Last Update01 May 25Fair value Decreased 7.78%

Key Takeaways

- Strategic expansion into international and healthcare markets, fueled by new legislation, is expected to diversify revenue and boost sales.

- The introduction of the One Gateway product and effective use of channel partners are driving sales growth and operational efficiency.

- The company's revenue growth may disappoint investors, with success reliant on legislative changes and security demand, while risks include margin compression and global economic challenges.

Catalysts

About Xtract One Technologies- Engages in the research, development, and commercialization of threat detection gateway solutions in the United States, Japan, France, the United Kingdom, and Canada.

- The company's record quarter for bookings and booking backlog, with $13.5 million reported in Q2 and a total booking backlog of $37 million, sets a strong foundation for future revenue growth.

- Expansion into international markets, driven by legislative changes similar to Martyn's Law, and the rapid expansion of demand in Europe and Asia, are expected to diversify the revenue stream and boost overall sales.

- Increased presence in the healthcare market, which now accounts for nearly 30% of all Q2 bookings, offers a significant opportunity for revenue growth, especially with new legislation in California mandating weapon screening by 2027.

- The introduction of the One Gateway product, which has generated strong interest in the education and manufacturing sectors, is expected to drive future sales and improve profit margins due to its innovative capabilities.

- The strategic use of channel partners has allowed the company to scale its operations efficiently, accounting for about 50% of total systems deployed and contributing to sustained revenue growth and improved net margins in the long term.

