Last Update 16 Sep 25

Fair value Decreased 38%TeraGo's price target was cut following a substantial decline in its forward P/E ratio amid slightly weaker revenue growth expectations, lowering the fair value estimate from CA$1.60 to CA$1.00.

What's in the News

- TeraGo announced a non-brokered private placement to issue 6,547,619 common shares at CAD 0.84 for proceeds of CAD 5.5 million, with insider participation expected and subject to stock exchange approval.

- The company filed a follow-on equity offering for CAD 16.84 million, offering 20,053,411 common shares at CAD 0.84 in a rights offering.

Valuation Changes

Summary of Valuation Changes for TeraGo

- The Consensus Analyst Price Target has significantly fallen from CA$1.60 to CA$1.00.

- The Future P/E for TeraGo has significantly fallen from 15.04x to 9.53x.

- The Consensus Revenue Growth forecasts for TeraGo has fallen from 1.4% per annum to 1.3% per annum.

Key Takeaways

- TERAGO's strategic mid-market focus and reduced churn anticipate future revenue growth, bolstered by improved account revenues and spectral assets.

- Enhanced operational and financial results, including EBITDA growth and increased cash flow, suggest stronger net margins and earnings potential.

- Uncertainty in regulatory decisions and slow revenue growth raise concerns about TeraGo's profitability and competitive positioning in the telecom market.

Catalysts

About TeraGo- Provides connectivity services for businesses primarily in Canada.

- TERAGO’s strategic focus on the mid-market and lower enterprise businesses, along with reduced customer churn and a 5.2% growth in average revenue per account, is expected to drive future revenue growth.

- Possession of 91% of the millimeter wave spectrum positions TERAGO advantageously for potential regulatory changes allowing flexible use, unlocking new revenue streams through mobile services.

- Operational improvements, including better deal-level economics, reduced operating expenditures, and a 16.9% rise in adjusted EBITDA, suggest potential improvements in net margins.

- A significant improvement in backlog, with $112,000 in monthly recurring revenue compared to $65,000 in the previous year, indicates future revenue growth potential.

- A strong cash flow increase, with $5 million generated from operations compared to $523,000 in the previous year, may contribute to better net margins and earnings due to optimized business operations.

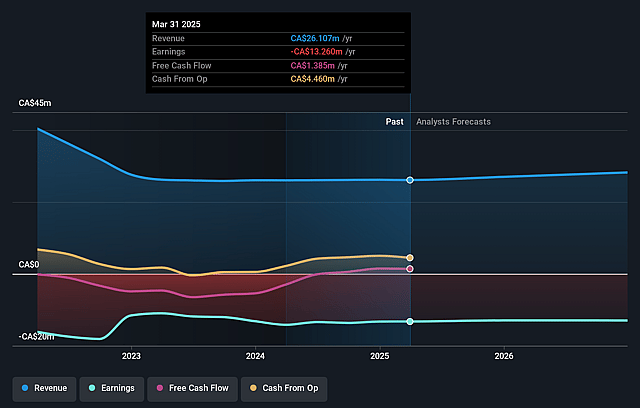

TeraGo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TeraGo's revenue will grow by 4.5% annually over the next 3 years.

- Analysts are not forecasting that TeraGo will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate TeraGo's profit margin will increase from -50.8% to the average CA Telecom industry of 9.4% in 3 years.

- If TeraGo's profit margin were to converge on the industry average, you could expect earnings to reach CA$2.8 million (and earnings per share of CA$0.14) by about August 2028, up from CA$-13.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.4x on those 2028 earnings, up from -1.7x today. This future PE is greater than the current PE for the CA Telecom industry at 11.9x.

- Analysts expect the number of shares outstanding to grow by 0.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.69%, as per the Simply Wall St company report.

TeraGo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The anticipated decision by ISED regarding the repurposing of the lower 26 gigahertz band for flexible use remains uncertain, potentially delaying or altering market opportunities, impacting future revenue growth from new offerings.

- The marginal increase in total revenue from $26.05 million to $26.16 million in 2024 suggests slow revenue growth, not meeting possible investor expectations for significant expansion.

- Continuous net losses, with a net loss of $13.2 million in 2024 compared to $13.1 million in 2023, may raise concerns regarding TERAGO's path to profitability, impacting overall financial outlook.

- The company’s substantial reliance on governmental and regulatory decisions (e.g., spectrum license renewals and adjustments) can introduce uncertainties and risks, potentially affecting future earnings stability.

- Canada's lag behind other countries in utilizing the millimeter wave spectrum for mobile, alongside possible competitive pressures from larger telecoms, could hinder rapid revenue expansion and negatively impact net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$2.0 for TeraGo based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$29.8 million, earnings will come to CA$2.8 million, and it would be trading on a PE ratio of 17.4x, assuming you use a discount rate of 6.7%.

- Given the current share price of CA$1.15, the analyst price target of CA$2.0 is 42.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on TeraGo?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.