Key Takeaways

- Diversification into water-related drilling and strong relationships with major miners enhance revenue stability and reduce financial risk.

- Strategic expansion and disciplined financial management support margin improvement and sustainable long-term growth amid rising commodity demand.

- Heavy reliance on a few major mining clients, geopolitical and currency risks, ongoing debt pressures, and overcapacity all create headwinds for revenue stability and margin growth.

Catalysts

About Foraco International- Provides drilling services in North America, South America, the Asia Pacific, the Middle East, Africa, and Europe.

- The company is strategically positioned to benefit from increasing global demand for copper and gold driven by industrial electrification, AI infrastructure, and supply chain security concerns in major economies, translating into higher drilling activity and growth in long-term project pipelines-supporting future revenue and earnings.

- Foraco's continued expansion into water-related drilling, underpinned by robust utilization rates and upcoming proprietary rig deployments, is generating recurring, higher-margin revenue streams; this diversification into water projects helps stabilize cash flow and bolster overall net margins.

- The ramp-up of new contracts, particularly in South America and selective entry into stable, resource-rich jurisdictions like the U.S., is expected to materially improve equipment utilization rates, leading to increased operating leverage and top-line growth as projects mobilize and mature.

- Growing engagement with major mining clients, who account for over 80% of Foraco's revenue, enhances long-term revenue visibility and reduces receivables risk, supporting steadier cash flows and strengthening financial stability amid volatile industry cycles.

- Proactive cost management, disciplined capital allocation (debt reduction and targeted CapEx), and prudent pricing strategies position Foraco to defend and potentially widen net margins as demand rebounds, especially in a market environment where specialized technical drilling is increasingly required.

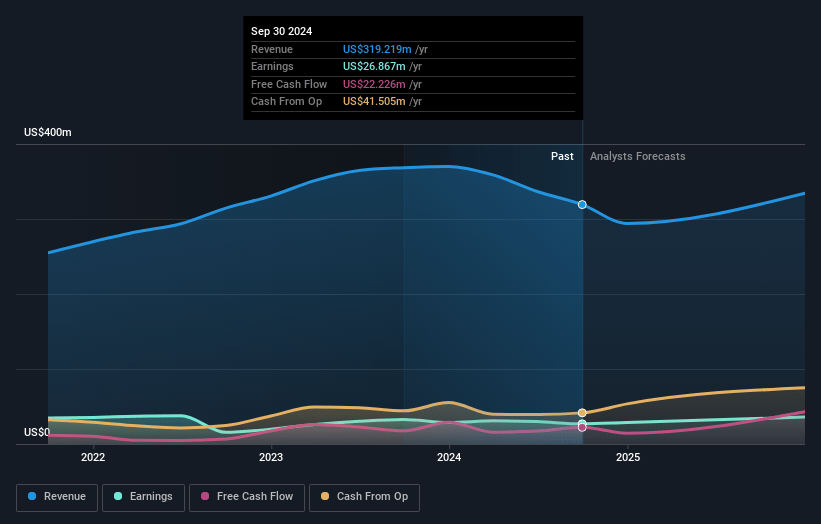

Foraco International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Foraco International's revenue will grow by 14.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.6% today to 11.0% in 3 years time.

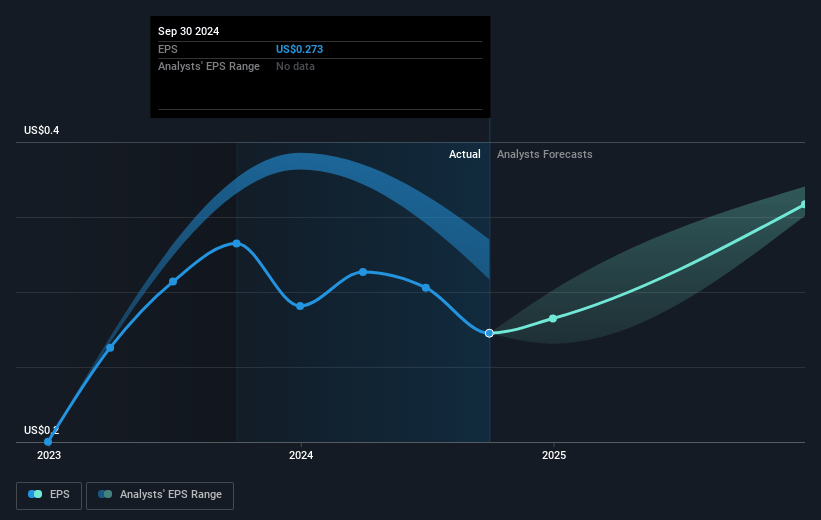

- Analysts expect earnings to reach $45.1 million (and earnings per share of $0.47) by about July 2028, up from $20.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.1x on those 2028 earnings, up from 6.4x today. This future PE is lower than the current PE for the CA Metals and Mining industry at 17.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.96%, as per the Simply Wall St company report.

Foraco International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Foraco experienced a significant year-over-year revenue decline (Q1 2025: $55 million vs. Q1 2024: $77 million), with management attributing this to project delays and exits from certain jurisdictions, highlighting the company's vulnerability to project timing and geopolitical risks, which threatens long-term revenue stability and growth.

- Over 80% of revenues continue to come from senior mining clients, indicating a high client concentration risk; if any major client reduces exploratory budgets or delays projects, Foraco's revenue and earning streams may become even more volatile.

- Foraco's exposure to fluctuating foreign currencies, especially in emerging markets, led to a $4 million negative FX impact in Q1 2025; ongoing currency volatility could materially impact future revenues and net margins.

- Capital allocation is prioritized toward debt reduction with no dividend for 2025, and significant CapEx is required to fund proprietary rig expansion, implying continued heavy financial leverage; this increases the company's vulnerability to rising interest rates and downturns, which could adversely impact net earnings and financial flexibility.

- Competitive pricing pressure and delayed ramp-up in new markets such as the U.S.-coupled with overcapacity (30% utilization rate in Q1 2025)-suggest potential margin compression and longer lead times before new business translates into profitable revenue, putting pressure on sustained net margins and overall earnings trajectory.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$3.938 for Foraco International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$4.75, and the most bearish reporting a price target of just CA$3.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $409.4 million, earnings will come to $45.1 million, and it would be trading on a PE ratio of 8.1x, assuming you use a discount rate of 9.0%.

- Given the current share price of CA$1.8, the analyst price target of CA$3.94 is 54.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.