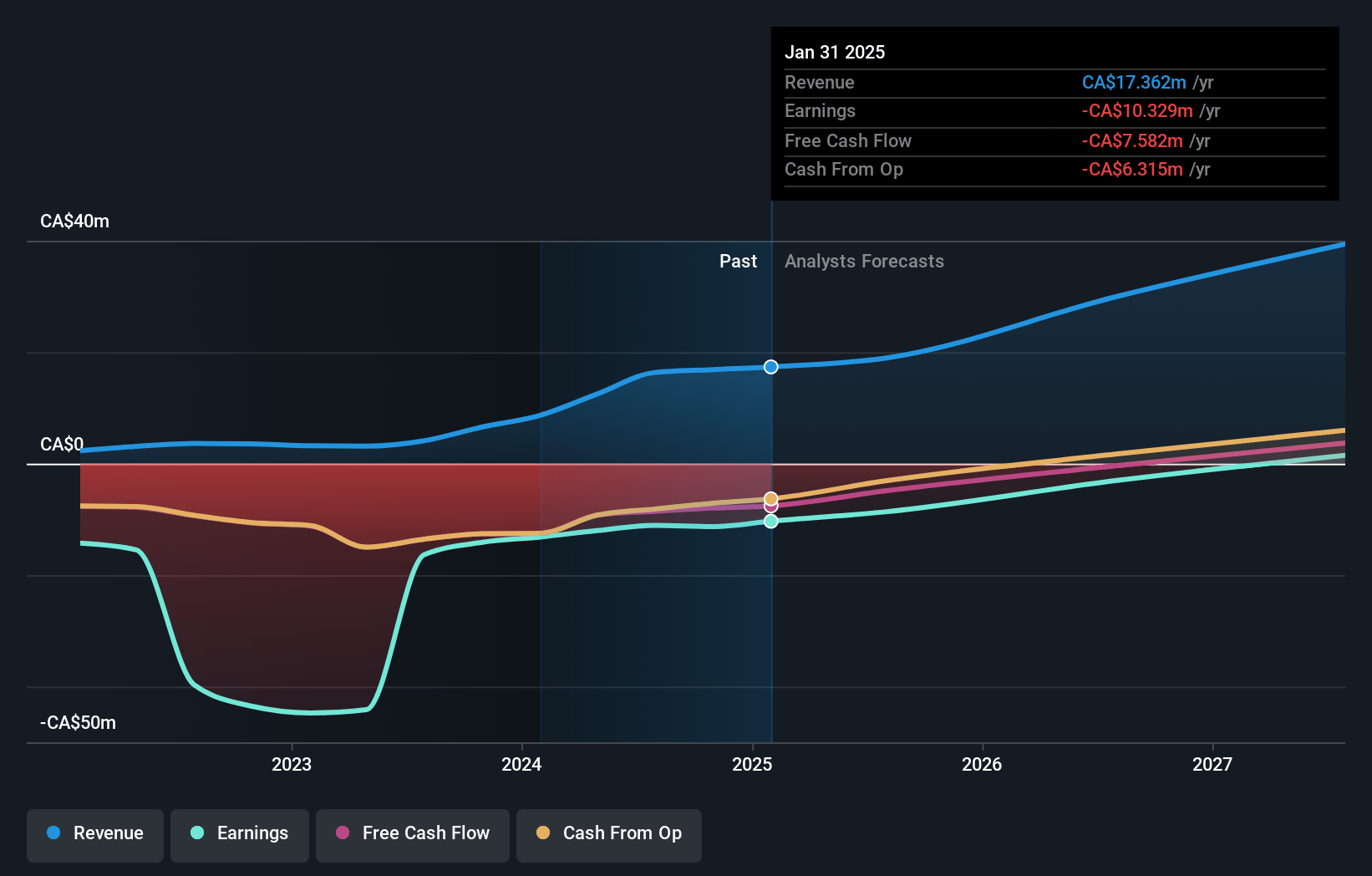

Xtract One Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Xtract One Technologies's revenue will grow by 39.1% annually over the next 3 years.

- Analysts are not forecasting that Xtract One Technologies will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Xtract One Technologies's profit margin will increase from -59.5% to the average CA Aerospace & Defense industry of 6.9% in 3 years.

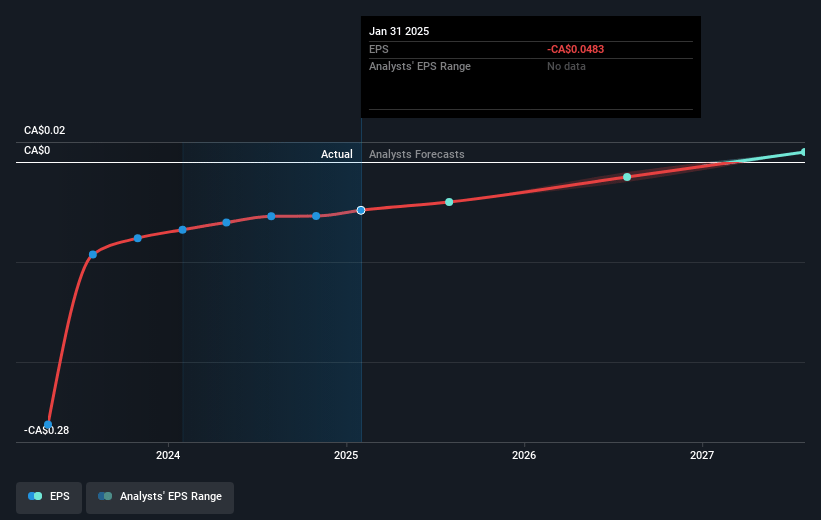

- If Xtract One Technologies's profit margin were to converge on the industry average, you could expect earnings to reach CA$3.2 million (and earnings per share of CA$0.01) by about May 2028, up from CA$-10.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 71.7x on those 2028 earnings, up from -8.6x today. This future PE is greater than the current PE for the CA Aerospace & Defense industry at 31.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.83%, as per the Simply Wall St company report.

Xtract One Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The revenue growth for the quarter was modest, increasing from $2.9 million to $3.4 million year-over-year, which may not satisfy investor expectations for rapid growth. This could impact future revenue forecasts if the growth does not accelerate as expected.

- The company's success seems heavily reliant on legislative changes and a growing demand for security solutions, particularly in healthcare and education. If these legislative changes are delayed or demand does not materialize as strongly, it could affect revenue projections.

- While gross margins improved to 70%, there is mention of potential margin compression as the company ramps up manufacturing for new products. If gross margins decline, this could impact net margins and profitability.

- The backlog of $37 million includes a significant portion of signed agreements pending installation. If there are delays in these installations, it could defer expected revenue recognition and impact short-term financial performance.

- Currency fluctuations and potential impacts from tariffs remain a risk, especially given the global expansion efforts and dependence on international demand, which could affect costs and net earnings if unfavorable economic conditions arise.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$0.9 for Xtract One Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$1.0, and the most bearish reporting a price target of just CA$0.8.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$46.8 million, earnings will come to CA$3.2 million, and it would be trading on a PE ratio of 71.7x, assuming you use a discount rate of 5.8%.

- Given the current share price of CA$0.4, the analyst price target of CA$0.9 is 55.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.