Last Update 22 Dec 25

CCO: Shareholder Value Will Rise On Takeover Momentum And Completed Asset Sales

Analysts have nudged their price target on Cameco modestly higher to reflect a slightly faster projected revenue growth rate and only marginally lower long term margin and valuation assumptions, which together support a fair value estimate of about $150.81 per share.

Analyst Commentary

Recent research updates reflect a generally constructive stance on Cameco, with analysts modestly increasing their price targets as they recalibrate assumptions for revenue growth, long term margins, and the broader uranium cycle. While the tone is skewed positive, the commentary also highlights execution and macro risks that could constrain further upside if not well managed.

Bullish Takeaways

- Bullish analysts point to accelerating demand visibility in the nuclear fuel market as justification for higher revenue growth assumptions, supporting a premium valuation relative to historical averages.

- Improving operational consistency and clearer production ramp plans are viewed as key drivers for maintaining resilient long term margin profiles, even if short term cost pressures persist.

- Stronger pricing power in contracted volumes, combined with disciplined capital allocation, is seen as enhancing free cash flow durability and underpinning confidence in the raised fair value estimate.

- Analysts also highlight that a more constructive regulatory and energy security backdrop could extend the current upcycle, providing upside optionality to both earnings forecasts and the target multiple.

Bearish Takeaways

- Bearish analysts caution that the recent upward revisions to growth expectations leave less room for error in execution, particularly around production ramp timing and project delivery.

- There is concern that any moderation in uranium prices or delays in contract renewals could compress margins, challenging the slightly richer valuation now embedded in models.

- Some caution remains around macro and policy risks, including shifts in energy policy or financing conditions, which could slow nuclear build out and reduce long term demand visibility.

- A subset of analysts notes that, following the target increase, Cameco is trading closer to the upper end of its historical valuation range, which may limit multiple expansion as a source of further share price appreciation.

What's in the News

- Cameco entered a strategic partnership with the U.S. Department of Commerce and Brookfield to accelerate deployment of Westinghouse nuclear reactors, with at least USD 80 billion in planned reactor investments aimed at bolstering U.S. grid reliability and AI related power demand (company announcement).

- The company issued 2025 guidance calling for consolidated revenue of USD 3.3 billion to USD 3.55 billion and up to 20 million pounds of U3O8 production (company guidance).

- Cameco reported third quarter 2025 uranium production of 4.4 million pounds, slightly above the prior year, while nine month uranium output declined to 15.0 million pounds from 17.3 million pounds in 2024, reflecting mine sequencing and ramp dynamics (operating results).

- The board declared an increased annual dividend of CAD 0.24 per common share, payable December 16, 2025 (dividend announcement).

Valuation Changes

- Fair Value Estimate remained unchanged at approximately CA$150.81 per share, indicating that offsetting assumption tweaks left the overall valuation intact.

- Discount Rate edged down slightly from 6.12 percent to 6.12 percent, reflecting a marginally lower perceived cost of capital.

- Revenue Growth rose modestly from about 7.37 percent to 7.56 percent, signaling slightly stronger top line expectations over the forecast horizon.

- Net Profit Margin eased slightly from roughly 35.30 percent to 35.21 percent, incorporating a minor step down in long term profitability assumptions.

- Future P/E dipped marginally from about 51.79x to 51.66x, suggesting a small reduction in the multiple applied to forward earnings despite the stable fair value estimate.

Key Takeaways

- Cameco is set to benefit from increasing global nuclear energy demand, policy support, and supply constraints, supporting long-term growth and pricing power.

- Strategic utility contracting and disciplined production enable Cameco to capitalize on higher uranium prices and future reactor projects for margin expansion.

- Delays in nuclear projects, operational and supply chain risks, and limited contracting activity threaten Cameco's revenue growth, profit margins, and earnings stability.

Catalysts

About Cameco- Provides uranium for the generation of electricity.

- Cameco stands to benefit from a global wave of new nuclear construction, driven by heightened government policy support, net-zero emission mandates, and growing energy security concerns-factors likely to accelerate demand for uranium and nuclear fuel, directly supporting higher long-term revenues.

