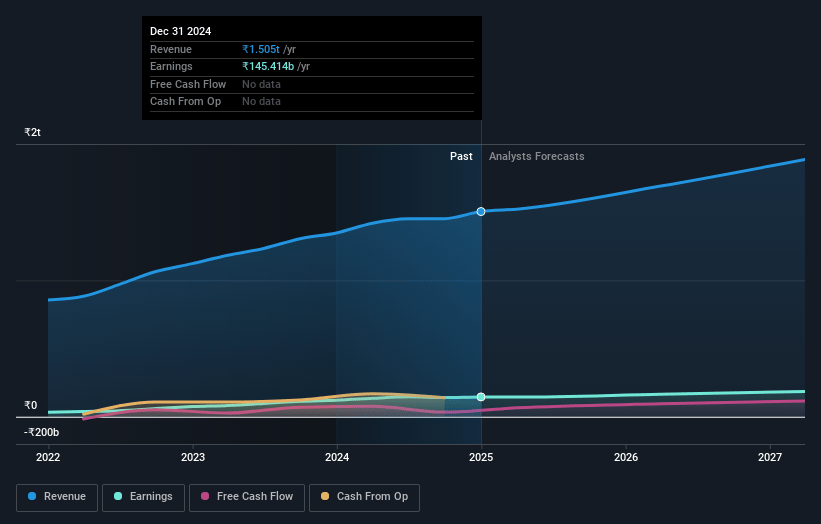

Maruti Suzuki India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Maruti Suzuki India's revenue will grow by 10.4% annually over the next 3 years.

- Analysts are assuming Maruti Suzuki India's profit margins will remain the same at 9.5% over the next 3 years.

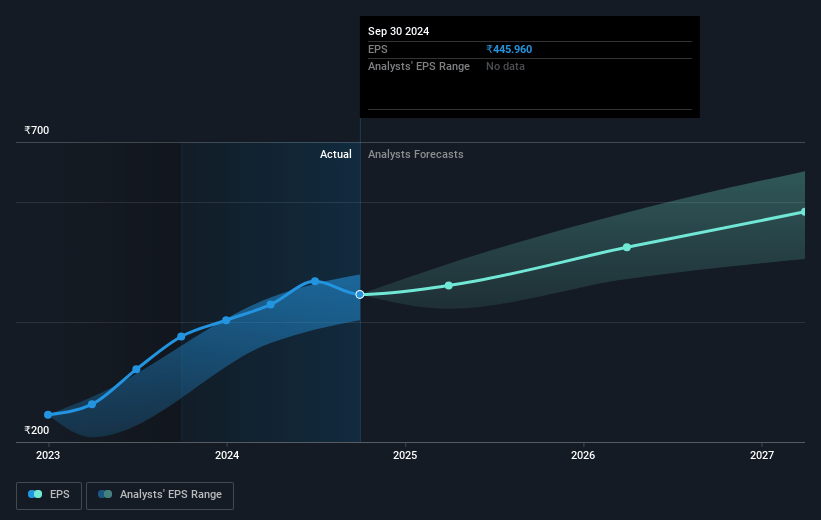

- Analysts expect earnings to reach ₹196.5 billion (and earnings per share of ₹624.59) by about May 2028, up from ₹145.0 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹166.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.9x on those 2028 earnings, up from 26.6x today. This future PE is greater than the current PE for the IN Auto industry at 28.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.27%, as per the Simply Wall St company report.

Maruti Suzuki India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The growth rate in the passenger vehicle (PV) industry has moderated sharply from 8.4% in financial year '24 to 2.5% in financial year '25, suggesting a slowdown in overall market growth which can affect Maruti's revenue and earnings.

- The hatchback segment, a key product area for Maruti, continued to shrink, reducing its share to 23.5% in FY '25, down from 46% in FY '19. This shift in consumer preference towards SUVs and MPVs can impact Maruti's revenue if not adequately countered.

- Operating profit margins decreased, with EBIT falling to 8.7% of net sales compared to 10% in the previous quarter due to factors like adverse commodity prices, especially steel, and increased expenses related to new plant depreciation and advertisement costs, thereby impacting net margins.

- Expenses related to seasonality, repairs and maintenance, CSR, digitalization initiatives, and R&D were notably adverse, by about 90 basis points, potentially straining net earnings if similar expenses recur in future quarters.

- The company noted that demand overall is not growing significantly, emphasizing the lack of growth in entry-level cars, which have been crucial to Maruti's success. If this trend continues, it may affect Maruti's revenue growth prospects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹13626.231 for Maruti Suzuki India based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹15775.0, and the most bearish reporting a price target of just ₹11100.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹2058.1 billion, earnings will come to ₹196.5 billion, and it would be trading on a PE ratio of 37.9x, assuming you use a discount rate of 20.3%.

- Given the current share price of ₹12257.0, the analyst price target of ₹13626.23 is 10.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.