Key Takeaways

- Pembina anticipates revenue growth through global market exposure, strategic expansions, and increased production in Western Canada, guided by diverse projects and partnerships.

- Investments in energy and petrochemical ventures, such as Cedar LNG and Greenlight Electricity, aim to improve margins and integrate existing infrastructure.

- Dependency on successful execution of new projects amid market volatility poses risks to revenue and profitability, while rising interest expenses impact financial performance.

Catalysts

About Pembina Pipeline- Provides energy transportation and midstream services.

- Pembina is expecting to increase their exposure to global markets by reaching a positive FID on the Cedar LNG project in 2025, which could enhance revenue by accessing premium international pricing.

- The completion of the Phase VIII Peace Pipeline expansion and other tailored solutions for Montney and Duvernay area customers are anticipated to accommodate growing production in Western Canadian Sedimentary Basin, potentially boosting revenues with increased volumes.

- The strategic expansion in Northeast U.S. natural gas and NGL markets, particularly by consolidating ownership of Alliance and Aux Sable, is expected to contribute to revenue growth through higher volumes and demand for seasonal contracts.

- Adoption of the Greenlight Electricity Center project for the burgeoning Alberta data center industry might yield additional revenue streams by securing long-term power contracts with industrial operators, which could also spur integration benefits with existing gas and carbon sequestration infrastructure.

- The partnership with Dow to supply 50,000 barrels per day of ethane from Alberta’s petrochemical industry and efficient capital execution are expected to improve net margins due to lower-than-estimated capital investments for a de-ethanizer, coupled with resilient demand growth.

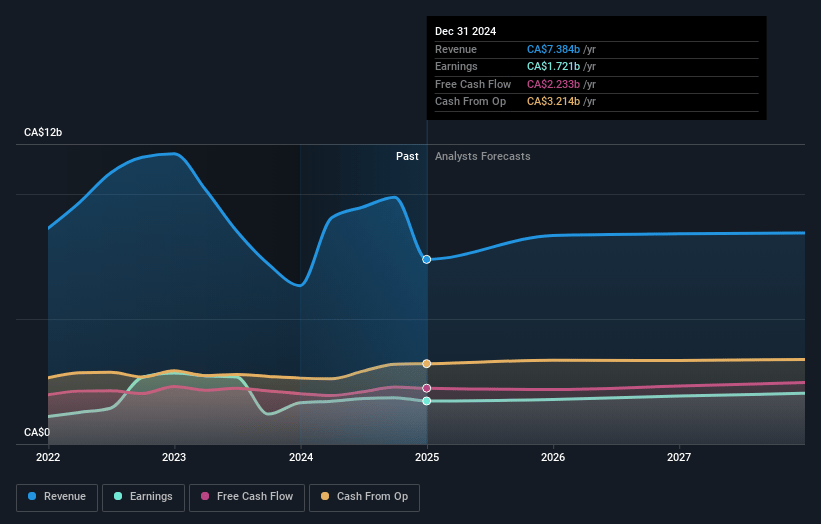

Pembina Pipeline Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Pembina Pipeline's revenue will grow by 4.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 23.3% today to 24.1% in 3 years time.

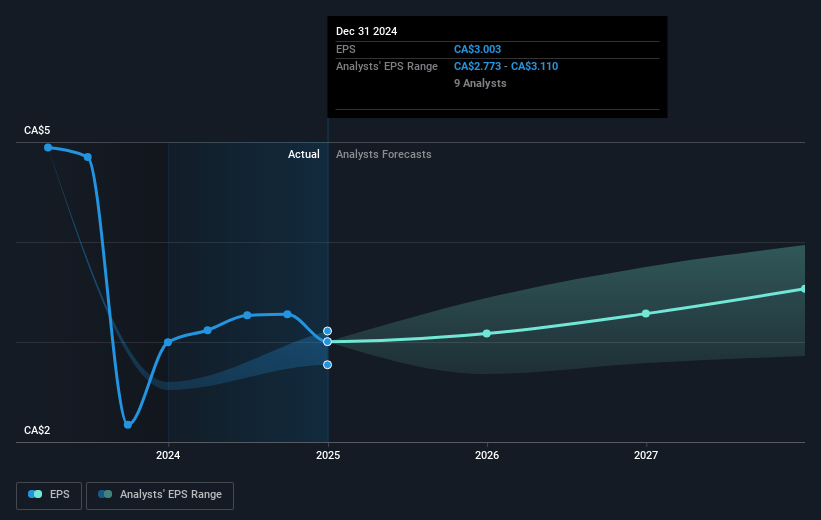

- Analysts expect earnings to reach CA$2.0 billion (and earnings per share of CA$3.44) by about May 2028, up from CA$1.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CA$2.3 billion in earnings, and the most bearish expecting CA$1.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.7x on those 2028 earnings, up from 18.0x today. This future PE is greater than the current PE for the CA Oil and Gas industry at 11.5x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.85%, as per the Simply Wall St company report.

Pembina Pipeline Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There is a risk of decreased earnings from lower net revenue on the Cochin Pipeline due to reduced front holds and interruptible volumes, which may impact Pembina's future revenue streams.

- Pembina faces the challenge of lower fourth-quarter earnings, down 18% from the previous year, primarily due to unrealized losses on commodity-related derivatives and higher interest expenses, potentially affecting short-term earnings stability.

- Rising interest expenses and tax liabilities in the fourth quarter could lead to a decrease in net margins and profits, affecting overall financial performance.

- The need for significant investment in new projects, such as Greenlight Electricity Center and Yellowhead Mainline, introduces capital risk and potential delays, which could strain cash flow and impact earnings if projects do not generate expected returns.

- Dependency on the successful execution of new partnerships and projects amidst regulatory hurdles and market volatility poses execution risks that could diminish projected revenues and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$61.389 for Pembina Pipeline based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$66.0, and the most bearish reporting a price target of just CA$55.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$8.3 billion, earnings will come to CA$2.0 billion, and it would be trading on a PE ratio of 21.7x, assuming you use a discount rate of 6.9%.

- Given the current share price of CA$53.33, the analyst price target of CA$61.39 is 13.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.