Key Takeaways

- Reinvesting in newer, cost-effective rental properties and repurchasing units signals portfolio efficiency and management's confidence in stock valuation.

- Focus on lower CapEx and regulated properties enhances cash flow, increases operational efficiency, and stabilizes revenue potential.

- Increased market vacancies, rising costs, and regulatory changes could pressure Canadian Apartment Properties REIT's occupancy rates, revenue growth, and financial stability.

Catalysts

About Canadian Apartment Properties Real Estate Investment Trust- CAPREIT is Canada's largest publicly traded provider of quality rental housing.

- CAPREIT's strategy of selling noncore, high-CapEx burden properties and reinvesting in recently constructed rental properties at prices below replacement cost enhances its portfolio efficiency and long-term earnings potential. This strategy is expected to improve revenue and net margins.

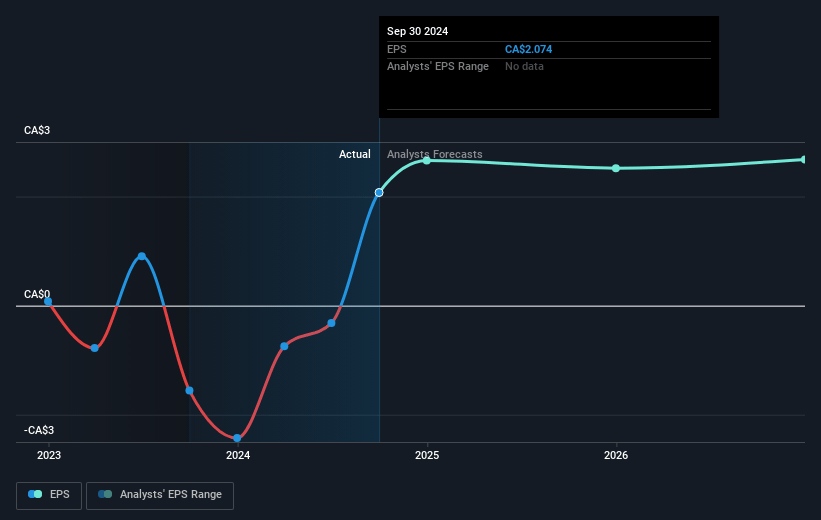

- The execution of their NCIB (Normal Course Issuer Bid) program by repurchasing units at a 20% discount to NAV indicates management's confidence in the undervaluation of the stock, which should support EPS growth.

- The reallocation of capital towards purpose-built rental properties with lower CapEx requirements improves cash flow management. This capital expenditure reduction is likely to enhance net margins and support free cash flow growth.

- Improvements in operational efficiency by focusing on regulated properties with lower turnover and mark-to-market rent increases are expected to stabilize and potentially increase revenue and NOI (Net Operating Income) margins.

- CAPREIT's geographically diverse portfolio with a mix of older regulated and newer unregulated apartments provides stability and opportunities for long-term rental revenue growth, while reducing risks associated with short-term market fluctuations.

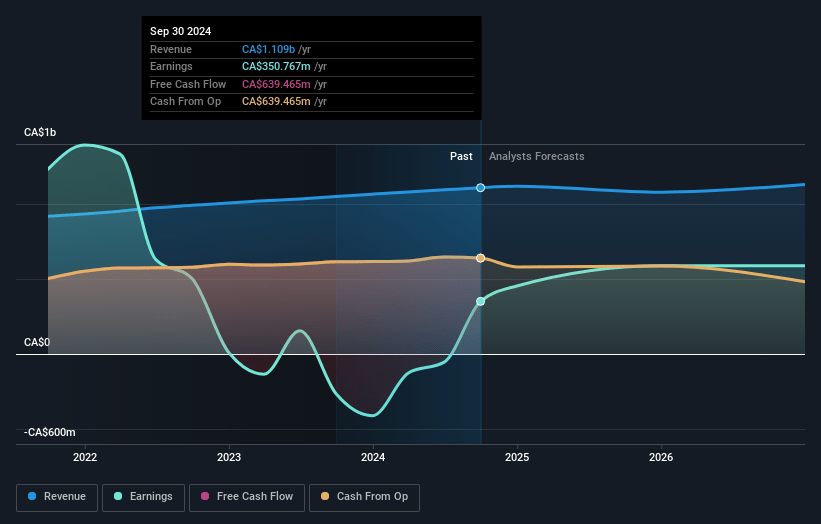

Canadian Apartment Properties Real Estate Investment Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Canadian Apartment Properties Real Estate Investment Trust's revenue will decrease by 1.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 26.3% today to 52.7% in 3 years time.

- Analysts expect earnings to reach CA$553.5 million (and earnings per share of CA$3.18) by about March 2028, up from CA$292.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.7x on those 2028 earnings, down from 23.3x today. This future PE is greater than the current PE for the CA Residential REITs industry at 7.2x.

- Analysts expect the number of shares outstanding to decline by 3.88% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.32%, as per the Simply Wall St company report.

Canadian Apartment Properties Real Estate Investment Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A temporary increase in market vacancies and reduced demand from nonpermanent residents and international students could impact Canadian Apartment Properties REIT's occupancy rates and rental revenues.

- Potential increases in property operating costs due to unexpected repairs and maintenance, elevated bad debt, and increased spending on marketing and legal fees may affect net operating income margins.

- The transition of short-term rentals into the long-term market and legislative changes could lead to increased supply, impacting rental rates and revenue growth.

- Challenges with tenant incentives and the ability to maintain leasing spreads against a backdrop of competitive market dynamics may influence future net margins.

- Although the company has lowered its leverage, any significant transactions or unexpected changes in the valuation of properties could alter the debt-to-gross book value ratio, affecting the financial stability and potential earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$52.077 for Canadian Apartment Properties Real Estate Investment Trust based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$1.1 billion, earnings will come to CA$553.5 million, and it would be trading on a PE ratio of 16.7x, assuming you use a discount rate of 7.3%.

- Given the current share price of CA$42.04, the analyst price target of CA$52.08 is 19.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.