Key Takeaways

- Loblaw's investment in new stores, clinics, and a U.S. market expansion could drive significant revenue growth and geographic diversification.

- Strategic improvements in supply chain efficiency and digital engagement are expected to boost margins and enhance customer experience through cost savings and extended market reach.

- Inflationary pressures from the weak Canadian dollar and pricing challenges could strain Loblaw's costs, while strategy shifts and weather unpredictability may impact revenue and earnings stability.

Catalysts

About Loblaw Companies- A food and pharmacy company, provides grocery, pharmacy and healthcare services, health and beauty products, apparel, general merchandise, financial services, and wireless mobile products and services in Canada and the United States.

- Loblaw's plan to reinvest over $10 billion into the Canadian economy over the next 5 years, including opening 80 new stores and 100 pharmacist care clinics in 2025, is expected to drive revenue growth by improving access to affordable food and health care services.

- The expansion of the T&T brand into the U.S. market, beginning with the successful opening in Seattle, could significantly boost revenues as T&T taps into new geographic markets outside Canada.

- Loblaw's strategy to increase their number of hard discount stores, which are currently outperforming conventional stores, is expected to drive higher tonnage growth and sales volumes, leading to revenue growth.

- Plans to employ a new 1.2 million square foot fully automated distribution center to enhance supply chain efficiencies could improve net margins through cost savings and operational efficiencies once fully operational.

- The increased focus on digital engagement and online sales, which grew by 18.4% in the quarter, is likely to enhance revenue through an improved customer shopping experience and extended reach, particularly as delivery remains a strong-performing channel.

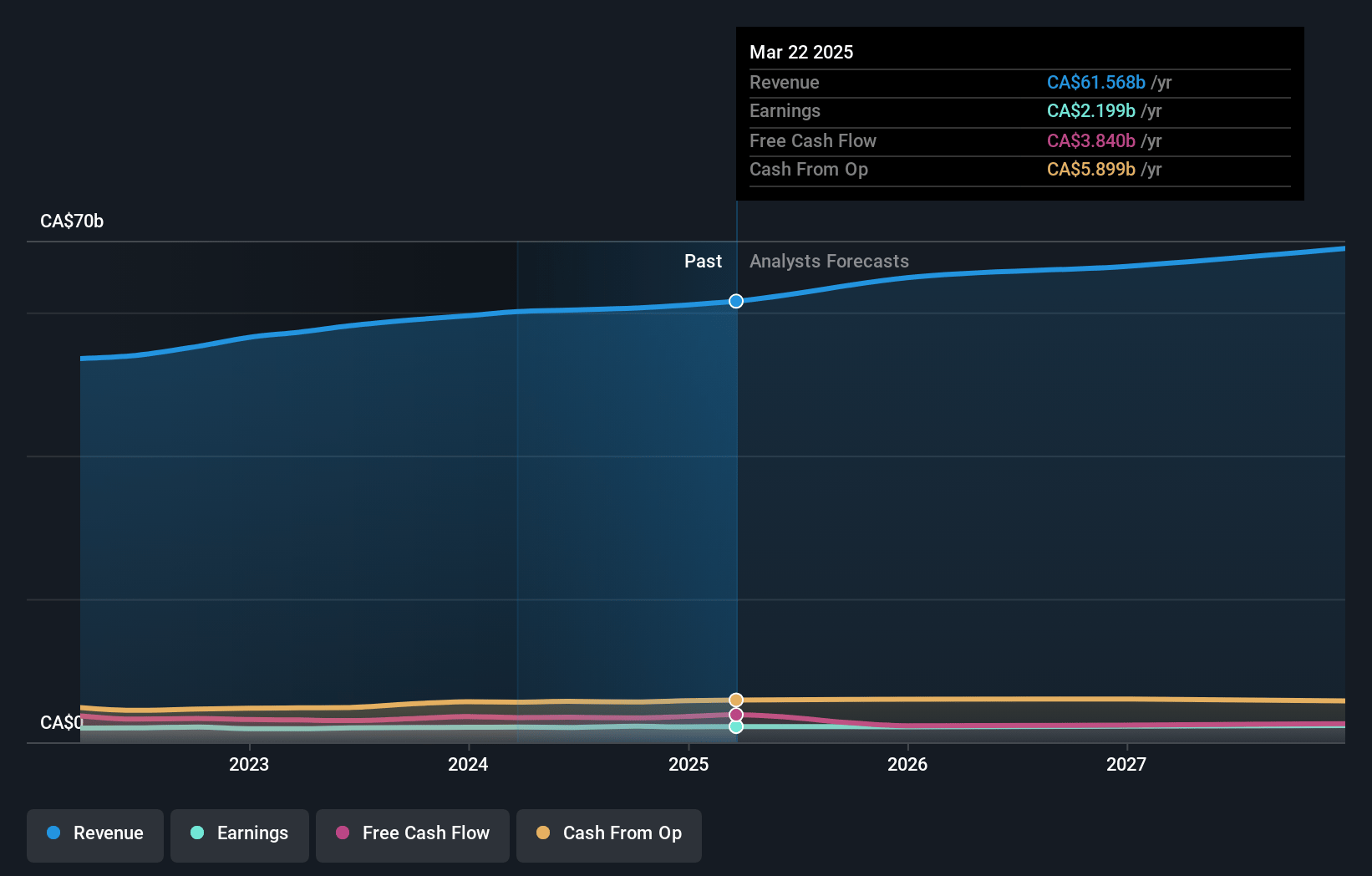

Loblaw Companies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Loblaw Companies's revenue will grow by 3.4% annually over the next 3 years.

