Key Takeaways

- The ramp-up of new axle models and focus on heavier vehicle segments aims to boost revenue and market share.

- Efforts in modernization and exports, alongside targeting the electric vehicle segment, are set to enhance operational efficiency and diversify revenue streams.

- Dependency on Ashok Leyland and ambitious growth plans introduce execution risk amidst a flat M&HCV market and uncertain domestic and export conditions.

Catalysts

About Automotive Axles- Manufactures and sells automotive components in India.

- The successful ramp-up of the MS 185 axle with existing customers is a key operational catalyst, expected to enhance revenue as adoption increases in heavier vehicle segments.

- The introduction of new axle models targeted at buses and heavier commercial vehicles is set to broaden the product range, potentially boosting revenue and improving market share as these products roll out.

- Modernization and cost optimization efforts under Mission 25 are anticipated to improve operational efficiencies, which could enhance net margins by driving down production costs.

- An increased focus on exports as global markets recover is anticipated to drive revenue growth, leveraging Automotive Axles' existing global connections.

- A strategic push in the aftermarket and export sectors, including efforts to capture the electric vehicle segment, is expected to bolster revenue and build a more diversified income stream, supporting long-term earnings growth.

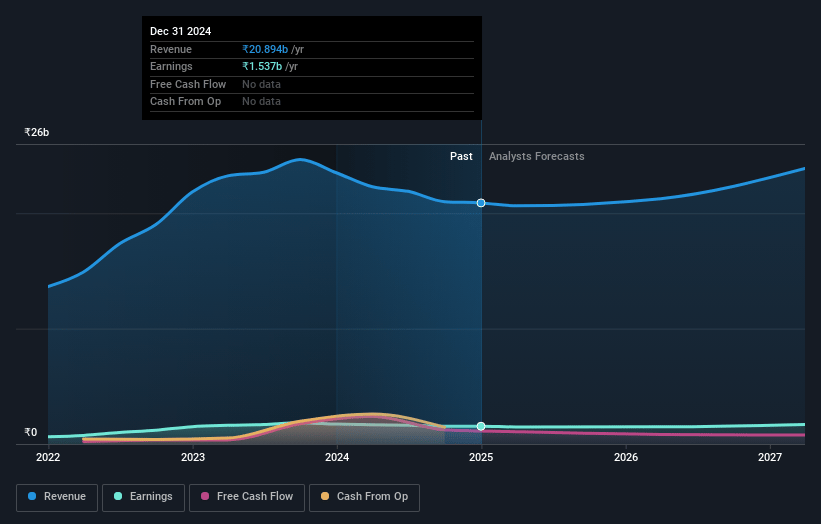

Automotive Axles Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Automotive Axles's revenue will grow by 5.7% annually over the next 3 years.

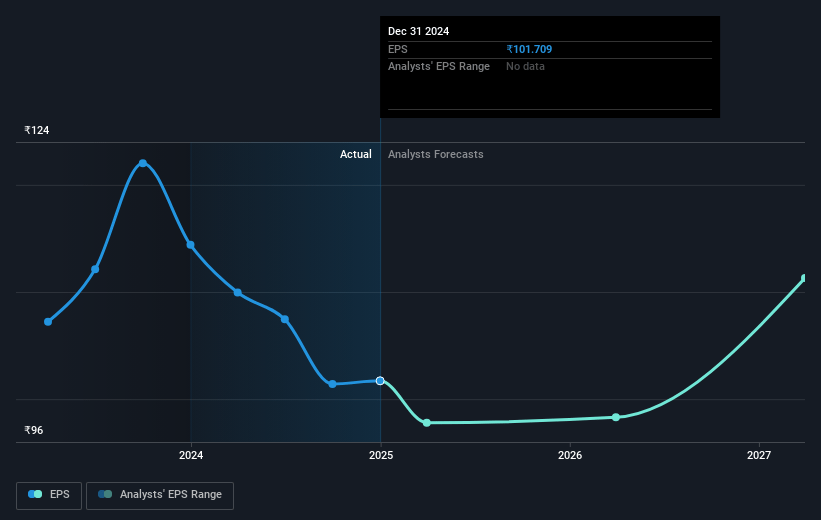

- Analysts assume that profit margins will shrink from 7.4% today to 6.9% in 3 years time.

- Analysts expect earnings to reach ₹1.7 billion (and earnings per share of ₹112.84) by about May 2028, up from ₹1.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.9x on those 2028 earnings, up from 16.2x today. This future PE is lower than the current PE for the IN Auto Components industry at 28.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.72%, as per the Simply Wall St company report.

Automotive Axles Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The M&HCV (Medium & Heavy Commercial Vehicle) market is expected to remain flat from April to March 2026, which could limit revenue growth opportunities.

- The domestic market is currently soft, with a slow recovery anticipated in export markets like North America and Europe, potentially affecting future revenue and earnings.

- There is significant customer concentration risk with Ashok Leyland, which could impact revenue stability if this client diversifies suppliers or reduces orders.

- The planned doubling of revenue by 2029 relies heavily on successful new product launches and a shift in market dynamics, introducing execution risk that could affect earnings.

- Recent shareholder rejection of related-party transactions with Meritor HVS poses uncertainty in operations and strategic collaborations, which could impact future margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹2003.0 for Automotive Axles based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹24.7 billion, earnings will come to ₹1.7 billion, and it would be trading on a PE ratio of 25.9x, assuming you use a discount rate of 13.7%.

- Given the current share price of ₹1650.95, the analyst price target of ₹2003.0 is 17.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.