Key Takeaways

- Strategic shift to focus on industrial properties enhances revenue through increased rental income and lowers operational risk and volatility.

- Asset disposition and proactive leasing strategies improve balance sheet strength and sustain mid-growth in net operating income.

- Tenant vacancies, economic uncertainties, and high leverage could challenge Nexus Industrial REIT's revenue growth and stability amid sector-specific vulnerabilities.

Catalysts

About Nexus Industrial REIT- A growth-oriented real estate investment trust focused on increasing unitholder value through the acquisition of industrial properties located in primary and secondary markets in Canada, and the ownership and management of its portfolio of properties.

- Nexus Industrial REIT has made strategic acquisitions and developments, focusing on high-quality industrial properties in desirable markets, which should drive future revenue growth through increased rental income.

- The transition to a pure-play industrial REIT from mixed-use reduces risk and volatility, potentially leading to improved net margins by focusing on higher-yielding industrial properties and simplifying operations.

- Strategic dispositions of noncore assets, with proceeds used to reduce debt, should enhance net earnings by lowering interest expenses and improving the balance sheet.

- Proactive leasing and embedded rent escalations in leases are expected to sustain mid-single-digit same-property NOI growth, driving future revenue growth and potentially improving net margins.

- Development projects like St. Thomas and Calgary are advancing with high projected yields, indicating a strong pipeline for future revenue increases and earnings growth as these properties are completed and leased.

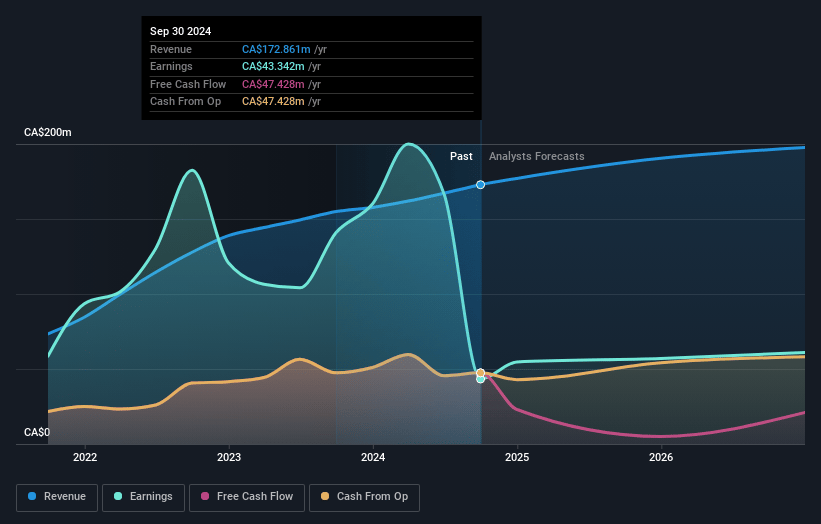

Nexus Industrial REIT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Nexus Industrial REIT's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 51.2% today to 20.6% in 3 years time.

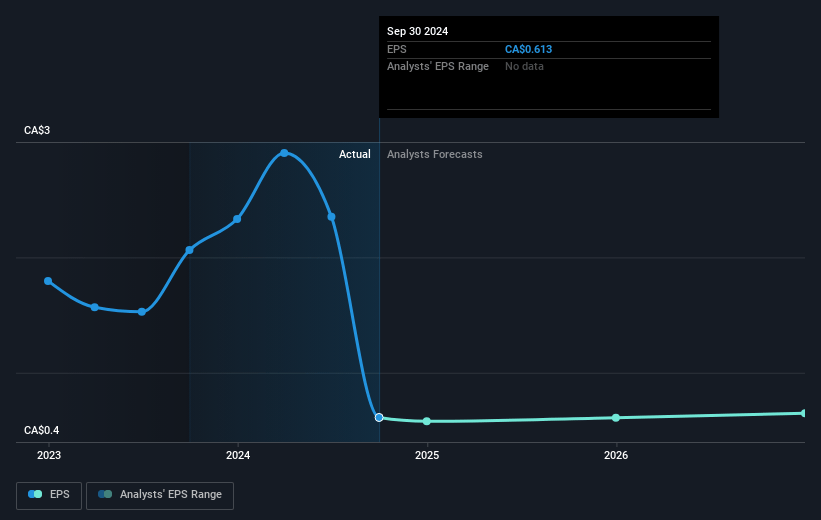

- Analysts expect earnings to reach CA$42.8 million (and earnings per share of CA$0.38) by about May 2028, down from CA$90.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.6x on those 2028 earnings, up from 5.3x today. This future PE is greater than the current PE for the CA Industrial REITs industry at 11.2x.

- Analysts expect the number of shares outstanding to grow by 3.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.81%, as per the Simply Wall St company report.

Nexus Industrial REIT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The slowing market in Hamilton, with difficulties in leasing the Glover Road property, indicates potential challenges in filling vacancies, potentially impacting future net operating income growth.

- Economic uncertainties and tariff discussions have led to tenant hesitation, specifically affecting renewal and leasing timelines, which may delay or reduce revenue inflow.

- The potential departure of key tenants entering creditor protection, such as Peavey Mart, could result in significant vacancies and loss of immediate net operating income until new tenants are secured.

- Increased borrowing to fund acquisitions and developments has led to higher net interest expenses, which could weigh on overall earnings if leverage is not managed effectively.

- The exposure to sectors sensitive to economic fluctuations, particularly automotive in Windsor, could result in future revenue instability if economic conditions deteriorate, affecting those tenants' operations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$8.111 for Nexus Industrial REIT based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$9.5, and the most bearish reporting a price target of just CA$6.75.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$207.5 million, earnings will come to CA$42.8 million, and it would be trading on a PE ratio of 26.6x, assuming you use a discount rate of 10.8%.

- Given the current share price of CA$6.78, the analyst price target of CA$8.11 is 16.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.