Key Takeaways

- Work-sharing and strategic facility use aim to stabilize margins and increase capacity amid production fluctuations.

- Efforts to secure USMCA exemptions and new contracts aim to improve margins and bolster future revenue streams.

- Tariffs, trade uncertainty, and currency fluctuations threaten ADF Group's profits and margins despite revenue growth, with risks to operational efficiency and future orders.

Catalysts

About ADF Group- Engages in the design and engineering of connections including industrial coatings in Canada and the United States.

- The implementation of a work-sharing program in Terrebonne allows ADF to reduce employee costs, potentially stabilizing net margins during periods of reduced production until new projects begin.

- Strategic use of the Great Falls facility could potentially increase capacity and revenue generation, provided the shift accommodates anticipated production volumes effectively.

- Ongoing negotiations and applications for USMCA exemptions may lead to reduced tariffs on materials, thus potentially improving future gross margins by lowering input costs.

- The acquisition of new contracts totaling $120 million enhances the order backlog, promising potential future revenue streams once tariffs and logistical challenges are addressed.

- Continued investment and developments on the drawing board, such as strategic reallocations or expansions, showcase ADF's proactive approach to maintaining a strong balance sheet and adapting to market changes.

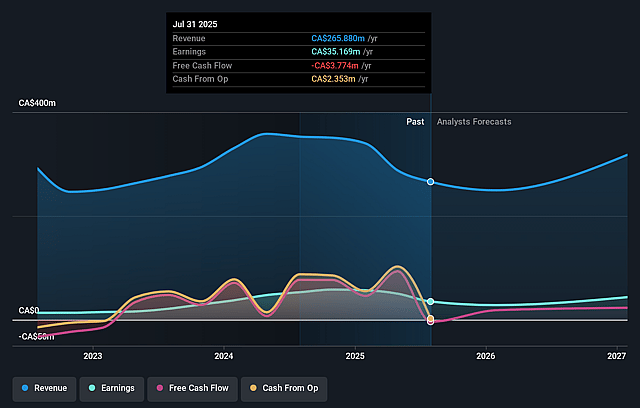

ADF Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ADF Group's revenue will grow by 4.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 17.5% today to 10.1% in 3 years time.

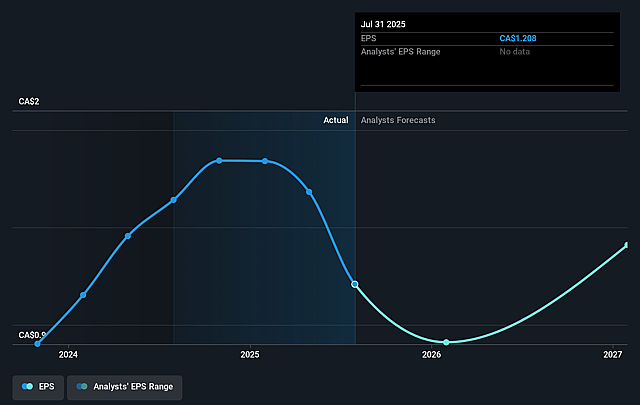

- Analysts expect earnings to reach CA$32.8 million (and earnings per share of CA$1.02) by about September 2028, down from CA$50.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.7x on those 2028 earnings, up from 5.7x today. This future PE is lower than the current PE for the CA Metals and Mining industry at 18.0x.

- Analysts expect the number of shares outstanding to decline by 4.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.74%, as per the Simply Wall St company report.

ADF Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The uncertainty surrounding U.S. tariffs and trade agreements is increasing costs and creating market unpredictability, which could adversely impact future revenues and gross margins.

- The foreign exchange losses due to currency fluctuation between the U.S. and Canadian markets resulted in a higher FX loss, which negatively affects net income.

- Despite the increase in revenue compared to the previous year, the order backlog showed signs of decline, potentially indicating lower future revenues if not replenished with new contracts.

- The implementation of a work-sharing program to reduce labor costs suggests that there may be challenges in maintaining current production levels, potentially affecting operational efficiency and net margins.

- The potential inability to meet USMCA and other tariff exemption requirements for all shipments could lead to increased costs under current tariff structures, negatively impacting profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$12.0 for ADF Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$325.8 million, earnings will come to CA$32.8 million, and it would be trading on a PE ratio of 10.7x, assuming you use a discount rate of 6.7%.

- Given the current share price of CA$10.11, the analyst price target of CA$12.0 is 15.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on ADF Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.