Key Takeaways

- Teck's focus on energy transition metals like copper positions it for growth, leveraging global electrification and urbanization trends post-coal business sale.

- Cost reductions and project ramp-ups in Chile enhance copper production, supporting earnings and shareholder returns through strategic buybacks.

- Trade uncertainties, operational challenges, and project risks could significantly disrupt Teck's revenue and earnings if not addressed efficiently.

Catalysts

About Teck Resources- Engages in research, exploration, development, processing, smelting, refining, and reclamation of mineral properties in Asia, the Americas, and Europe.

- Teck's strategic repositioning as a pure-play energy transition metals company, with a focus on copper and zinc after the sale of its steelmaking coal business, is a catalyst for future revenue growth driven by increased demand for these metals in global electrification and urbanization.

- The completion and ramp-up of the QB facility in Chile to design throughput rates and significant expected increase in copper production could enhance earnings through higher production and lower net cash unit costs.

- Substantial planned reduction in net cash unit costs for copper in 2025, driven by increased production, ongoing cost discipline, and higher byproduct credits, can lead to improved net margins and earnings.

- Advanced engineering and permitting of low-capital-intensity greenfield projects like Zafranal in Peru and San Nicolas in Mexico position Teck for long-term revenue growth opportunities through an increased copper output by the end of the decade.

- Strategic share buybacks and potential further cash returns to shareholders, with $1.8 billion already authorized for buybacks, are expected to drive EPS growth and enhance shareholder value.

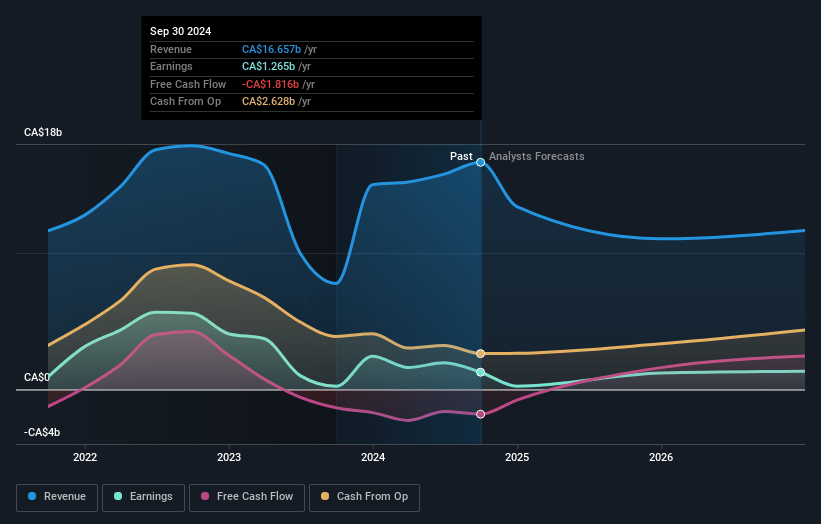

Teck Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Teck Resources's revenue will grow by 8.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -8.8% today to 10.1% in 3 years time.

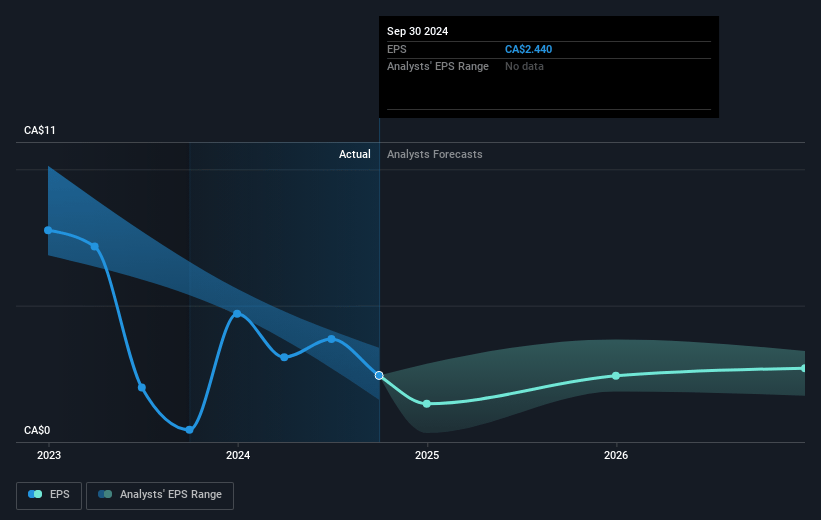

- Analysts expect earnings to reach CA$1.2 billion (and earnings per share of CA$2.33) by about March 2028, up from CA$-800.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CA$1.6 billion in earnings, and the most bearish expecting CA$672 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.4x on those 2028 earnings, up from -38.0x today. This future PE is greater than the current PE for the US Metals and Mining industry at 12.6x.

- Analysts expect the number of shares outstanding to decline by 3.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.68%, as per the Simply Wall St company report.

Teck Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The potential imposition of tariffs or other trade restrictions between the U.S. and Canada could disrupt Teck's market dynamics, potentially impacting revenue, especially if trade flows cannot be adjusted smoothly in response to changes in U.S. policy.

- Uncertainty in Mexico's mining sector could pose risks to the San Nicolas project, potentially delaying capital investments and impacting projected future earnings unless favorable conditions are met.

- Continued depreciation concerns are raised by Trail operations, which have been a cash flow negative entity and may continue to impact overall net margins if profitability does not improve.

- Dependence on sustaining and capitalized stripping efforts along with cost management at the Highland Valley site highlights risk in operational efficiency, which could affect net earnings if permits and community agreements face unresolved challenges.

- Any misalignment or execution risk in the QB2 plant's ramp-up or processing of lower-grade materials could lead to lower-than-expected production output, impacting revenue and earnings projections based on planned capacity increases.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$70.254 for Teck Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$90.0, and the most bearish reporting a price target of just CA$43.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$11.6 billion, earnings will come to CA$1.2 billion, and it would be trading on a PE ratio of 34.4x, assuming you use a discount rate of 7.7%.

- Given the current share price of CA$60.42, the analyst price target of CA$70.25 is 14.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.