Key Takeaways

- Strategic diversification and renewable expansion enhance Enel Chile's stability and growth prospects, ensuring reliable supply and efficiency benefits in Chile's energy transition.

- Improvements in regulation and cash flow management strengthen financial position, bolstering asset resilience, profitability, and potential for higher dividends.

- Extraordinary weather impacts and currency volatility, combined with regulatory risks, create significant challenges for Enel Chile's financial stability and future revenue prospects.

Catalysts

About Enel Chile- An electricity utility company, engages in the generation, transmission, and distribution of electricity in Chile.

- The successful integration of the Los Condores hydro power project and the positive hydrological conditions are expected to enhance Enel Chile's hydro generation capacity, likely boosting future revenues from increased electricity production.

- The strategic diversification of energy sources, including securing year-round contracts with Argentinean natural gas providers and maintaining LNG contracts, provides price stability and supply reliability, which can improve net margins by reducing fuel costs.

- The expansion of Enel Chile's renewable portfolio, including solar, wind, and battery energy storage systems (BESS), positions the company to benefit from Chile's energy transition, potentially driving revenue growth through increased capacity and efficiency.

- Regulatory advancements, such as improvements in distribution remuneration rates and expected VAD process outcomes, may positively impact profitability and drive an increase in earnings and EBITDA by enhancing asset resilience and operational efficiency.

- The execution of PEC factoring and the subsequent reduction of receivables are expected to improve cash flow, thereby strengthening the financial position and potentially supporting higher dividend payouts and earnings visibility.

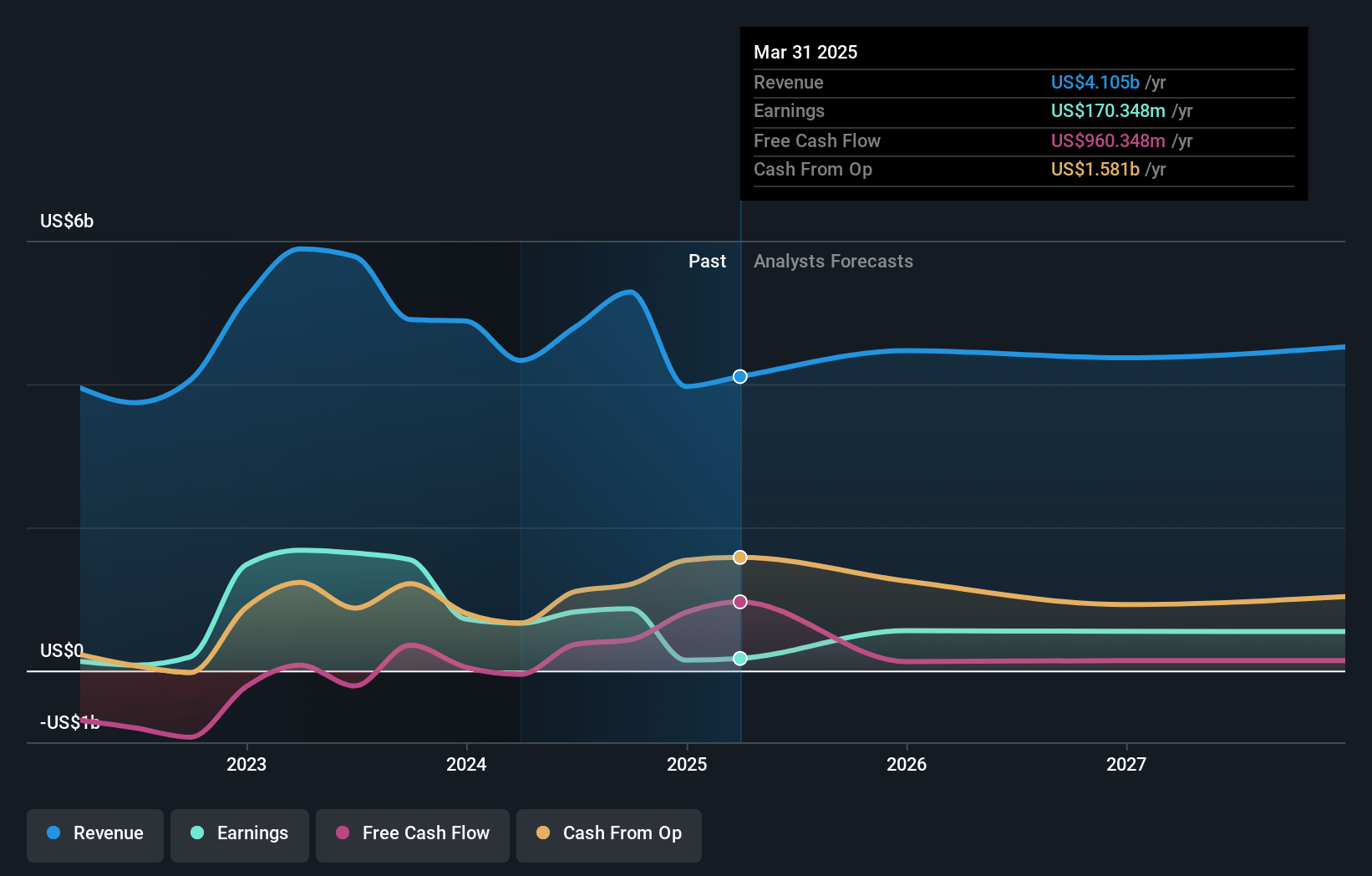

Enel Chile Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Enel Chile's revenue will grow by 3.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.7% today to 10.9% in 3 years time.

