Key Takeaways

- Strategic sale of Highway 407 interest simplifies operations, reduces debt, and enhances shareholder value through acquisitions and share buybacks.

- Expansion strategies, including U.S. footprint growth and nuclear investment, align with high-demand market trends, supporting revenue and margin growth.

- Uncertainty in project timelines, financial challenges in major projects, and cash flow issues may strain AtkinsRéalis Group's growth and financial stability.

Catalysts

About AtkinsRéalis Group- Provides professional services and project management, and capital investment services in United Kingdom, Canada, the United States, Saudi Arabia, and internationally.

- The strategic sale of AtkinsRéalis' interest in Highway 407 is a significant move to simplify the business and focus on core operations in engineering services and nuclear. The proceeds from this sale will be used to pay down debt, fund acquisitions, and conduct share buybacks, potentially boosting EPS and enhancing shareholder value.

- The record backlog of $17.5 billion, driven by high growth in sectors like engineering services and nuclear, suggests robust future revenue pipelines. This positioning in high-demand markets such as energy transition and aging infrastructure replacement is expected to support continued revenue growth.

- Operational changes, including a focus on margin improvement measures and personnel changes in key regions, are anticipated to drive margin expansion. The company's stated target is to improve EBITDA margins to 16%-17% in 2025, indicating potential growth in operating income.

- The acquisition of David Evans Enterprises is a strategic move to expand geographic footprint in the U.S., with expected synergy in capabilities and client relationships. This aligns with the company’s expansion strategy and should drive revenue growth in high-demand markets like transportation and renewables.

- The investment in developing the MONARK nuclear reactor demonstrates a commitment to capturing future opportunities in low-carbon nuclear energy. Supported by government financing, this initiative is positioned to drive long-term growth in nuclear revenue, capitalizing on global demand for reliable power solutions.

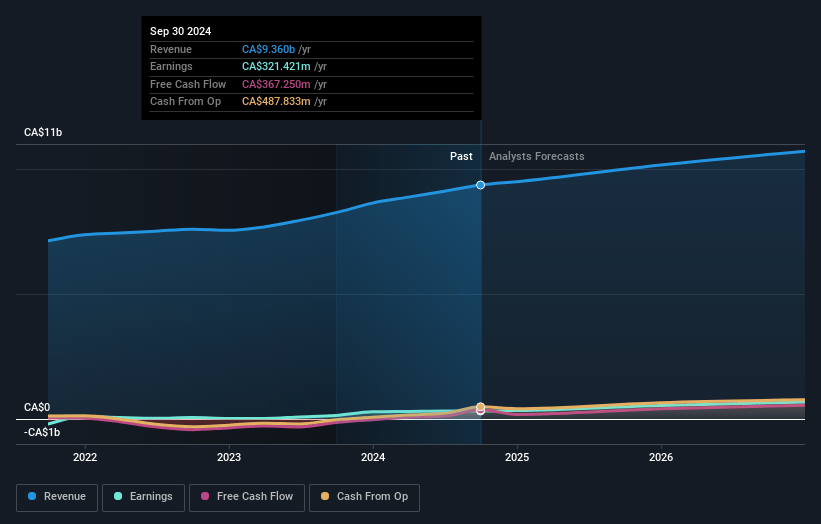

AtkinsRéalis Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AtkinsRéalis Group's revenue will grow by 7.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.9% today to 6.6% in 3 years time.

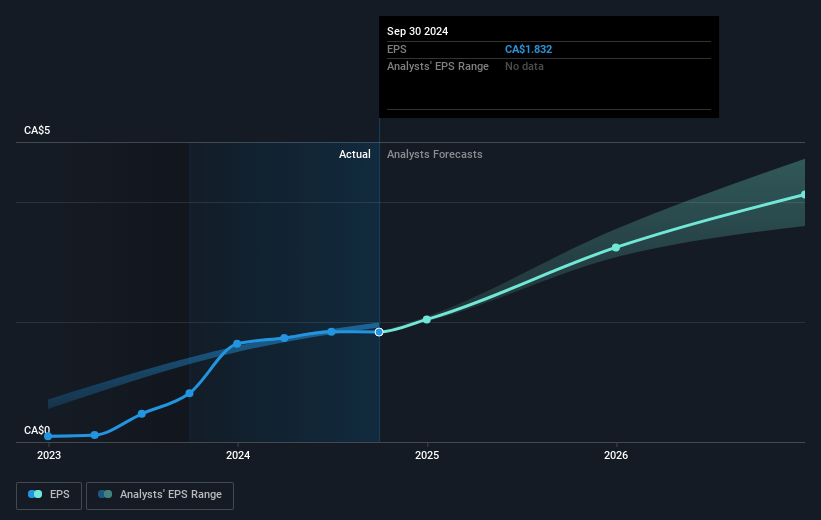

- Analysts expect earnings to reach CA$791.0 million (and earnings per share of CA$4.68) by about March 2028, up from CA$283.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.8x on those 2028 earnings, down from 41.4x today. This future PE is lower than the current PE for the CA Construction industry at 37.2x.

- Analysts expect the number of shares outstanding to decline by 0.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.24%, as per the Simply Wall St company report.

AtkinsRéalis Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The uncertainty of government projects in the UK and potential deferrals on transportation, education, and health projects could negatively impact regional revenue growth, especially if these delays persist. This would impact future revenue projections in these sectors.

- Challenges on two major projects, including elevated commissioning costs and delays on the Trillium Line and Eglinton projects, resulted in negative EBIT adjustments, which could continue to affect net margins if not resolved soon.

- The organic decline in revenue for the AMEA region, especially if growth moderates, could impact earnings if the company is unable to secure high-quality clients and projects to sustain its operations.

- The anticipated decrease in net cash from operating activities in 2025 could strain cash reserves, especially considering the significant advances predominantly from nuclear refurbishment contracts in 2024 that will be consumed going forward, potentially impacting liquidity.

- The structural changes with the sale of interest in Highway 407 and the uncertainty around the exercise of the additional share agreements could constrain capital availability for reinvestment or shareholder returns, affecting net margins and future growth investments.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$91.929 for AtkinsRéalis Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$107.0, and the most bearish reporting a price target of just CA$74.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$12.0 billion, earnings will come to CA$791.0 million, and it would be trading on a PE ratio of 24.8x, assuming you use a discount rate of 7.2%.

- Given the current share price of CA$67.24, the analyst price target of CA$91.93 is 26.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.