Key Takeaways

- SCOR's strategic reserve building and market approach could enhance net earnings through opportunistic capital deployment.

- Focus on high-margin Life & Health segments and improved ALM aims to stabilize earnings and improve cost efficiency.

- Earnings volatility and limited profitability improvements could impact SCOR due to challenges in Life & Health, market sensitivity, and reliance on one-off management actions.

Catalysts

About SCOR- Provides life and non-life reinsurance products in Europe, the Middle East, Africa, the Americas, Latin America, and Asia Pacific.

- SCOR's successful 01/01 P&C renewals with a 9.6% growth in premiums and stable combined ratios demonstrate strong underlying business performance, which is expected to bolster future revenue and profits.

- The strategic acceleration in building P&C reserves 2 years ahead of schedule allows SCOR to adopt a more opportunistic market approach, potentially enhancing net earnings by strategically deploying excess capital.

- The company’s solvency ratio of 210% post a challenging year and the issuance of €500 million RT1 debt highlights financial resilience and improved capital management, likely leading to stable dividends and favorable investor perception influencing earnings positively.

- Implementation of the Forward 2026 strategic plan, which includes operational improvements in asset-liability management (ALM) and risk partnerships, aims to improve cost efficiency and net margins over time.

- SCOR's focus on shifting the Life & Health business toward higher-margin segments and improved monitoring of the existing portfolio is anticipated to enhance future revenue growth and stabilize associated earnings volatility.

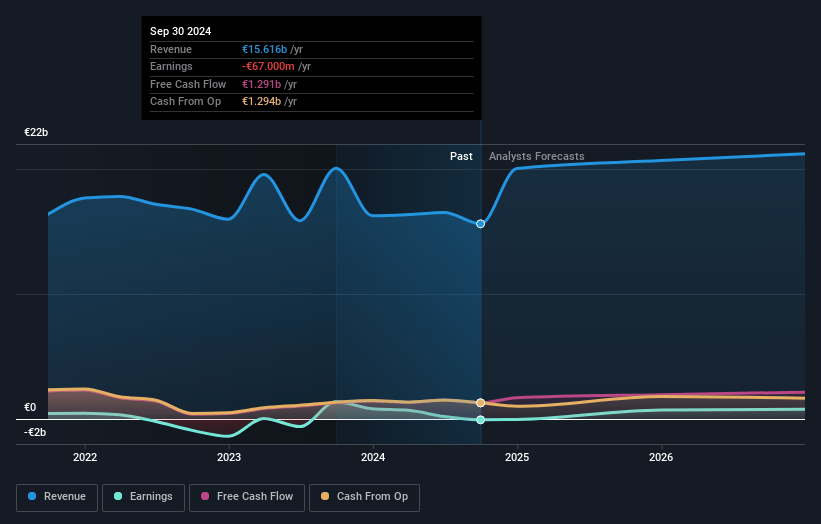

SCOR Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming SCOR's revenue will grow by 10.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.0% today to 3.8% in 3 years time.

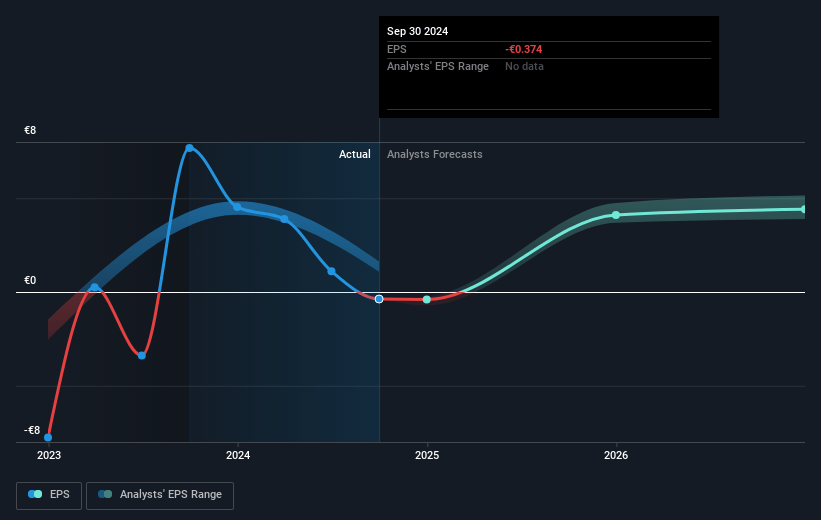

- Analysts expect earnings to reach €835.0 million (and earnings per share of €4.74) by about April 2028, up from €4.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €931 million in earnings, and the most bearish expecting €682.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.6x on those 2028 earnings, down from 1119.3x today. This future PE is lower than the current PE for the GB Insurance industry at 573.6x.

- Analysts expect the number of shares outstanding to grow by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.31%, as per the Simply Wall St company report.

SCOR Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The impact of the Life & Health review was significant, with the full year being negative and adjustments impacting earnings. This could continue to negatively influence SCOR's net margins and overall earnings.

- The combined ratio targets and buffer building in P&C could imply limited room for future earnings improvement if underwriting results worsen, potentially impacting profitability and net margins.

- Experience variances in the U.S. Life & Health portfolio are still presenting challenges, which could lead to volatility in earnings and affect the predictability of SCOR's revenue from this segment.

- Market sensitivity, particularly to euro interest rate movements, remains an area where the company plans further actions, implying ongoing exposure to market risks that could affect revenue and solvency metrics.

- SCOR's solvency ratio, while strong, has been assisted by one-off management actions, and future earnings or capital generation might need to account for similar measures, impacting its financial resilience and capital management capabilities.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €29.428 for SCOR based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €34.0, and the most bearish reporting a price target of just €22.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €22.0 billion, earnings will come to €835.0 million, and it would be trading on a PE ratio of 7.6x, assuming you use a discount rate of 6.3%.

- Given the current share price of €24.96, the analyst price target of €29.43 is 15.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.