Key Takeaways

- Bajaj Auto's focus on EVs and greener fuels, along with strong export growth, is expected to significantly boost revenue streams and international market share.

- The company plans to capture untapped market segments with new innovative products and expand customer acquisition via financing, enhancing profitability and margins.

- Currency volatility and compliance costs could affect profitability, while declining domestic market share and reliance on a single partner threaten revenue growth.

Catalysts

About Bajaj Auto- Engages in the development, manufacture, and distribution of automobiles in India and internationally.

- Bajaj Auto's shift towards electric vehicles (EVs) and greener fuels through its robust lineup in electric two-wheelers and three-wheelers is expected to positively impact future revenue growth. With the green energy portfolio making up 44% of domestic revenue and continuous expansion in the EV market, increased volumes and leading market positions are anticipated to enhance revenue streams.

- The company's strong export growth in regions like Latin America and Africa is poised to support revenue increases. The management's expectation of 20% plus year-on-year growth in exports, particularly with significant volumes from premium brands, suggests robust revenue acceleration in international markets.

- Introduction of new models, variants, and premium product offerings in the 125cc+ motorcycle segment is expected to capture higher market share and leverage pricing power, potentially leading to enhanced net margins. The focus on subsegmenting the market and offering new features could elevate customer engagement and profitability.

- Continuous expansion of the Bajaj Auto Credit Limited financing arm not only strengthens customer acquisition through enhanced financing options but also contributes positively to net margins. As the captive finance company increases its scale, the profitability from this subsidiary will bolster earnings.

- The launch of innovative products, like the CNG-fueled motorcycles and expanded e-rickshaw offerings, is set to capture untapped market segments and boost revenue. As these categories gain traction, especially with increasing awareness and infrastructure, they will likely contribute significantly to future revenue growth.

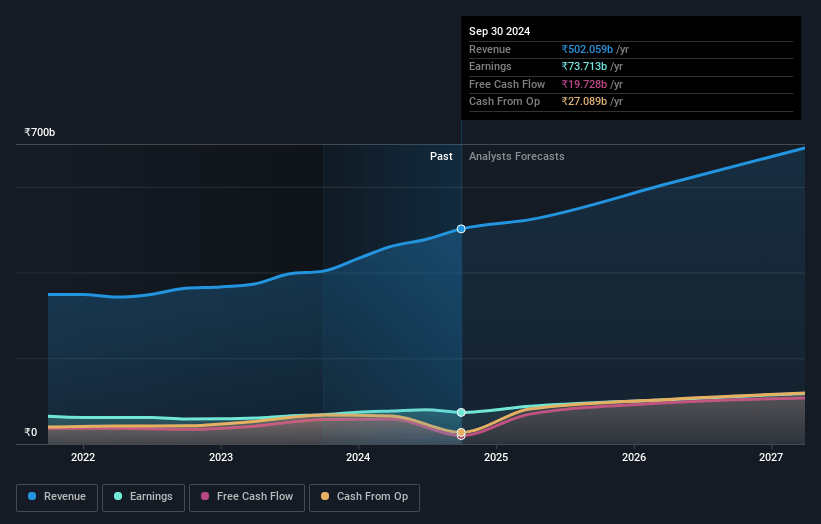

Bajaj Auto Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bajaj Auto's revenue will grow by 12.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.7% today to 16.9% in 3 years time.

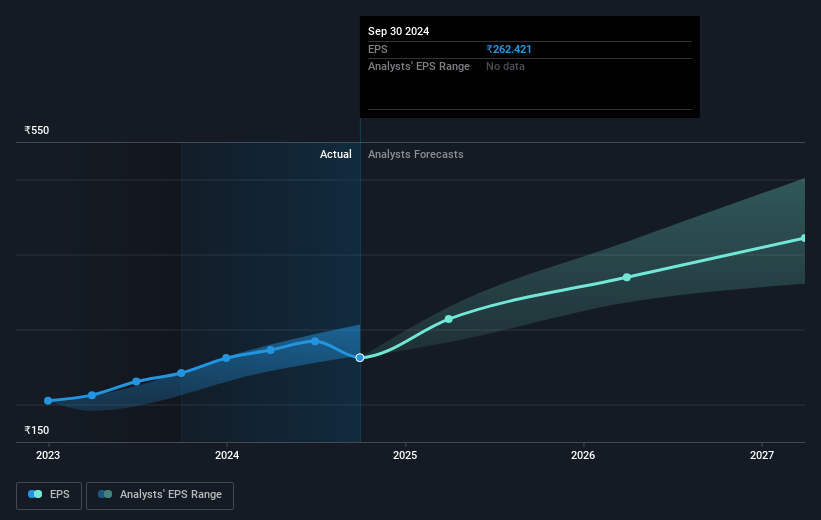

- Analysts expect earnings to reach ₹123.2 billion (and earnings per share of ₹440.55) by about April 2028, up from ₹75.3 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.6x on those 2028 earnings, up from 29.5x today. This future PE is greater than the current PE for the IN Auto industry at 27.6x.

- Analysts expect the number of shares outstanding to decline by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.32%, as per the Simply Wall St company report.

Bajaj Auto Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Currency volatility, particularly in South Asia and Africa, poses risks that could affect export revenues and profitability, as fluctuations in exchange rates can increase costs and reduce margins.

- The decline in market share in the domestic 100cc segment due to staying away from tactical pricing initiatives might impact revenue growth as competitors capture this important entry-level market.

- The issues faced by KTM overseas, resulting in a 50% drop in exports, have negatively impacted revenue and profit mix, highlighting the risk of over-reliance on a single partner for high-margin segments.

- Economic conditions in key export markets, such as the ongoing need for stability in African currencies, can affect sales volumes and export revenues, especially in price-sensitive regions.

- Potential cost increases from compliance with OBD 2B norms starting from April 1st, 2025, could impact pricing and margins, as the costs will need to be passed on to consumers amid stiff competition in the motorcycle market.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹9559.154 for Bajaj Auto based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹12584.0, and the most bearish reporting a price target of just ₹7000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹727.3 billion, earnings will come to ₹123.2 billion, and it would be trading on a PE ratio of 37.6x, assuming you use a discount rate of 20.3%.

- Given the current share price of ₹7961.5, the analyst price target of ₹9559.15 is 16.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.