Key Takeaways

- Strategic acquisitions and asset expansions are set to diversify the portfolio and significantly boost production and revenues.

- Strong financial position with cash reserves and credit availability supports growth opportunities and enhances shareholder returns.

- Wheaton faces cash flow pressures and revenue risks from expansion costs, project execution delays, price fluctuations, and reliance on volatile gold streams.

Catalysts

About Wheaton Precious Metals- Sells precious metals in North America, Europe, Africa, and South America.

- Wheaton Precious Metals has projected a 40% increase in annual production to 870,000 gold equivalent ounces by 2029, driven by new acquisitions and expansions, which is expected to significantly boost future revenues.

- The company plans to begin inaugural production from 9 assets within the next five years, including key projects such as Artemis Gold's Blackwater, B2Gold's Goose, and Ivanhoe's Platreef, enhancing future earnings.

- The recent acquisitions, including Montage Gold's Koné project and other development assets, are anticipated to diversify Wheaton's portfolio and improve its geographic presence, contributing to increased future revenues and reduced operational risk.

- Continued strong performance at existing assets like Salobo, with potential throughput expansions, exemplifies the possibility of sustained high production levels, potentially improving net margins due to better economies of scale.

- Financial flexibility is emphasized through a robust balance sheet with $818 million in cash and an undrawn $2 billion credit facility, positioning Wheaton to capitalize on new growth opportunities that could lead to further increases in earnings and shareholder returns.

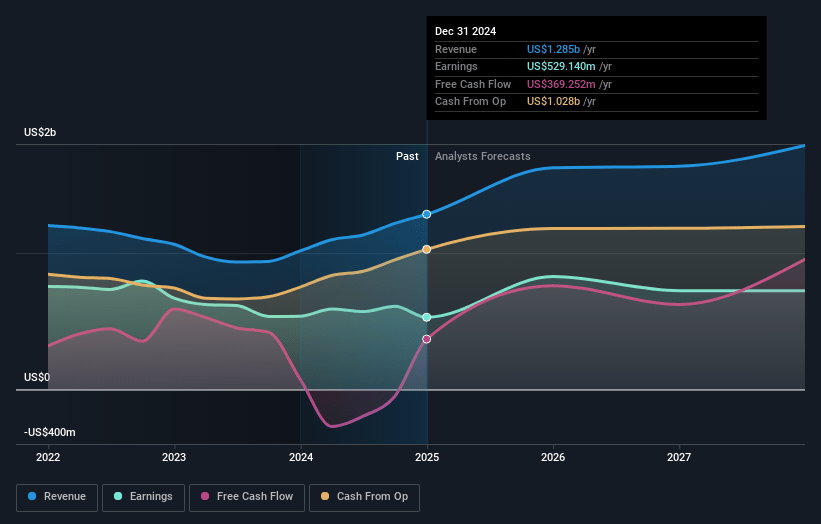

Wheaton Precious Metals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Wheaton Precious Metals's revenue will grow by 11.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 41.2% today to 42.1% in 3 years time.

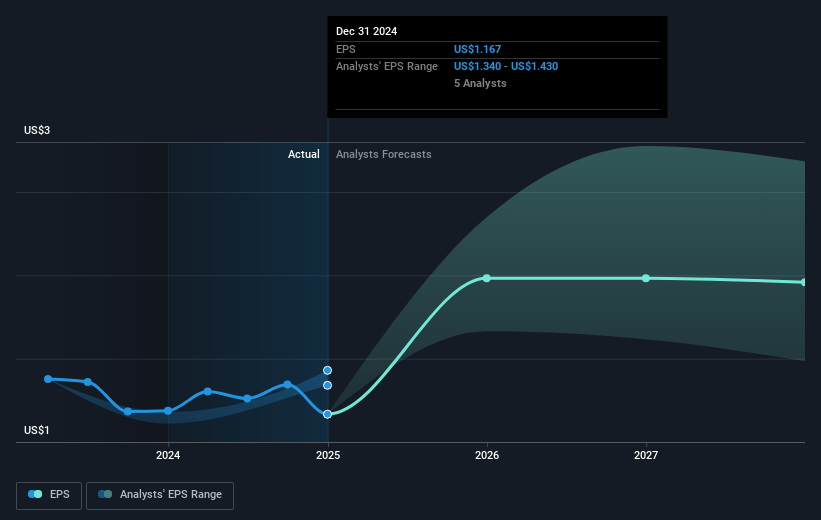

- Analysts expect earnings to reach $753.1 million (and earnings per share of $1.94) by about March 2028, up from $529.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $841.7 million in earnings, and the most bearish expecting $674.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 58.6x on those 2028 earnings, down from 65.1x today. This future PE is greater than the current PE for the CA Metals and Mining industry at 14.6x.

- Analysts expect the number of shares outstanding to grow by 0.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.93%, as per the Simply Wall St company report.

Wheaton Precious Metals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The completion of Salobo phases and anticipated expansion payments may strain Wheaton's cash flow and financial flexibility, affecting net margins if commodity prices do not remain strong.

- Dependence on the timely development and production ramp-up of several new projects poses execution risks, which could impact future revenue if delays occur.

- The impairment charge on the Voisey's Bay cobalt stream due to declining cobalt prices highlights vulnerabilities in revenue and earnings from price fluctuations in non-core metals.

- Forecasted declines in gold production from Constancia and silver production from Peñasquito in 2025 could adversely impact revenue if new projects do not compensate for these reductions.

- The heavy reliance on gold streams for future growth amidst volatile gold prices could negatively affect earnings if forecasts do not materialize or if prices fall.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$113.546 for Wheaton Precious Metals based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $753.1 million, and it would be trading on a PE ratio of 58.6x, assuming you use a discount rate of 6.9%.

- Given the current share price of CA$108.49, the analyst price target of CA$113.55 is 4.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.