Key Takeaways

- JD Logistics is focused on global expansion and efficiency improvements to drive growth and enhance net margins.

- Strategic collaborations and technology investments aim to uncover new revenue from emerging segments and sustain profit margin expansion.

- Increasing competition and execution risks alongside high investments in technology and international expansion could pressure JD Logistics' revenue margins and net earnings.

Catalysts

About JD Logistics- An investment holding company, provides integrated supply chain solutions and logistics services in the People’s Republic of China.

- JD Logistics is committed to expanding its Global Smart Supply Chain Network by increasing its overseas warehouse gross floor area by over 100% by the end of 2025, enhancing global supply chain capacities and driving revenue growth through international market expansion.

- The company is leveraging technology through initiatives like the JD Logistics Super Brain and self-developed automated warehousing solutions to improve operational efficiency and reduce costs, which can enhance net margins over time.

- By deepening collaborations with key industries like FMCG, home appliances, and electronics, JD Logistics is addressing sector-specific needs and uncovering new business opportunities, which could boost revenue from these growing segments.

- JD Logistics continues to expand its service offerings on major e-commerce platforms like Taobao and Tmall, aiming to consolidate e-commerce channels, reduce inventory turnover cycles, and increase external customer revenue.

- The company's strategic investments in technology-fueled operational enhancements and cost control measures are expected to sustain high-quality growth and drive earnings improvements, underpinning future profit margin expansion.

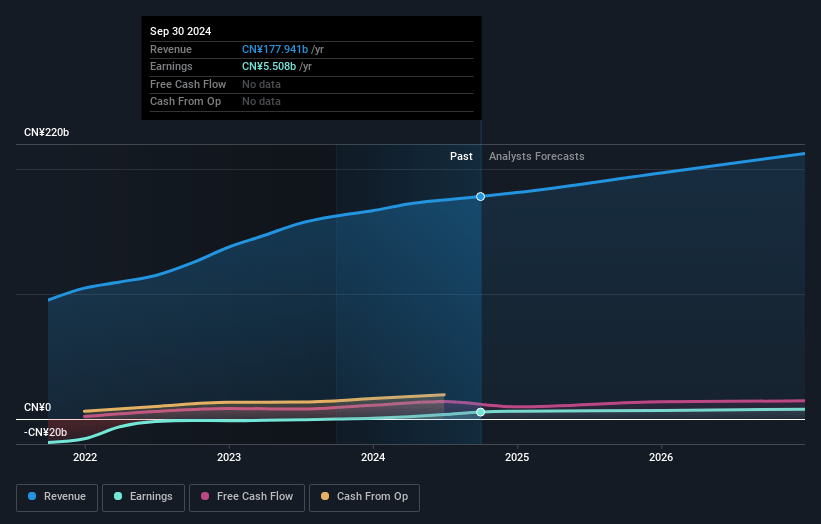

JD Logistics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming JD Logistics's revenue will grow by 9.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.4% today to 3.7% in 3 years time.

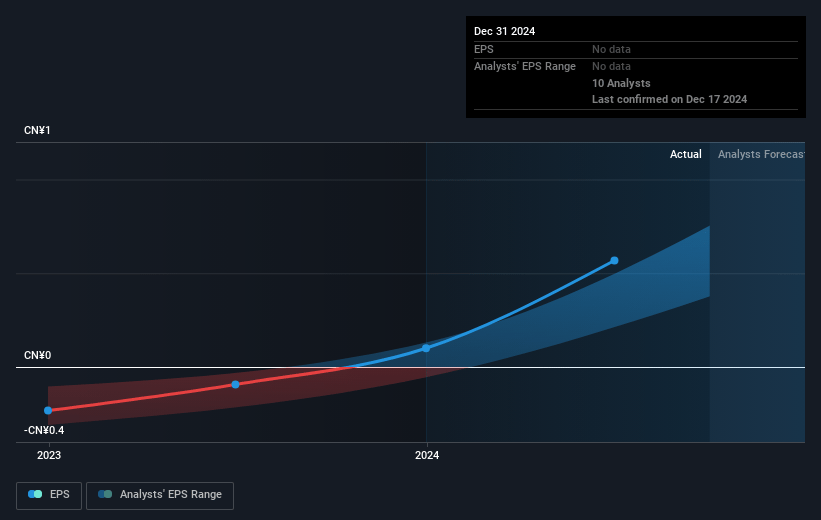

- Analysts expect earnings to reach CN¥8.9 billion (and earnings per share of CN¥1.43) by about March 2028, up from CN¥6.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.0x on those 2028 earnings, up from 12.6x today. This future PE is greater than the current PE for the HK Logistics industry at 12.7x.

- Analysts expect the number of shares outstanding to grow by 0.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.64%, as per the Simply Wall St company report.

JD Logistics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- JD Logistics faces increasing competition in the delivery and logistics sector, which could affect its ability to maintain or grow its revenue margins amidst price wars. [Revenue, Net Margins]

- The company's substantial investments in technology and infrastructure, while potentially boosting future efficiency, could lead to short-term increases in operating costs and impact net earnings. [Net Margins, Earnings]

- Expansion into new markets and services, such as those on Taobao and Tmall, while promising, also involves execution risks and the possibility of not achieving expected market penetration, which may affect projected revenue growth. [Revenue]

- Dependence on AI and technological innovations to drive efficiency improvements and cost reductions could pose risks if these technologies do not deliver the expected results or require more time and resources to implement. [Net Margins, Earnings]

- The emphasis on developing its international business may spread resources thin and introduce volatility due to geopolitical or regulatory changes in those regions, potentially impacting revenue stability and growth. [Revenue]

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$18.503 for JD Logistics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$23.28, and the most bearish reporting a price target of just HK$12.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥242.8 billion, earnings will come to CN¥8.9 billion, and it would be trading on a PE ratio of 15.0x, assuming you use a discount rate of 7.6%.

- Given the current share price of HK$13.68, the analyst price target of HK$18.5 is 26.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.