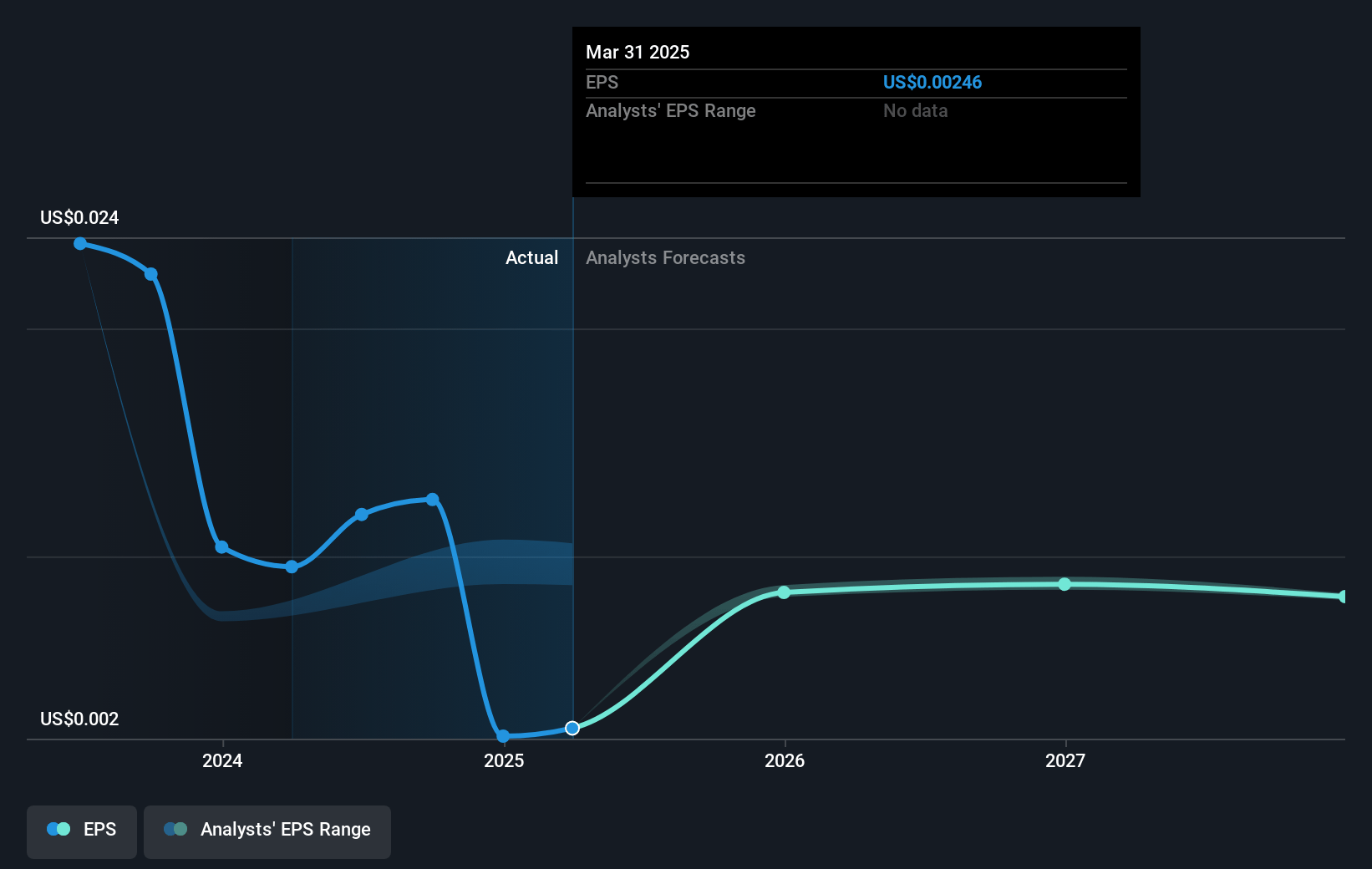

- Analysts expect earnings to reach CLP 470.9 billion (and earnings per share of CLP 12.14) by about April 2028, up from CLP 145.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.2x on those 2028 earnings, down from 30.4x today. This future PE is greater than the current PE for the US Electric Utilities industry at 7.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.84%, as per the Simply Wall St company report.

Enel Chile Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The August 2024 extraordinary weather event significantly impacted Enel Chile's distribution network, resulting in fines and a voluntary compensation program. This could negatively affect the company's net margins due to increased operational costs and regulatory penalties.

- The non-cash impact from changing the company's functional currency resulted in a $657 million EBITDA adjustment, highlighting foreign exchange vulnerability, which could impact earnings if currency volatility continues.

- Enel Chile faces regulatory and legal risks, including a $20 million fine related to the August storm and potential government assessment of concession revocation, which could affect future revenue stability and regulatory costs.

- The dependence on hydrological conditions introduces volatility, as conservative hydro output estimates are based on a 10-year average despite recent wet years. Future reductions in favorable hydrology could significantly impact revenue and earnings.

- The ongoing restructuring of tariffs and regulatory frameworks might impact distribution margins and investor confidence, given the proposed but pending distribution reform and potential increase in PEC-related subsidies.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CLP72.833 for Enel Chile based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CLP80.0, and the most bearish reporting a price target of just CLP62.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CLP4320.4 billion, earnings will come to CLP470.9 billion, and it would be trading on a PE ratio of 14.2x, assuming you use a discount rate of 9.8%.

- Given the current share price of CLP63.85, the analyst price target of CLP72.83 is 12.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.