Key Takeaways

- Strong transaction pipeline and strategic partnerships could enhance revenue growth and investment returns, offering greater optionality for future deals.

- Focus on share buybacks and U.S. service-based investments signals potential earnings growth, revenue stability, and an increase in book value per share.

- Changes in accounting standards and reliance on leverage could obscure financial transparency and impact net margins amidst operational challenges and economic uncertainties.

Catalysts

About Alaris Equity Partners Income Trust- A private equity firm specializing in management buyouts, growth capital, lower & middle market, later stage, industry consolidation, growth capital, and mature investments.

- Alaris Equity Partners’ future growth could benefit from a strong pipeline of potential transactions, supported by new partnerships with large asset management companies that enable Alaris to engage in larger deals. This is anticipated to impact revenue growth and optionality for investment returns.

- The anticipated increase in partner resets by approximately $5 million in 2025 and the higher-than-expected common distributions are likely to enhance future revenue, indicating a positive growth trajectory.

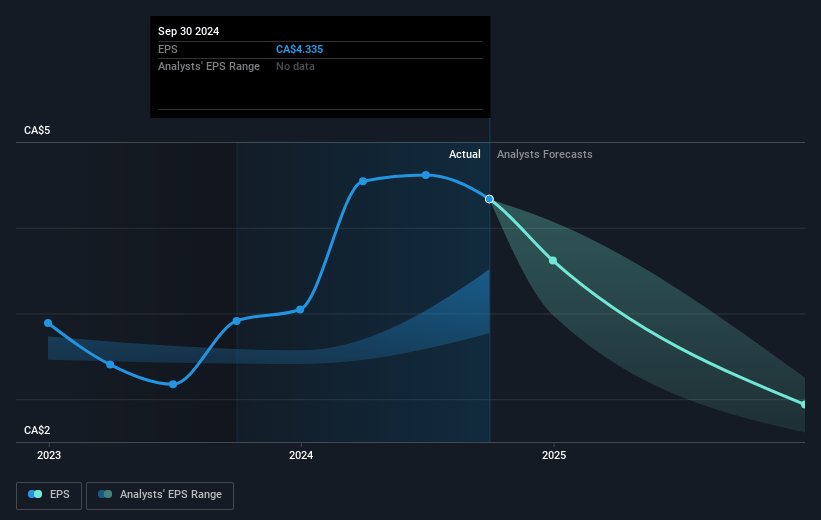

- Alaris’ strategic focus on share buybacks using free cash flows, with a plan to maintain a payout ratio of roughly 65%, suggests that earnings per share (EPS) could increase due to a reduced share count, contributing to a higher book value per share.

- The company's investment in service-based U.S. businesses, insulated from tariffs and economic turbulence, indicates sustainable cash flow and revenue stability that could bolster net margins, especially with 90% of revenue being in U.S. dollars.

- Increases in fair value of portfolio investments such as Fleet and Ohana, and anticipated recovery in EBITDA for some partners (e.g., Fleet’s recovery in 2025), highlight potential earnings growth and improvement in the overall valuation of Alaris’ investment portfolio.

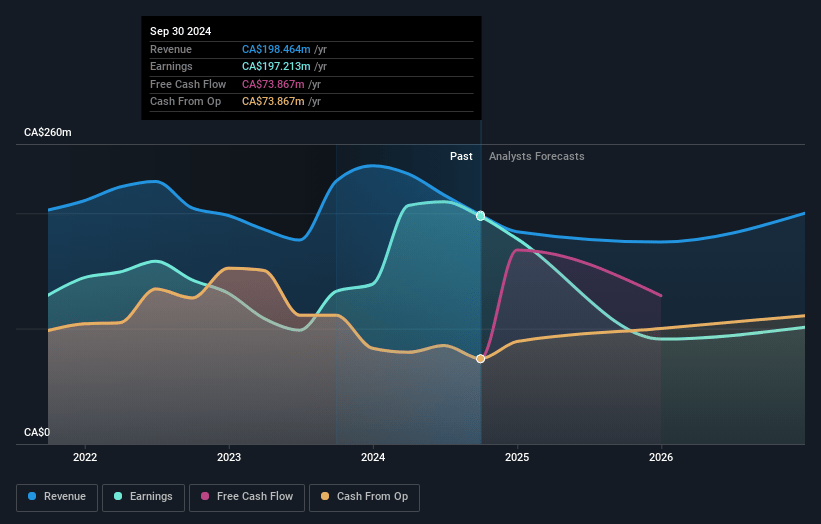

Alaris Equity Partners Income Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Alaris Equity Partners Income Trust's revenue will grow by 14.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 151.2% today to 23.9% in 3 years time.

- Analysts expect earnings to reach CA$54.7 million (and earnings per share of CA$1.04) by about April 2028, down from CA$234.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.9x on those 2028 earnings, up from 3.6x today. This future PE is greater than the current PE for the CA Capital Markets industry at 10.7x.

- Analysts expect the number of shares outstanding to grow by 0.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.8%, as per the Simply Wall St company report.

Alaris Equity Partners Income Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The change in accounting standards under IFRS 10 means Alaris no longer consolidates its investment entity subsidiaries. This could lead to misleading financial comparisons across periods, impacting clarity in reported revenues and earnings.

- The higher cost of advertising in the U.S. and declining conversion rates for Sono Bello could impact its EBITDA in the short term, affecting Alaris' revenue from this partner.

- Heritage's delayed return to profitability means it won't be able to support preferred distributions until 2026, affecting forecasted cash flow and net margins from this part of Alaris' portfolio.

- The potential impact of U.S. government spending cuts or tariffs could disrupt operations at partner firms like FMP, affecting the revenue and earnings from these companies within Alaris' investment portfolio.

- Despite a significant deployment pipeline, Alaris relies heavily on its revolver for funding and is planning an expansion of its debt facility. This reliance on leverage could impact net margins if interest rates rise.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$25.85 for Alaris Equity Partners Income Trust based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$229.3 million, earnings will come to CA$54.7 million, and it would be trading on a PE ratio of 25.9x, assuming you use a discount rate of 6.8%.

- Given the current share price of CA$18.5, the analyst price target of CA$25.85 is 28.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.