Last Update23 Oct 25Fair value Increased 16%

Analysts have raised their price target for MedinCell from €26.90 to €31.16, citing improved revenue growth projections and favorable updates to future earnings expectations as key drivers for this upward revision.

What's in the News

- FDA approves UZEDY, a once-monthly, long-acting risperidone injection, as monotherapy or adjunctive therapy for maintenance treatment of bipolar I disorder in adults. This approval expands its prior indication for schizophrenia (FDA approval).

- Olanzapine LAI, an investigational long-acting injection for schizophrenia, is expected to be submitted for NDA approval in the US by Q4 2025. This marks the second product in MedinCell's partnership with Teva using proprietary copolymer technology (Company announcement).

- UZEDY receives regulatory approval in South Korea and shows strong commercial performance, achieving $117 million in net sales in 2024 and $95 million in the first half of 2025. MedinCell continues to earn royalties and remains eligible for milestone payments (Company announcement).

Valuation Changes

- Consensus Analyst Price Target has increased from €26.90 to €31.16, reflecting a notable upward revision.

- Revenue Growth has risen significantly, moving from 69.8% to 85.1%.

- Discount Rate remains unchanged at 5.98%.

- Net Profit Margin has decreased slightly, from 51.4% to 51.1%.

- Future P/E ratio has declined from 18.4x to 16.5x, which indicates improved earnings expectations.

Key Takeaways

- Expansion of UZEDY and BEPO®-based programs, along with strong partnerships, underpin growth and reduce reliance on a single product.

- Extended patent protection and real-world value evidence support sustained pricing power and margin strength amid growing demand globally.

- Heavy reliance on two products and the need for timely regulatory approvals expose MedinCell to financial risks from delays, competition, and constrained access to capital for pipeline growth.

Catalysts

About MedinCell- A pharmaceutical company, develops long acting injectables in various therapeutic areas in France.

- Recent tripling of revenues driven by successful commercialization of UZEDY and the strong ongoing ramp in prescriptions suggest that MedinCell's growth assumptions remain underappreciated, with continued expansion into new indications (like bipolar disorder) likely to further enhance royalty revenue streams and accelerate top-line growth.

- U.S. patent extensions for UZEDY (to 2042) and Olanzapine LAI (to 2044) significantly prolong periods of exclusivity, protecting pricing power and supporting higher net margins and long-term earnings visibility than may be reflected in the current stock price.

- MedinCell's demonstrated ability to secure large-scale partnerships (recent AbbVie deal, high ongoing partner interest) and expansion into emerging global markets for long-acting injectable therapies position it to capture rising demand fueled by broader healthcare access and aging populations-directly supporting future revenue expansion potential.

- Positive real-world outcomes data for UZEDY (e.g., significant reductions in relapse, hospitalization, and healthcare costs) respond to the growing priority among payers and systems for improved medication adherence and economic value, positioning MedinCell's platform for premium pricing and broader uptake, supporting higher EBIT.

- The diversification of the BEPO® technology platform into new high-growth therapeutic areas (contraception, oncology, CNS) and transition of multiple partnered and in-house programs toward clinical stages is set to drive future revenue streams and stabilize earnings as the company moves beyond reliance on its initial blockbusters.

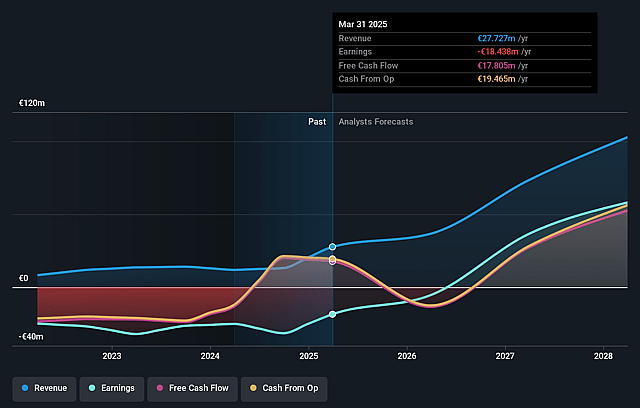

MedinCell Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MedinCell's revenue will grow by 54.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -66.5% today to 56.5% in 3 years time.

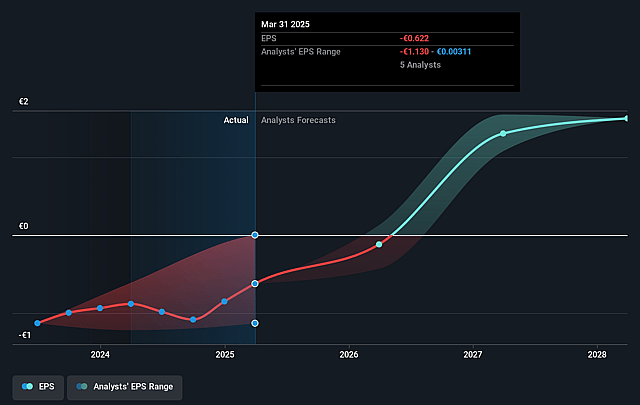

- Analysts expect earnings to reach €58.1 million (and earnings per share of €1.5) by about September 2028, up from €-18.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €73.5 million in earnings, and the most bearish expecting €42.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.7x on those 2028 earnings, up from -30.4x today. This future PE is lower than the current PE for the FR Pharmaceuticals industry at 18.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.98%, as per the Simply Wall St company report.

MedinCell Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- MedinCell's financial performance is currently reliant on the successful commercialization and continued growth of just two products, UZEDY and Olanzapine LAI, making it vulnerable to clinical, regulatory, or competitive setbacks in either-any delays or failures would significantly impact future revenue and net earnings.

- The company's future profitability is predicated on timely regulatory approvals (especially for Olanzapine LAI in 2026 and broader UZEDY indications), but any increase in regulatory rigor or unexpected demands for additional studies could delay launches and defer revenue generation.

- Despite recent revenue growth, MedinCell remains dependent on milestone payments, royalties, and the successful forging of new commercial partnerships; any slowdown in partnership activity or deal failures would hinder revenue expansion and could pressure net margins.

- MedinCell faces potential market share and pricing pressure over the long term from generic long-acting injectables or alternative delivery technologies as the sector attracts more competition, potentially eroding future revenue streams and profit margins.

- The company's plans for international expansion, entry into complex markets (like oncology), and increased R&D activity rely on sustained access to capital, but tightening biotech funding cycles and macroeconomic instability could complicate future fund-raising, restricting pipeline investment and jeopardizing long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €22.771 for MedinCell based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €27.0, and the most bearish reporting a price target of just €19.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €102.8 million, earnings will come to €58.1 million, and it would be trading on a PE ratio of 18.7x, assuming you use a discount rate of 6.0%.

- Given the current share price of €16.94, the analyst price target of €22.77 is 25.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.