- Momentum in utility contracting is building, but current volumes are subdued; as uncovered utility uranium needs through 2045 accumulate, the eventual surge in term contracting is expected to drive material price and volume upside, improving both Cameco's revenue growth and pricing power (with likely gains to net margins).

- Westinghouse (Cameco's 49% share) is poised for significant upside as dozens of planned gigawatt-scale reactors in the US, Europe, and Asia reach final investment decision (FID)-these builds are not yet in current business guidance, suggesting meaningful forward earnings and EBITDA improvement as project approvals materialize.

- Established Tier 1 production assets and a disciplined strategy of only bringing supply online in step with contract demand allow Cameco to capitalize on rising uranium prices without risking oversupply; this operational leverage supports margin expansion when demand materializes.

- Ongoing structural supply constraints in the uranium sector, combined with years of underinvestment and the need for Western-aligned, geopolitically secure fuel suppliers, further enhance Cameco's long-term volume and pricing opportunities, underpinning stronger forecast cash flows and sustained profitability.

Cameco Future Earnings and Revenue Growth

Assumptions

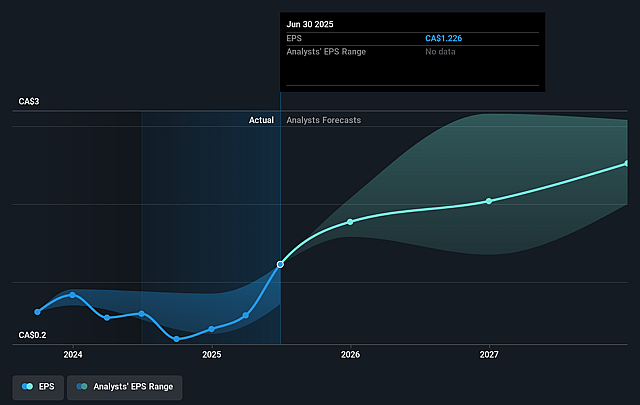

How have these above catalysts been quantified?- Analysts are assuming Cameco's revenue will grow by 2.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.9% today to 31.6% in 3 years time.

- Analysts expect earnings to reach CA$1.2 billion (and earnings per share of CA$2.8) by about September 2028, up from CA$533.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CA$1.3 billion in earnings, and the most bearish expecting CA$873 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 48.7x on those 2028 earnings, down from 86.9x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.97%, as per the Simply Wall St company report.

Cameco Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Delays and bottlenecks in final investment decisions (FID) for new nuclear reactor projects globally mean that many anticipated demand drivers for uranium and nuclear services are not yet included in Cameco's business outlook, risking slower revenue and earnings growth if these projects are further pushed out or canceled.

- Persistent operational challenges at key assets like McArthur River-including labor shortages, equipment commissioning issues, and the technical complexity of mining new areas-create significant production risk, which could lead to lower revenues and higher costs if mining targets are missed.

- Cameco's uranium cost advantage benefited in the current period from drawing down low-cost inventory, but future periods will see higher-cost purchases making up a larger share of supply, which may compress net margins if uranium market prices do not rise accordingly.

- Ongoing supply chain, geopolitical, and transportation risks-especially regarding deliveries from JV Inkai in Kazakhstan via the Trans-Caspian corridor-could disrupt Cameco's ability to source and deliver contracted uranium, impacting revenue and profitability.

- Market uncertainty and slow pace of long-term uranium contracting (with both spot and term contracting volumes down year-over-year) suggest utilities are deferring purchases, and without a sustained pick-up in contracting activity, Cameco may struggle to lock in future revenues, exposing earnings to volatility if demand does not materialize as expected.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$114.75 for Cameco based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$131.0, and the most bearish reporting a price target of just CA$100.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$3.9 billion, earnings will come to CA$1.2 billion, and it would be trading on a PE ratio of 48.7x, assuming you use a discount rate of 6.0%.

- Given the current share price of CA$106.49, the analyst price target of CA$114.75 is 7.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Cameco?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.