Key Takeaways

- CXI's strategic focus on ending loss-making operations and expanding in the U.S. is set to boost earnings and enhance net margins.

- Embracing cloud technology and expanding its digital platform aims to improve operational efficiency, increase scalability, and support sustained revenue growth.

- The discontinuance of Exchange Bank of Canada and increased regulatory and borrowing costs introduce uncertainties impacting overall profitability and net margins.

Catalysts

About Currency Exchange International- Together with its subsidiary, Exchange Bank of Canada, provides foreign exchange technology and processing services in Canada and the United States.

- The discontinuation of the Exchange Bank of Canada is expected to positively impact the overall group results by ceasing loss-making operations, allowing CXI to focus more on efficient and strategic growth in the U.S. market, ultimately benefiting earnings and net margins.

- The strategic move to a modern cloud computing environment for core transaction processing and client-facing systems is anticipated to improve operational efficiency and scalability, which can lead to improved net margins by reducing costs and enhancing revenue growth.

- The company's expansion of its OnlineFX platform to 45 states and recent network growth, including in states like Nebraska, is expected to drive revenue growth in the direct-to-consumer segment by capturing a larger market share and increasing sales through digital channels.

- The focus on growing banknotes and payment businesses in the United States, including the potential for increased agent relationships and new market entries, is likely to support sustained revenue growth by broadening the company's footprint and leveraging existing infrastructure.

- The company's Normal Course Issuer Bid (NCIB) to repurchase up to 5% of its common shares indicates a commitment to enhancing shareholder value, which can improve earnings per share (EPS) by reducing the number of outstanding shares.

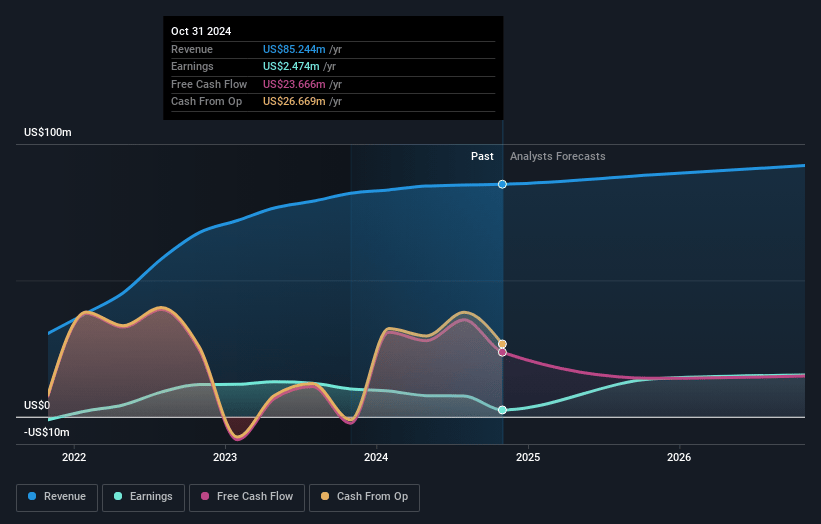

Currency Exchange International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Currency Exchange International's revenue will grow by 3.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.8% today to 41.5% in 3 years time.

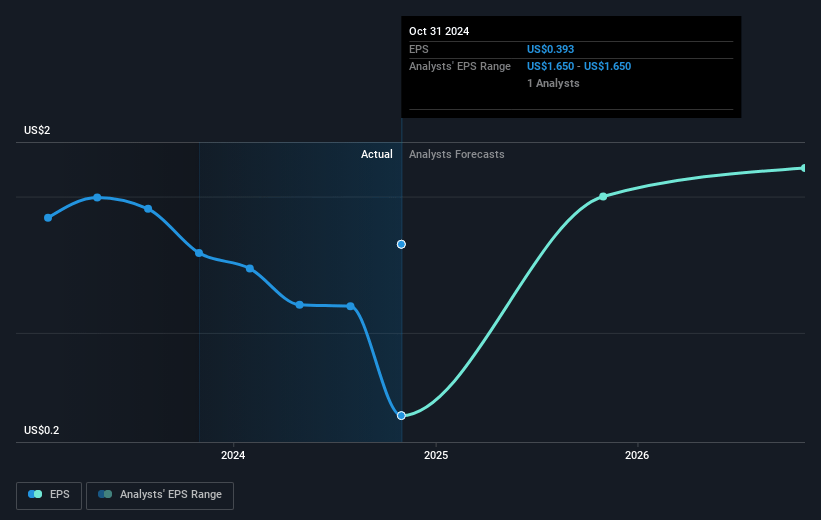

- Analysts expect earnings to reach $39.6 million (and earnings per share of $5.59) by about May 2028, up from $2.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 3.3x on those 2028 earnings, down from 36.9x today. This future PE is lower than the current PE for the CA Consumer Finance industry at 16.4x.

- Analysts expect the number of shares outstanding to decline by 1.96% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.7%, as per the Simply Wall St company report.

Currency Exchange International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decision to cease operations of the Exchange Bank of Canada introduces uncertainties and unknowns regarding the financial impact of its discontinuance, potentially affecting the overall revenue and profit margins of the group.

- The Canadian operation has been experiencing losses, impacting net profit, highlighted by an adjusted net loss of $572,000 in Canada compared to a $1.66 million adjusted net income in the United States.

- Regulatory compliance costs have increased operating expenses, particularly impacting net margins in Canada with a reported $280,000 in third-party advisory costs, reducing overall profitability.

- Volatility in foreign exchange markets, particularly with the Mexican Peso, has contributed to net foreign exchange losses, which could cause fluctuations and unpredictability in earnings.

- The higher interest rates on borrowings, which are at 8.7%, combined with increased borrowings ($6.2 million outstanding), might increase interest expenses, thus affecting net margins negatively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$29.996 for Currency Exchange International based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $95.5 million, earnings will come to $39.6 million, and it would be trading on a PE ratio of 3.3x, assuming you use a discount rate of 6.7%.

- Given the current share price of CA$19.85, the analyst price target of CA$30.0 is 33.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.