Last Update01 May 25Fair value Decreased 0.92%

Key Takeaways

- Operational improvements and project completions position Cenovus for efficiency gains, reduced costs, and increased production, enhancing margins and revenue.

- Strategic financial management, including debt reduction and shareholder returns, strengthens financial stability and potentially boosts earnings per share.

- Currency risks, reduced margins, and high capital expenditures challenge Cenovus's financial stability, posing threats to revenue streams, shareholder returns, and debt management.

Catalysts

About Cenovus Energy- Develops, produces, refines, transports, and markets crude oil, natural gas, and refined petroleum products in Canada, the United States, and China.

- Cenovus Energy's success in operational turnarounds and improvements, such as at Christina Lake and the Lima Refinery, positions the company for enhanced production efficiency and reduced operating costs in 2025, potentially benefiting net margins and earnings.

- The completion of growth projects like Narrows Lake and the West White Rose, along with expected first oil in 2026, suggests a clear path for production growth, likely contributing to revenue increases as new capacity comes online.

- In the Downstream segment, anticipated improvements in crack spreads, alongside expansions in the U.S. refining network and reduced unit operating costs, aim to improve margins and generate additional earnings.

- Achieving mechanical completion on critical projects and progressing on Foster Creek optimizations positions Cenovus for significant future production increases, with projections of adding about 150,000 BOE per day by 2028, which is poised to boost revenue substantially.

- Strategic emphasis on debt reduction and returning 100% of excess free funds flow to shareholders, coupled with disciplined capital management, enhances the financial stability and shareholder value, potentially driving higher earnings per share (EPS).

