Last Update 30 Oct 25

Fair value Increased 30%Analysts have raised their price target for Americas Gold and Silver from $6.17 to $8.04. They cite improved profit margins and an optimistic outlook on the company's future earnings potential as the reasons for this change.

What's in the News

- Reported strong consolidated silver production of 765,000 ounces for Q3 2025, up 98% year-over-year. This was achieved despite a planned 10-day shutdown for Phase 1 upgrades at the Galena No. 3 Shaft (Announcement of Operating Results).

- Completed Phase 1 upgrades to increase hoisting capacity at the Galena Complex ahead of schedule. The upgrades boosted material movement to 80 tons per hour, with Phase 2 upgrades scheduled to begin before year-end (Product-Related Announcements).

- Announced updated metallurgical testing results confirming high extraction rates of antimony, silver, and copper from tetrahedrite ore at the Galena Complex using proprietary hydrometallurgical technology (Product-Related Announcements).

- Revealed significant exploration results at the Galena Complex with high-grade silver, copper, and antimony intercepts in the 149 Vein. These results support expansion plans and resource delineation (Product-Related Announcements).

- Common share consolidation at a ratio of 1-for-2.5 effective August 26, 2025. Shares will trade on a post-consolidation basis on the Toronto Stock Exchange and NYSE American (Stock Splits & Significant Stock Dividends).

Valuation Changes

- Consensus Analyst Price Target has increased from CA$6.17 to CA$8.04, reflecting improved valuation outlook for the company.

- The discount rate has risen slightly, moving from 6.75% to 6.77%.

- Revenue growth is now projected at 48.7%, down from the previous estimate of 52.7%.

- Net profit margin has improved, rising from 28.3% to 35.2%.

- The future P/E ratio has climbed from 18.2x to 20.8x, indicating higher expected earnings multiples.

Key Takeaways

- Operational improvements and higher-grade mining are set to boost productivity, margins, and cash generation, supporting ongoing expansion and improved earnings prospects.

- Diversification into antimony and increased silver exposure position the company to benefit from critical mineral demand and favorable sector trends.

- Heavy reliance on debt, operational concentration, and high costs amid regulatory pressures threaten profitability, magnifying risk if commodity prices or production targets are not met.

Catalysts

About Americas Gold and Silver- Engages in the exploration, development, and production of mineral properties in the Americas.

- Recent operational upgrades at the Galena Complex-specifically the introduction of long-hole stoping, new underground fleet equipment, and infrastructure improvements like the #3 shaft hoist motor-are expected to substantially improve productivity and lower unit costs, which should increase net margins and expand EBITDA as volumes rise.

- The transition to the higher-grade silver-copper EC120 at Cosalá, with commercial production expected by year-end 2025, promises significant increases in silver output and free cash flow, directly boosting consolidated revenue and improving cash generation.

- Breakthroughs in recovering antimony-a critical mineral in the US with rising strategic and industrial demand-may open a new revenue stream, diversify product exposure, and enhance earnings power if commercialized, especially given recent Chinese export restrictions.

- The company's growing exposure to silver (now 82% of revenue), aligns Americas Gold and Silver to benefit from increasing industrial and investment demand for silver in sectors like green technology and electronics, which could support higher realized prices and revenue growth.

- The strengthening of the balance sheet via a $100 million term loan and premium-priced equity raise provides both stability and capital required for growth initiatives, reducing financial risk, supporting ongoing expansion efforts, and improving long-term earnings visibility.

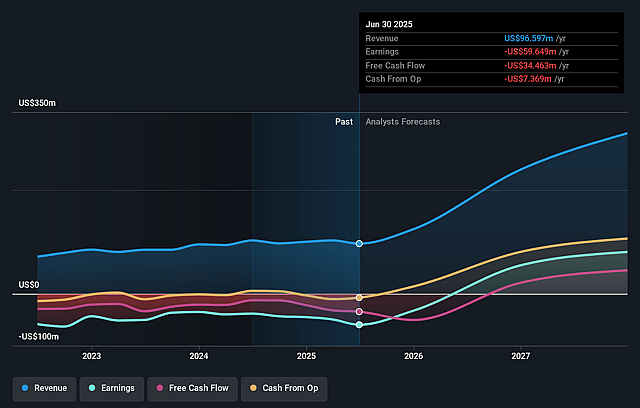

Americas Gold and Silver Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Americas Gold and Silver's revenue will grow by 52.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from -61.8% today to 28.7% in 3 years time.

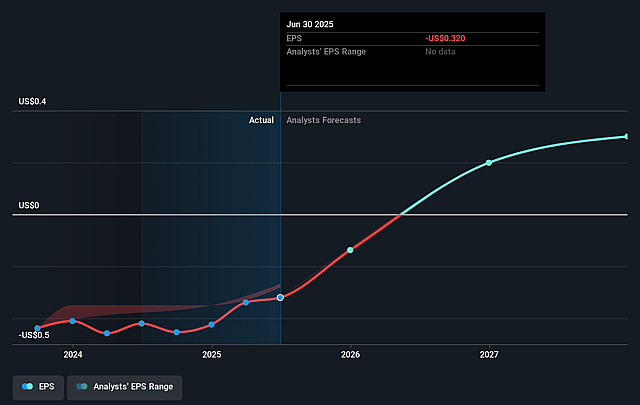

- Analysts expect earnings to reach $98.5 million (and earnings per share of $0.36) by about September 2028, up from $-59.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.8x on those 2028 earnings, up from -12.9x today. This future PE is lower than the current PE for the CA Metals and Mining industry at 18.0x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.57%, as per the Simply Wall St company report.

Americas Gold and Silver Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's $100 million senior secured debt facility and significant recent net losses ($15 million in Q2 2025, up from $4 million the previous year) indicate a heavy reliance on debt financing and continued negative earnings, increasing long-term risk of shareholder dilution and pressure on per-share equity value, which may weaken investor sentiment and ultimately depress share price.

- Shift in production focus-from historically higher base metal (zinc, lead) output to a predominantly silver/copper profile (especially as EC120 comes online)-has resulted in a significant revenue decline year-over-year ($27 million in Q2 2025 vs. $33 million in Q2 2024). If silver and copper prices are volatile or underperform, this concentrated revenue mix could amplify top-line and cash flow instability.

- The company's principal mines (Galena and Cosalá) represent concentrated operational risk; any adverse developments (such as delays or disruptions in ramping up long-hole stoping, shaft upgrades, or achieving commercial production at EC120) may significantly impact consolidated output, revenue, and free cash flow due to limited diversification.

- All-in sustaining costs remain high, even after recent reductions ($32.89/oz in Q2 2025), and profitability improvements are highly contingent on scaling up production and achieving efficiency targets-ongoing operational challenges or cost inflation could erode net margins and threaten long-term earnings predictability.

- Increasing regulatory scrutiny, potential ESG compliance costs, and heightened environmental standards-especially due to operations in the U.S. and Mexico-could result in higher long-term capital and operating expenditures, directly impacting margins and future free cash flow, particularly if additional permitting or compliance challenges arise.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$5.0 for Americas Gold and Silver based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $343.0 million, earnings will come to $98.5 million, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 6.6%.

- Given the current share price of CA$3.91, the analyst price target of CA$5.0 is 21.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.