Key Takeaways

- Strategic initiatives to boost occupancy and operational efficiency are expected to significantly enhance revenue, NOI, and net margins.

- Active acquisition and portfolio optimization strategies aim to elevate asset quality and stability, likely bolstering profitability and earnings.

- Increased operating costs, macroeconomic risks, and short-term financial strain from development activities may pressure Chartwell's margins and revenue growth.

Catalysts

About Chartwell Retirement Residences- Chartwell is in the business of serving and caring for Canada's seniors, committed to its vision of Making People's Lives BETTER and to providing a happier, healthier, and more fulfilling life experience for its residents.

- The company has strategically focused on increasing occupancy rates, with targeted incentives to drive rapid occupancy growth to an expected 95% by the end of 2025, which should significantly bolster revenue and NOI as higher occupancy leverages fixed costs more effectively.

- Chartwell's investments in operational reorganizations and scalable platforms, along with a reduction in staffing agency costs by 60%, are set to result in increased efficiency and margin expansion, directly enhancing net margins over time.

- The company's active acquisition strategy, purchasing high-quality properties below replacement cost with a focus on stabilizing and lease-up opportunities, is positioned to yield strong investment returns, likely impacting earnings positively as these acquisitions stabilize.

- Chartwell's commitment to ongoing portfolio optimization, including repositioning and selling non-core properties, is projected to improve the overall quality and strategic positioning of their assets, which should enhance profitability and result in increased earnings.

- A favorable demographic trend with growing demand for retirement living and a slow pace of new supply due to high construction costs signals potential for sustained rent growth, supporting revenue increases and improved net margins.

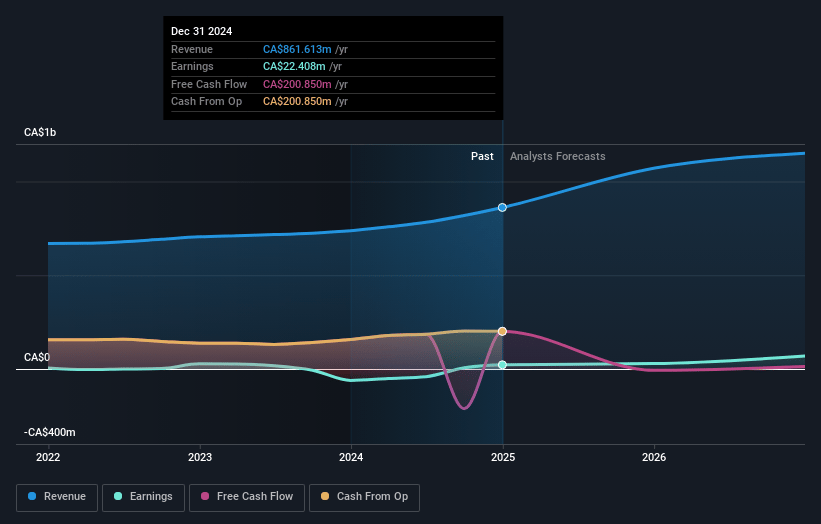

Chartwell Retirement Residences Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Chartwell Retirement Residences's revenue will grow by 15.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.6% today to 6.2% in 3 years time.

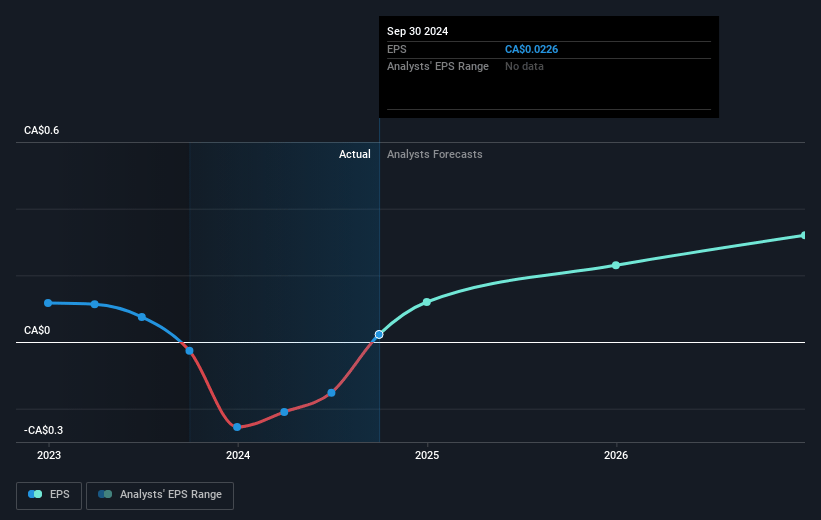

- Analysts expect earnings to reach CA$81.1 million (and earnings per share of CA$0.34) by about April 2028, up from CA$22.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 98.2x on those 2028 earnings, down from 201.8x today. This future PE is greater than the current PE for the CA Healthcare industry at 25.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.09%, as per the Simply Wall St company report.

Chartwell Retirement Residences Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The 2024 net income decreased significantly from 2023, primarily due to the absence of a substantial gain on the sale of long-term care (LTC) transactions from the previous year, which could negatively impact the perceived earnings stability of the company.

- Higher finance costs in 2024, including increased direct property operating expenses, could continue to pressure the company's margins and net income.

- The reliance on targeted incentives to rapidly increase occupancy might indicate underlying demand issues, which could affect revenue growth if these discounts persist.

- The potential economic downturn and trade disputes between Canada and the United States are indicators of macroeconomic risks that could impact overall financial performance, including revenue and net margins.

- Development and acquisition activities, though potentially beneficial long-term, could strain liquidity and increase leverage in the short term, creating financial risks associated with interest rates and debt levels.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$19.556 for Chartwell Retirement Residences based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$1.3 billion, earnings will come to CA$81.1 million, and it would be trading on a PE ratio of 98.2x, assuming you use a discount rate of 6.1%.

- Given the current share price of CA$16.31, the analyst price target of CA$19.56 is 16.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.