Key Takeaways

- Focus on late-stage developments and new product launches, including Vyepti, could drive future revenue growth and global expansion.

- Strategic capital allocation and acquisition of high-potential assets enhance long-term earnings and support R&D projects.

- Rising R&D and integration costs, along with competitive pressures and market volatility, could challenge net margins and impact Lundbeck's overall profitability despite strong revenue growth.

Catalysts

About H. Lundbeck- Engages in the research, development, manufacturing, and commercializing pharmaceuticals for the treatment of psychiatric and neurological disorders in Europe, United States, and internationally.

- The transformation strategy of H. Lundbeck highlights a robust pipeline change with a focus on late-stage developments, which could drive future revenue growth with new product launches, particularly with Vyepti's expansion and the anti-PACAP development program.

- The strategic shift in capital allocation towards funding larger R&D projects is expected to absorb additional investments, potentially leading to maintained healthy R&D expenditures, positively impacting earnings in the long term.

- The introduction and expansion of Rexulti and Vyepti into new markets, including potential launches in Asia, could serve as significant revenue catalysts, both globally and across prioritized markets.

- Cost-saving measures alongside a slight rebalancing of market strategies, such as modifications to the Trintellix collaboration with Takeda, are designed to enhance net margins despite competitive pressures and anticipated generic entries.

- The acquisition and integration of Longboard, alongside the associated development programs, aim to strengthen the earnings trajectory by adding high-potential assets into Lundbeck’s portfolio, supported by improved capital reallocation strategies.

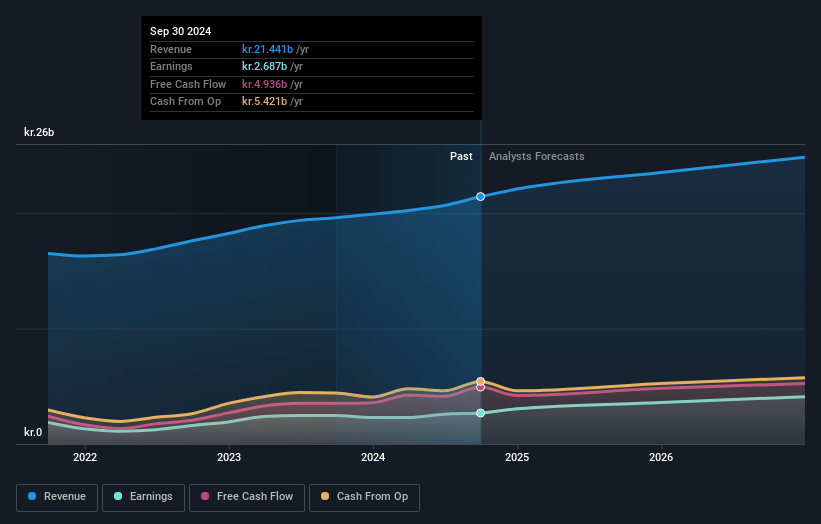

H. Lundbeck Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming H. Lundbeck's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.3% today to 16.5% in 3 years time.

