Key Takeaways

- Recent asset sale boosts cash but may mislead on sustainable growth, impacting future revenue perceptions and valuation.

- Resource allocation to shareholder returns limits growth funds, potentially dampening future earnings and investment opportunities.

- The sale of Black Hills improved the balance sheet, share repurchases and dividends reflect shareholder focus, and awards signal high-quality care boosting future prospects.

Catalysts

About Medical Facilities- Through its subsidiaries, owns and operates specialty hospitals and ambulatory surgery center in the United States.

- The recent sale of Black Hills Surgical Hospital significantly increased cash reserves, suggesting a temporary boost to financial metrics rather than sustainable revenue growth, which may give a misleading sense of high valuation affecting future revenue generation.

- The allocation of significant resources to shareholder returns through a substantial issuer bid and share repurchases might limit funds available for growth initiatives or new investments, potentially impacting future earnings expansion.

- The company's past focus on reducing debt and improving the balance sheet through the repayment of its corporate credit facility might not translate into future revenue and profit growth, as these financial improvements are not directly tied to increased operational efficiency or expanding service offerings.

- The fluctuating surgical case volumes and factors such as physician absences and historical intravenous saline fluid shortages present risks in maintaining consistent service revenue, which could pressure net margins and earnings assumptions in the future if such issues persist or recur.

- The current stability in competition, coupled with potential regulatory impacts like site neutrality legislation, could introduce uncertainties that might negatively affect future growth prospects and revenues if competitive pressures increase or regulatory changes are not favorable to the company's existing operations.

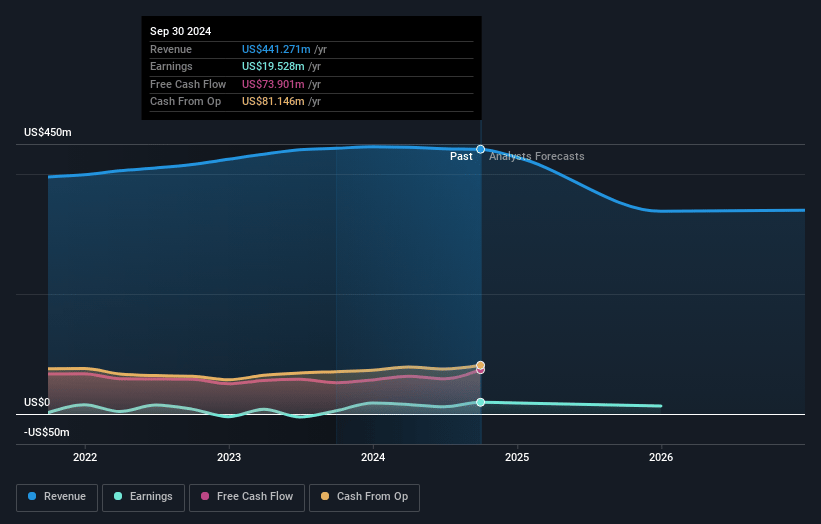

Medical Facilities Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Medical Facilities's revenue will decrease by 0.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 7.5% today to 5.2% in 3 years time.

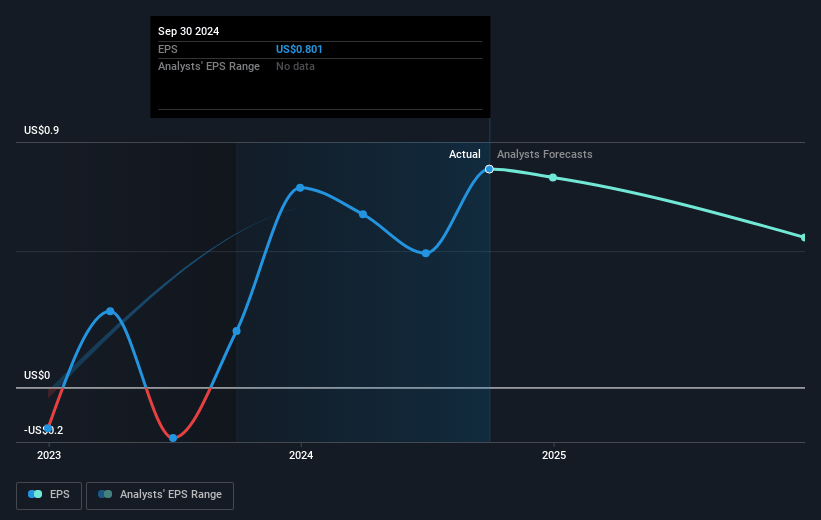

- Analysts expect earnings to reach $17.8 million (and earnings per share of $0.97) by about April 2028, down from $24.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.0x on those 2028 earnings, up from 10.2x today. This future PE is lower than the current PE for the CA Healthcare industry at 24.6x.

- Analysts expect the number of shares outstanding to decline by 5.91% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.82%, as per the Simply Wall St company report.

Medical Facilities Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The sale of Black Hills resulted in cash proceeds and significantly strengthened the balance sheet by increasing the cash balance to $108.5 million and eliminating $17 million in exchangeable interest, enhancing the company's financial flexibility and potential to improve net margins.

- The company repurchased approximately 1.7 million common shares and plans to distribute any remaining cash not used for share repurchase as a special dividend, suggesting that shareholder returns and confident earnings outlook could contribute positively to market sentiment.

- The receipt of the Press Ganey Human Experience Guardian of Excellence Award and recognition of the facilities in Arkansas and Sioux Falls as top orthopedic hospitals indicate high-quality care, which can boost the reputation, patient volumes, and ultimately revenue.

- Despite a 1.1% decrease in fourth quarter facility service revenue due to temporary issues like physician absences and an IV saline fluid shortage, these factors are mostly resolved, suggesting potential future stability and return to expected revenue levels.

- Efforts to optimize corporate expenses and previous successful rightsizing of expenses could help sustain efficient operations, potentially leading to stable or improved net income and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$16.425 for Medical Facilities based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $340.1 million, earnings will come to $17.8 million, and it would be trading on a PE ratio of 15.0x, assuming you use a discount rate of 5.8%.

- Given the current share price of CA$15.25, the analyst price target of CA$16.43 is 7.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.