Key Takeaways

- SMU's focus on expansion and digital growth aims to increase revenue and improve profit margins with new stores and rising e-commerce penetration.

- Efficiency improvements and cost-saving initiatives, including energy cost reductions, are designed to enhance net margins and boost long-term earnings.

- Competitive pressures and rising costs are challenging revenue, profitability, and financial stability, potentially deterring investor confidence and impacting long-term strategies.

Catalysts

About SMU- Operates as a food retailer in Chile and Peru.

- SMU's expansion strategy includes opening 24 new stores in 2025, building on the 34 stores opened in 2023 and 2024, which is expected to increase revenue growth through greater market presence and customer accessibility.

- The growth in e-commerce sales and online sales penetration, which rose from 2.8% in 2023 to 4% in 2024, suggests an upward trend in digital revenue streams that would likely improve both overall revenue and profit margins.

- SMU's focus on efficiency and productivity—through technological tools like automated demand planning and reduced reliance on manual processes—is meant to lower operating expenses, potentially enhancing net margins and increasing earnings.

- The restructuring plan in early 2025, which will generate annual savings of approximately CLP 9 billion beyond this year, will improve cost efficiency, boosting EBITDA and net income in future periods.

- By contracting a higher percentage of energy consumption under unregulated rates, aiming for over 50% by 2027, SMU is set to reduce energy costs significantly, enhancing net margins and contributing to sustainable earnings growth.

SMU Future Earnings and Revenue Growth

Assumptions

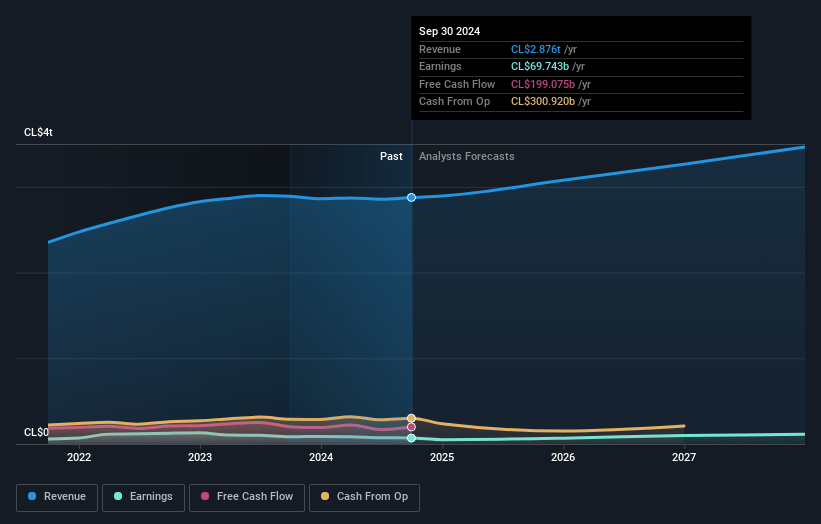

How have these above catalysts been quantified?- Analysts are assuming SMU's revenue will grow by 5.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.7% today to 3.1% in 3 years time.

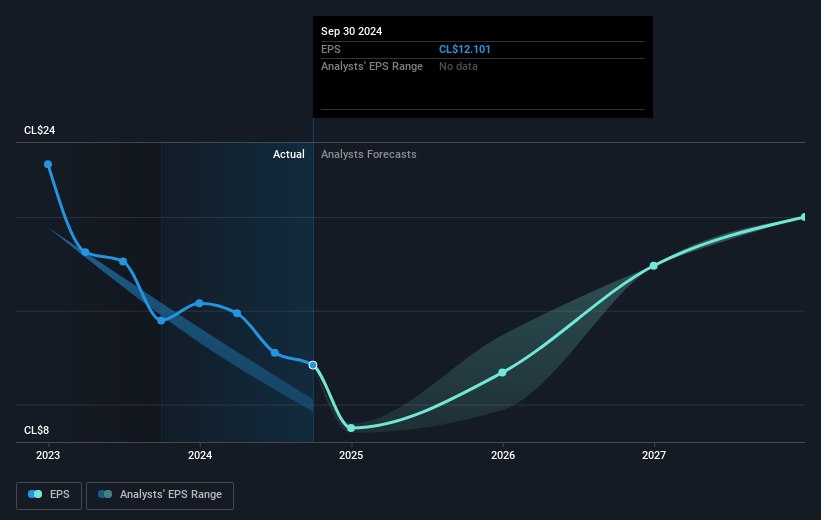

- Analysts expect earnings to reach CLP 104.9 billion (and earnings per share of CLP 18.06) by about May 2028, up from CLP 48.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.2x on those 2028 earnings, down from 21.9x today. This future PE is lower than the current PE for the CL Consumer Retailing industry at 40.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.98%, as per the Simply Wall St company report.

SMU Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces significant competitive pressure in both Chile and Peru, with aggressive pricing strategies and numerous new store openings by rivals, which could impact revenue and market share.

- Operating expenses are rising due to higher minimum wage, inflation, and increased electricity prices, impacting net margins and potentially offsetting revenue gains from new stores or sales growth initiatives.

- The company's net income has been under pressure, decreasing by 44.1% for the year, largely due to lower operating income and higher depreciation and amortization, which could deter investor confidence and affect earnings stability.

- The company has a high leverage ratio, as shown by net financial liabilities to EBITDA at 4.6x, signaling a risk to financial health and borrowing ability, which could impact long-term financial planning and net margins due to increased interest expenses.

- Increased reliance on promotional activities and price sensitivity among customers might continue to pressure gross margins, as seen with a dip in margins during earlier quarters despite recent recovery, affecting overall profitability and revenue strength.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CLP210.0 for SMU based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CLP3390.3 billion, earnings will come to CLP104.9 billion, and it would be trading on a PE ratio of 16.2x, assuming you use a discount rate of 12.0%.

- Given the current share price of CLP185.0, the analyst price target of CLP210.0 is 11.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.