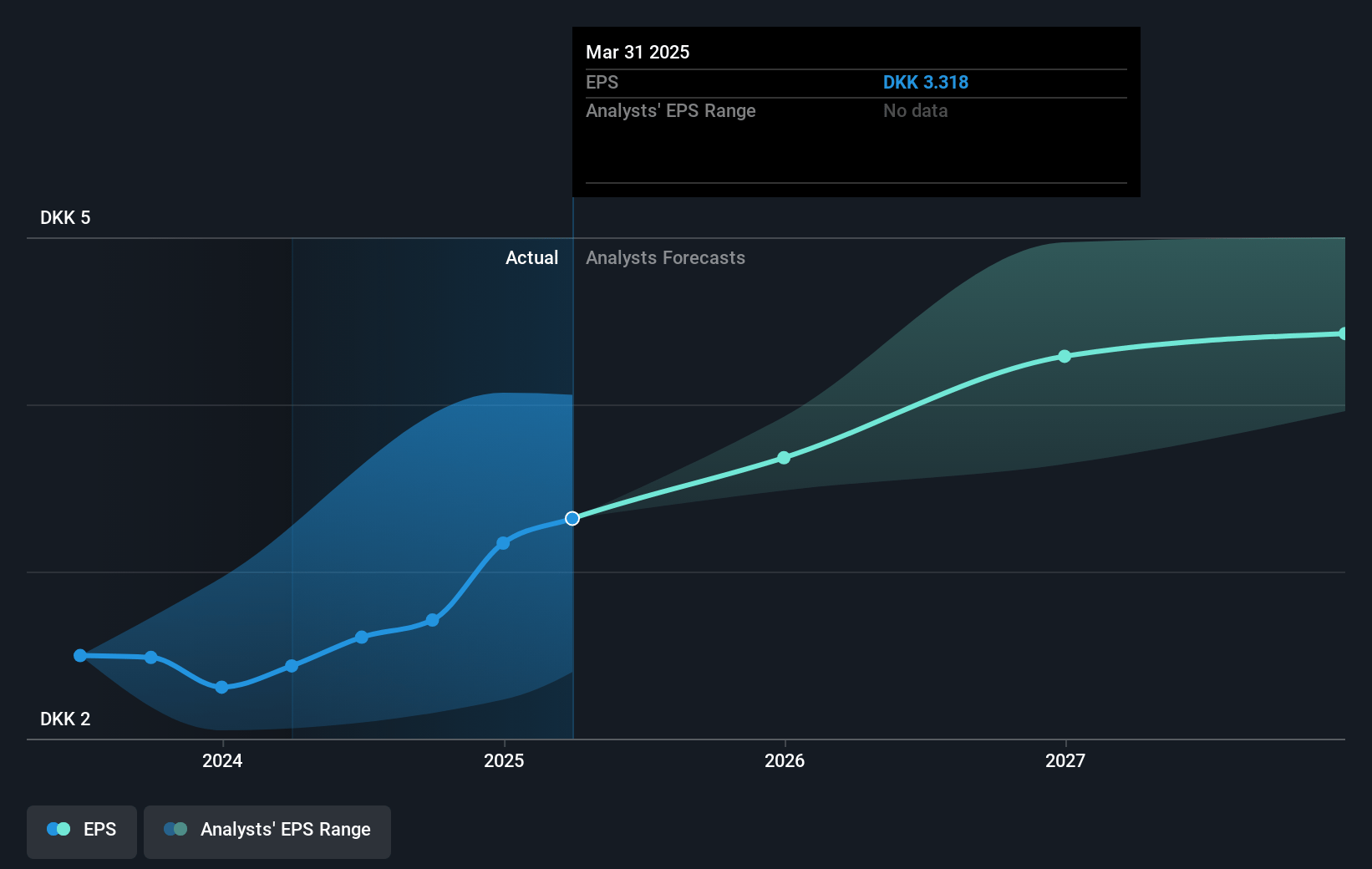

- Analysts expect earnings to reach DKK 4.2 billion (and earnings per share of DKK 4.24) by about April 2028, up from DKK 3.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as DKK3.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.4x on those 2028 earnings, up from 9.0x today. This future PE is lower than the current PE for the GB Pharmaceuticals industry at 18.7x.

- Analysts expect the number of shares outstanding to decline by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.74%, as per the Simply Wall St company report.

H. Lundbeck Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rising R&D costs driven by investments into anti-PACAP and alpha-synuclein mAb, along with potential MAGLi impairment losses, could pressure net margins despite strong revenue growth, impacting earnings.

- Expected generic competition for Brintellix in Canada and for Abilify in Europe during 2025 could negatively impact revenue and offset growth from other brands.

- The recent destocking of inventory for both Vyepti and Rexulti in the U.S. might indicate potential volatility in sales and revenue recognition, which could affect earnings in future quarters.

- Vyepti's dependence on IV administration could limit patient adoption compared to oral alternatives, potentially impacting its revenue growth trajectory.

- The ongoing legal provisions and the integration costs related to the Longboard acquisition might increase administrative expenses and affect net margins, impacting overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of DKK49.682 for H. Lundbeck based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of DKK70.0, and the most bearish reporting a price target of just DKK42.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be DKK25.6 billion, earnings will come to DKK4.2 billion, and it would be trading on a PE ratio of 13.4x, assuming you use a discount rate of 4.7%.

- Given the current share price of DKK28.56, the analyst price target of DKK49.68 is 42.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.