Key Takeaways

- New motorcycle models and international market share expansion, including CKD plants, are poised to drive revenue growth for Eicher Motors.

- Strategic investments in electric mobility and sustainability are expected to enhance long-term margins and appeal to eco-conscious consumers.

- Increased marketing and production costs amid geopolitical challenges and strategic shifts may pressure profitability and impact margins if not offset by pricing adjustments.

Catalysts

About Eicher Motors- An automobile company, engages in the manufacture and sale of motorcycles and commercial vehicles in India and internationally.

- The launch of new motorcycle models like the Goan Classic, SCRAM 440, and upcoming electric brand Flying Flea suggests anticipated revenue growth in both domestic and international markets as they appeal to diverse consumer segments.

- Royal Enfield's strong performance in expanding market share in international regions and the establishment of CKD plants, especially in Thailand, positions the company for improved earnings from scaling operations and tapping into new market dynamics.

- Investment in electric mobility and partnerships with companies like Qualcomm, as well as initiatives around sustainability, are expected to enhance long-term net margins by reducing costs tied to traditional manufacturing while appealing to environmentally-conscious consumers.

- Market share gains and new product launches in VE Commercial Vehicles, such as electric buses and trucks, indicate potential revenue growth catalyzed by expected increased demand for alternate energy vehicles, driven by both policy and market trends.

- Strong overall financial performance with record-breaking revenue, EBITDA, and profit after tax points towards anticipated efficiency improvements, which would contribute to expanded net margins going forward.

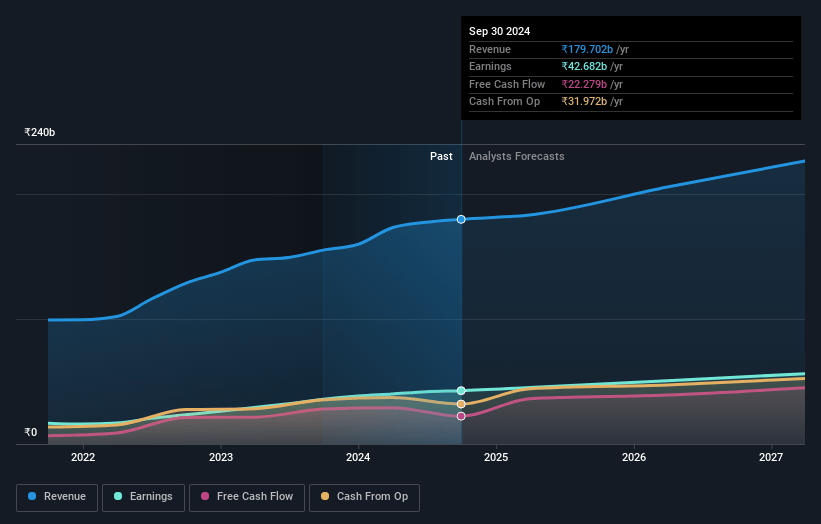

Eicher Motors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Eicher Motors's revenue will grow by 13.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 23.8% today to 24.2% in 3 years time.

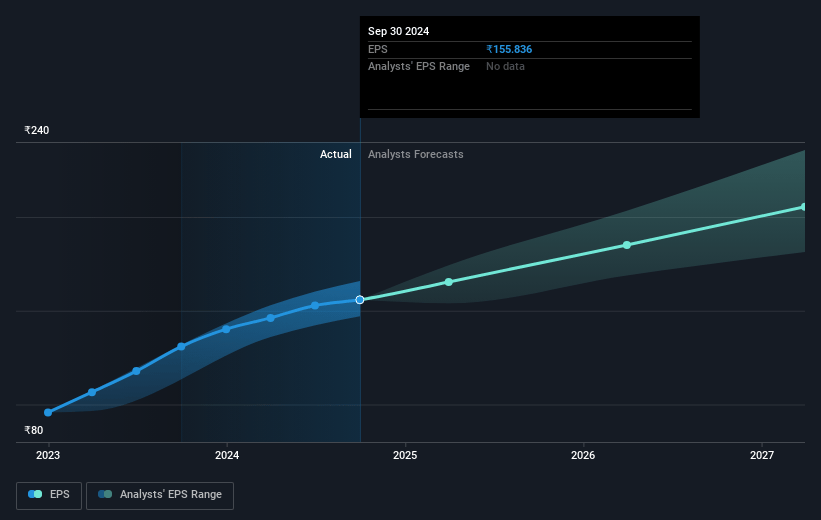

- Analysts expect earnings to reach ₹66.4 billion (and earnings per share of ₹242.18) by about May 2028, up from ₹44.4 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.2x on those 2028 earnings, up from 34.3x today. This future PE is greater than the current PE for the IN Auto industry at 28.1x.

- Analysts expect the number of shares outstanding to grow by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.29%, as per the Simply Wall St company report.

Eicher Motors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has experienced increased marketing expenses due to multiple launches, which could put pressure on profitability if sustained at higher levels, impacting net margins.

- The introduction of new models without corresponding price hikes may impact gross margins, with added production costs not yet passed on to consumers.

- Global economic conditions and geopolitical challenges can create headwinds for export growth, potentially affecting revenue from international markets.

- The shift towards growth-focused strategies might lead to reduced emphasis on operating leverage, which could impact profitability if sales volumes do not meet expectations.

- Any cost inflation due to regulatory changes like OBD2B, without adequate price adjustments, could increase production costs, potentially impacting earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹5436.243 for Eicher Motors based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹6700.0, and the most bearish reporting a price target of just ₹3855.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹274.4 billion, earnings will come to ₹66.4 billion, and it would be trading on a PE ratio of 39.2x, assuming you use a discount rate of 20.3%.

- Given the current share price of ₹5564.95, the analyst price target of ₹5436.24 is 2.4% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.