- Analysts are assuming Loblaw Companies's profit margins will remain the same at 3.5% over the next 3 years.

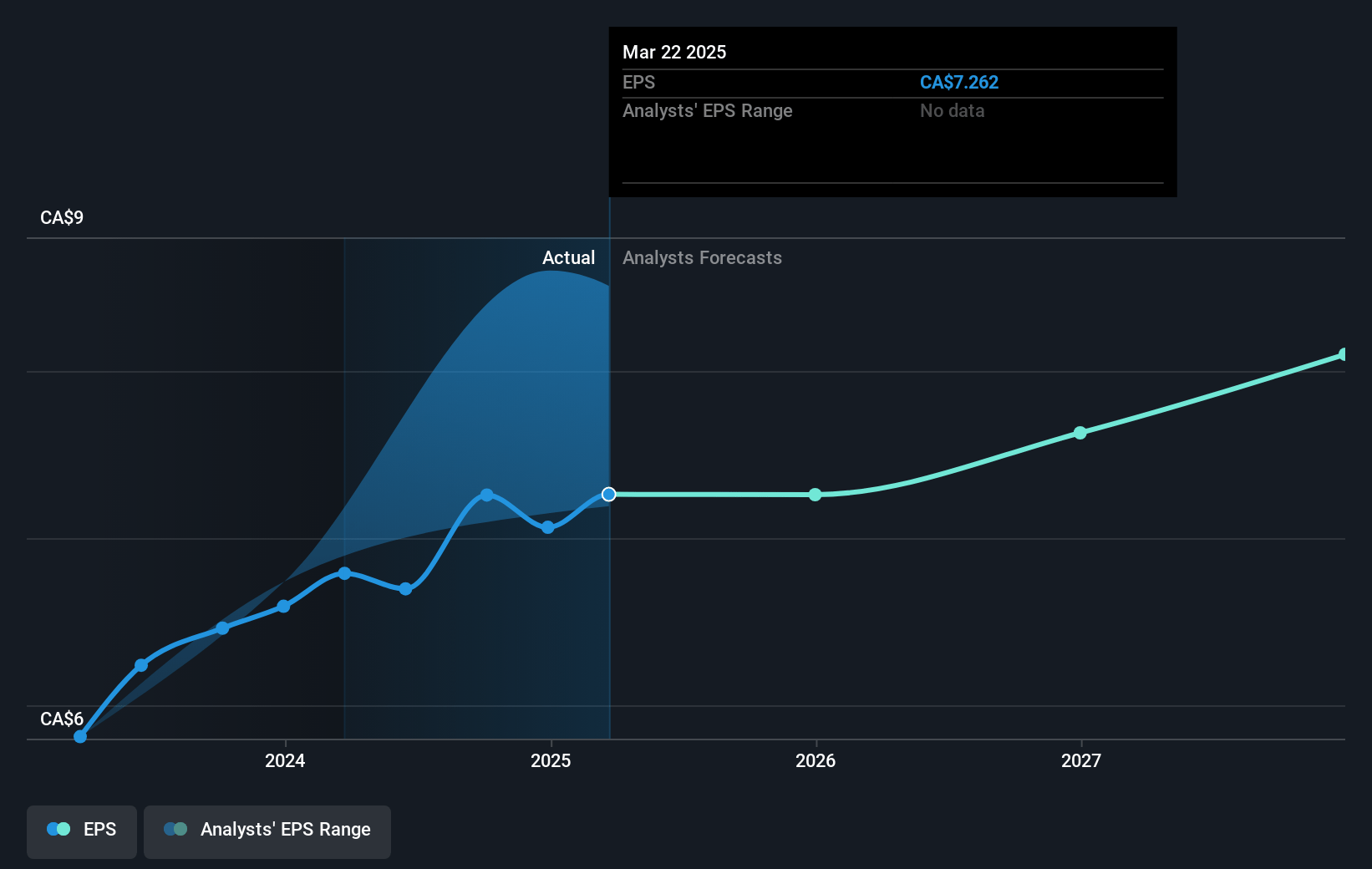

- Analysts expect earnings to reach CA$2.3 billion (and earnings per share of CA$9.55) by about April 2028, up from CA$2.2 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.8x on those 2028 earnings, up from 27.5x today. This future PE is greater than the current PE for the CA Consumer Retailing industry at 22.2x.

- Analysts expect the number of shares outstanding to decline by 2.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.31%, as per the Simply Wall St company report.

Loblaw Companies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decline in the Canadian dollar, which trades at its lowest level in over 20 years, could increase costs for U.S. imports, leading to inflationary pressures that might impact Loblaw's net margins.

- Continued higher-than-normal pricing increases from larger global vendors and the resulting necessity for Loblaw to push back against double-digit price increases could affect cost management strategies and future profitability.

- Engagement with the PC Optimum program has led to higher redemption rates, causing a non-cash charge this quarter. Increased redemption could result in higher costs in the long term, impacting net earnings stability.

- The decision to exit certain low-margin electronics categories could reduce front-store sales by about 1% in 2025, potentially impacting overall revenue streams from the Shoppers Drug Mart division.

- A mild fall led to weaker-than-expected sales in certain seasonal categories, such as cough and cold products, suggesting that unpredictable weather could affect inventory performance and, hence, revenue generation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$193.0 for Loblaw Companies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$215.0, and the most bearish reporting a price target of just CA$148.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$67.4 billion, earnings will come to CA$2.3 billion, and it would be trading on a PE ratio of 27.8x, assuming you use a discount rate of 6.3%.

- Given the current share price of CA$198.07, the analyst price target of CA$193.0 is 2.6% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.