Cenovus Energy Future Earnings and Revenue Growth

Assumptions

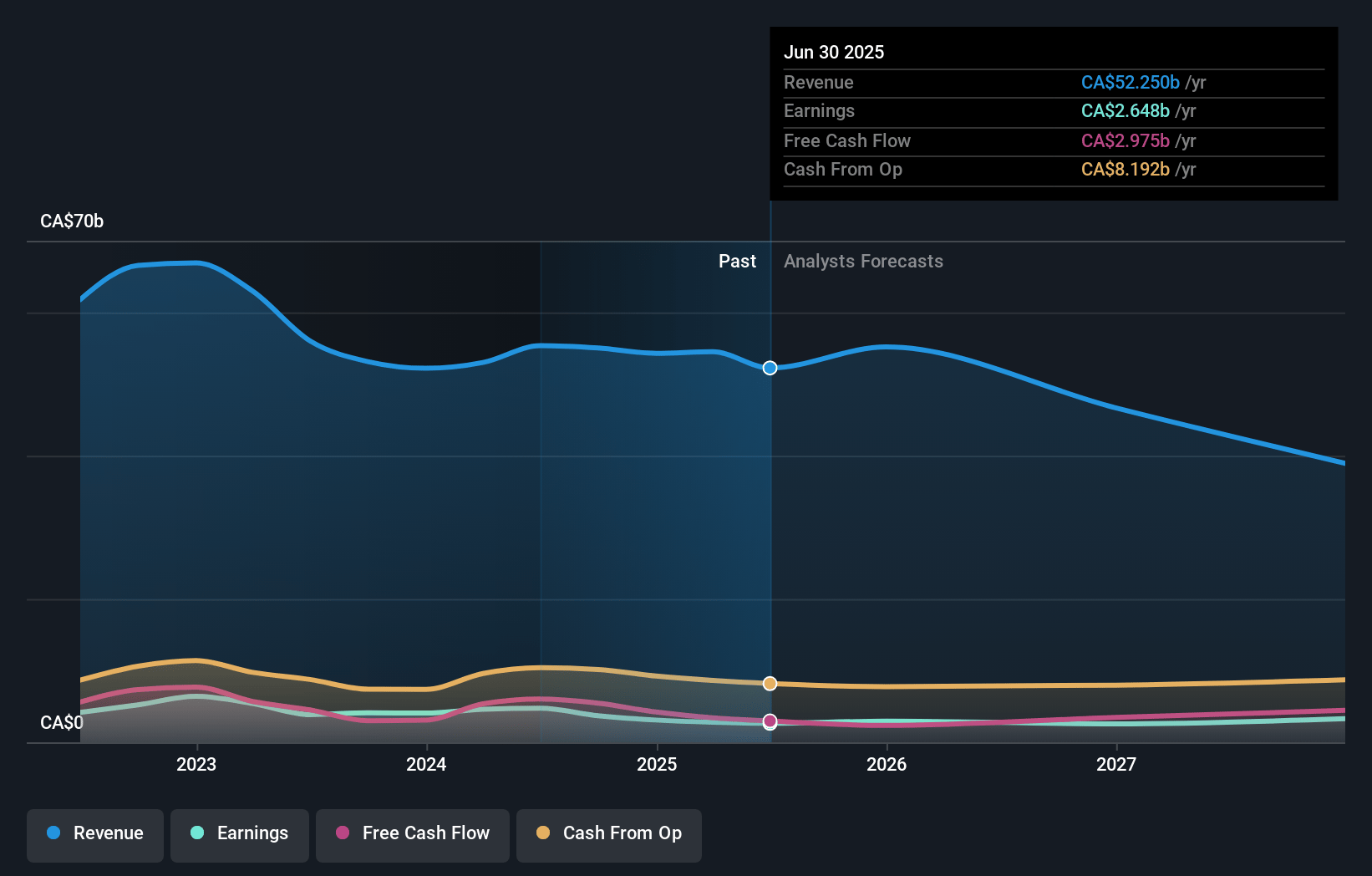

How have these above catalysts been quantified?- Analysts are assuming Cenovus Energy's revenue will grow by 2.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.7% today to 6.6% in 3 years time.

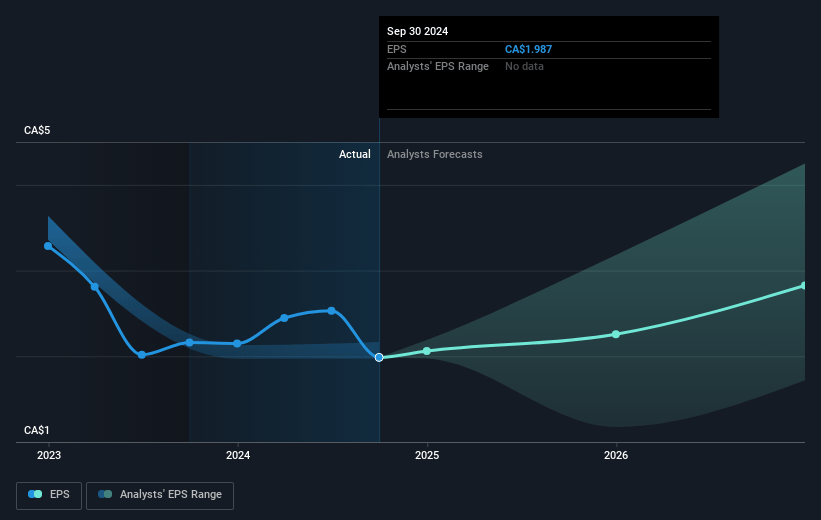

- Analysts expect earnings to reach CA$3.9 billion (and earnings per share of CA$2.48) by about May 2028, up from CA$3.1 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CA$4.6 billion in earnings, and the most bearish expecting CA$2.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.8x on those 2028 earnings, up from 9.8x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.5x.

- Analysts expect the number of shares outstanding to decline by 2.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.72%, as per the Simply Wall St company report.

Cenovus Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Canadian dollar's weakening relative to the U.S. dollar negatively impacted Cenovus's net debt, indicating currency exchange risk that could affect net earnings.

- The company's U.S. Downstream operating margin faced a shortfall of $396 million due to reduced crack spreads and heavy oil price differentials, which could continue to impact net margins if market conditions don't improve.

- The investment in growth capital remains high, with capital expenditures between $4.6 billion to $5 billion, raising concerns that long-term capital deployment might outweigh free cash flow benefits if operational targets are not met.

- Tariff uncertainties could affect the company's ability to effectively market barrels internationally, particularly in Asia, potentially impacting revenue streams if costs increase and demand decreases.

- The ongoing spending on major projects like West White Rose and Sunrise without immediate returns could strain Cenovus’s net debt reduction plan, threatening their capacity to maintain expected shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$25.676 for Cenovus Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$32.0, and the most bearish reporting a price target of just CA$18.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$59.2 billion, earnings will come to CA$3.9 billion, and it would be trading on a PE ratio of 13.8x, assuming you use a discount rate of 6.7%.

- Given the current share price of CA$16.76, the analyst price target of CA$25.68 is 34.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.