Key Takeaways

- Growth in AI-driven solutions and advanced analytics is driving new contracts, improving margins, and expanding opportunities as clients increase digital transformation investments.

- Strategic focus on cybersecurity, compliance, and international expansion supports recurring revenue streams, higher margins, and reduces reliance on the Nordic market.

- Persistent lack of revenue growth, operational inefficiencies, limited international diversification, and legacy technology challenges threaten Tietoevry Oyj's long-term competitiveness and profitability.

Catalysts

About TietoEVRY Oyj- Operates as a software and services company.

- The rapid increase in AI and advanced analytics adoption across client industries is reflected in Tietoevry's contract wins where embedded AI is highlighted as a differentiator, positioning the company to capture new growth opportunities and drive both revenue expansion and improved margins as more enterprises prioritize digital transformation projects.

- Heightened focus on cybersecurity and upcoming data privacy regulations, especially in highly regulated sectors like banking and healthcare, support Tietoevry's specialized software and compliance offerings, helping secure long-term contracts and providing visibility for stable revenue and margin growth.

- The company's €115 million cost optimization program (targeted by 2026), including significant SG&A and process efficiencies, is expected to structurally lift net margins and overall profitability, with parts of these savings beginning to accrue from H2 2024 onwards.

- The record-high order backlog, especially in the Banking segment (up 14% YoY), underpins medium-term revenue visibility and is likely to translate into top-line acceleration as new long-term contracts from recent wins are converted to revenue.

- Ongoing strategic international expansion in core verticals such as Banking and Care, including wins outside the Nordics, leverages proprietary cloud and platform solutions-creating potential for recurring, higher-margin revenues and reduction in geographic concentration risk.

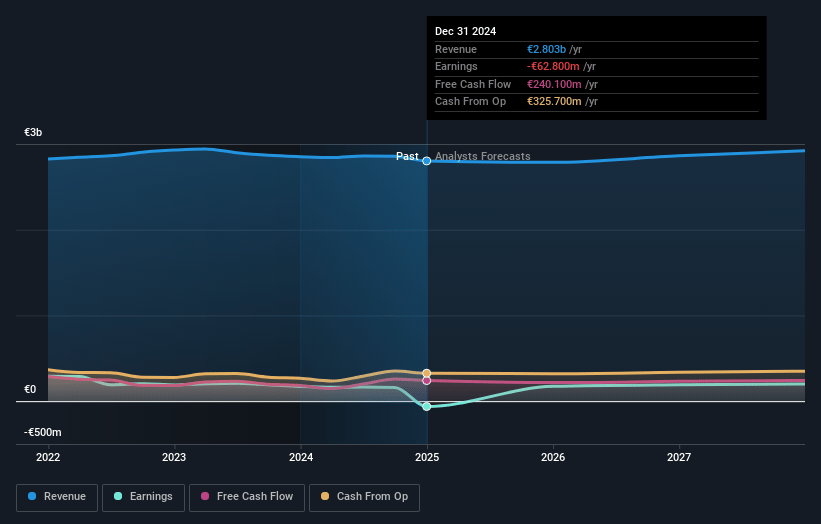

TietoEVRY Oyj Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TietoEVRY Oyj's revenue will decrease by 8.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from -6.4% today to 14.4% in 3 years time.

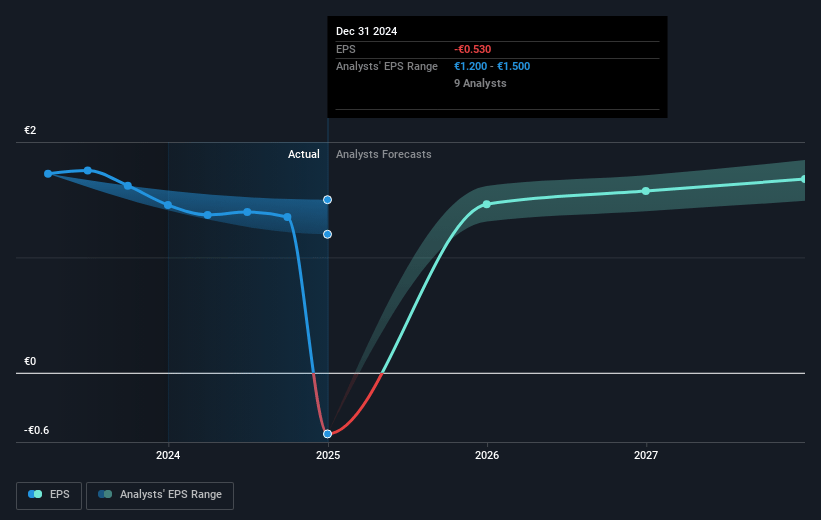

- Analysts expect earnings to reach €282.8 million (and earnings per share of €1.17) by about July 2028, up from €-163.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.8x on those 2028 earnings, up from -10.7x today. This future PE is lower than the current PE for the GB IT industry at 16.6x.

- Analysts expect the number of shares outstanding to decline by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.24%, as per the Simply Wall St company report.

TietoEVRY Oyj Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent lack of organic revenue growth over the past 12 years, with average growth close to 0% compared to a market CAGR of 4–7%, raises concerns about Tietoevry Oyj's ability to regain and sustain revenue expansion, potentially leading to long-term revenue stagnation or decline.

- Continued exposure to cost pressure and high SG&A base due to operational inefficiencies and market underperformance has required significant cost-cutting programs and workforce reductions, which may constrain future innovation and negatively impact net margins if not balanced carefully.

- Heavy dependence on mature Nordic markets for core business, with only early-stage international expansion in areas like Care and Banking, indicates that insufficient geographic diversification could constrain future top-line growth and limit market share gains, impacting long-term revenue growth prospects.

- Ongoing challenges in the Create and Industry segments, including weak consulting demand across all geographies, price pressure, project postponements/cancellations, and overcapacity, contribute to earnings volatility and create risks of further profit erosion if demand does not recover.

- Increased impairment of legacy technology investments (e.g., €80 million write-down in Banking) and the need to reinvest in R&D to remain competitive against larger or more innovative industry players signal a risk that Tietoevry may continue to lag in delivering next-gen digital solutions, potentially impacting both revenue growth and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €16.27 for TietoEVRY Oyj based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €20.0, and the most bearish reporting a price target of just €12.3.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €2.0 billion, earnings will come to €282.8 million, and it would be trading on a PE ratio of 8.8x, assuming you use a discount rate of 9.2%.

- Given the current share price of €14.79, the analyst price target of €16.27 is 9.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.