Key Takeaways

- Expanding in hyperscale, enterprise, and defense markets could drive future revenue growth and bolster Nokia's market presence.

- Strategic capital allocation and the Infinera acquisition may boost innovation, operating margins, and long-term value.

- Declines in sales and margins, ongoing tariff risks, and challenges with acquisitions and one-time charges could impact Nokia's future revenue and earnings stability.

Catalysts

About Nokia Oyj- Provides mobile, fixed, and cloud network solutions in North and Latin America, Greater China, India, rest of the Asia Pacific, Europe, the Middle East, and Africa.

- Nokia's leadership sees significant potential to expand presence in hyperscale, enterprise, and defense markets, which could drive future revenue growth.

- The Infinera acquisition is expected to provide scale, accelerate product road maps, and drive more innovation, potentially benefiting revenue and margins.

- Nokia's order growth across Network Infrastructure, especially in Optical Networks and Cloud and Network Services, signals an opportunity for increased revenues.

- The company is focusing on capital allocation to support efficiency and invest in growth segments, which may enhance operating margins and long-term value.

- Encouraging market recovery signs and extensions of key contracts, like the RAN agreement with T-Mobile U.S., are likely to contribute to revenue stabilization or growth in the Mobile Networks segment.

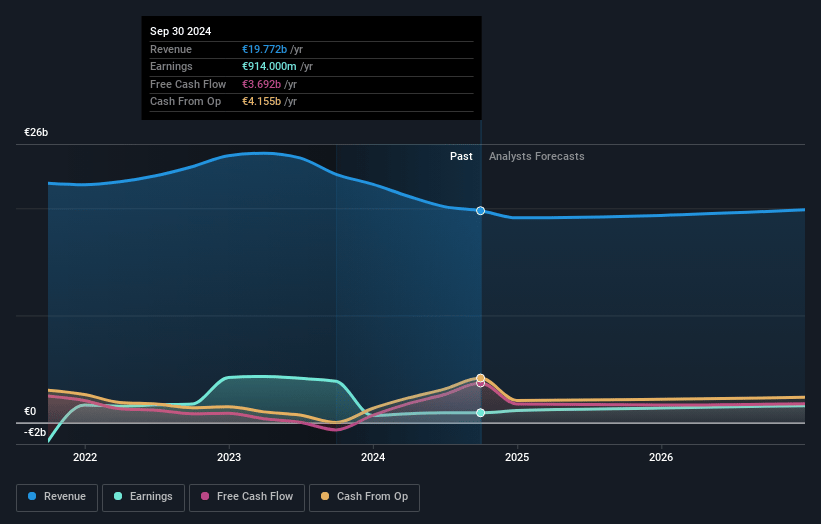

Nokia Oyj Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Nokia Oyj's revenue will grow by 4.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.3% today to 8.6% in 3 years time.

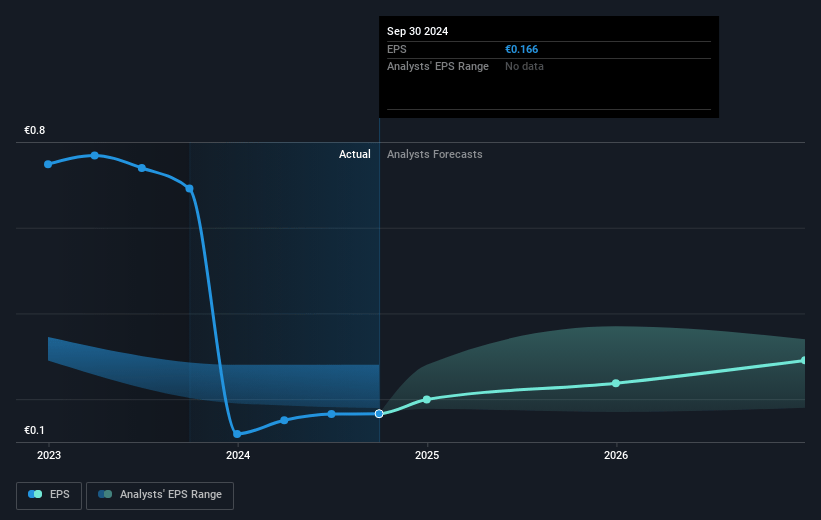

- Analysts expect earnings to reach €1.9 billion (and earnings per share of €0.33) by about May 2028, up from €1.2 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €2.1 billion in earnings, and the most bearish expecting €1.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.6x on those 2028 earnings, down from 19.7x today. This future PE is lower than the current PE for the US Communications industry at 19.6x.

- Analysts expect the number of shares outstanding to decline by 2.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.7%, as per the Simply Wall St company report.

Nokia Oyj Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Nokia experienced a decline in Q1 net sales by 3% year-over-year, attributed to licensing deals signed in Nokia Technologies in the previous year, which can impact future revenue growth.

- The company noted a decrease in gross margin by 820 basis points in Q1, partially due to one-off charges in Mobile Networks, which could negatively affect net margins.

- Nokia expects a €20 million to €30 million impact on operating profit due to potential tariffs in Q2, highlighting ongoing risks from the global trade landscape and supply chain, which could impact earnings.

- The integration of Infinera may not significantly impact the expected operating profit range, signaling potential risks or slower-than-anticipated benefits from the acquisition, which could affect synergies and future earnings.

- Unexpected one-time settlement charges (e.g., €120 million in Mobile Networks) highlight unforeseen operational risks, indicating challenges in maintaining consistent operating margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €4.774 for Nokia Oyj based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €6.05, and the most bearish reporting a price target of just €3.4.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €21.7 billion, earnings will come to €1.9 billion, and it would be trading on a PE ratio of 15.6x, assuming you use a discount rate of 6.7%.

- Given the current share price of €4.39, the analyst price target of €4.77 is 8.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.