Key Takeaways

- Significant infrastructure investments and project delays may lead to overestimated near-term cash flows and pressure on net margins.

- Increased financial expenses and reliance on regulatory income create revenue uncertainty, with long-term revenue risks from expiring concessions.

- Taesa's innovation, cost management, and strategic financial stability position it for enhanced margins, growth, and revenue amidst macroeconomic opportunities and energy transition demands.

Catalysts

About Transmissora Aliança de Energia Elétrica- Engages in the implementation, operation, and maintenance of electric power transmission lines in Brazil.

- Taesa's significant investments in infrastructure and ongoing projects, totaling R$1.6 billion to R$1.8 billion for 2025, and an expectation of additional expenditures due to project delays, could lead to an overestimation of near-term cash flows and pressure on net margins.

- The macroeconomic outlook, which includes expected higher interest rates impacting the company's debt service costs, might result in increased financial expenses and reduced net income, especially as Taesa's leverage is expected to rise in 2025 before any potential deleveraging in 2026.

- The reliance on regulatory income and adjustments from IGP-M (a measure of inflation) means that the company's future revenue growth is heavily contingent on favorable macroeconomic conditions, which introduces uncertainty and could lead to compressed future revenue if these conditions do not materialize as expected.

- Future strategic initiatives focused on operational efficiency and cost optimization are ongoing, with expected completion timelines extending through 2025. While these are likely to eventually reduce OpEx, the immediate impact may be minimal given current investment and restructuring costs, potentially leading to stagnant or declining EBITDA margins in the short term.

- The anticipated end of concessions in 2030 and the focus on domestic auction participation without clear paths for international growth or contract renewal presents potential future revenue risks, impacting revenue predictability and growth forecasts in the long term.

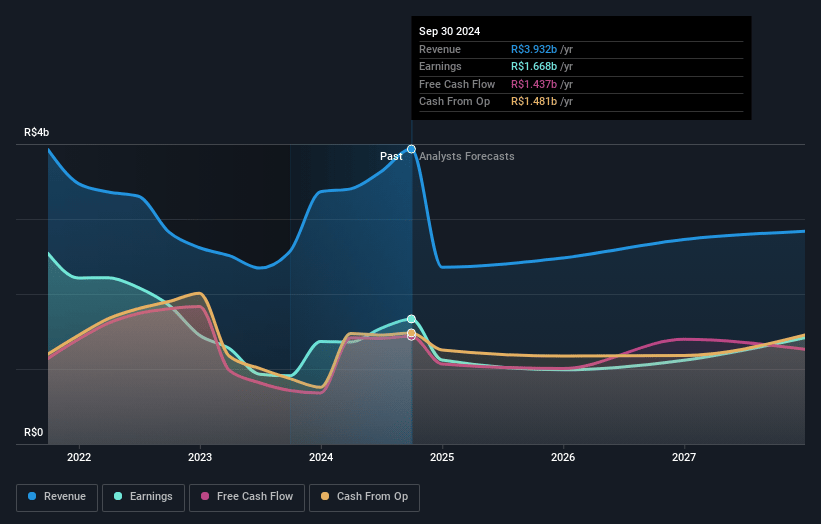

Transmissora Aliança de Energia Elétrica Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Transmissora Aliança de Energia Elétrica's revenue will decrease by 9.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 45.6% today to 50.6% in 3 years time.

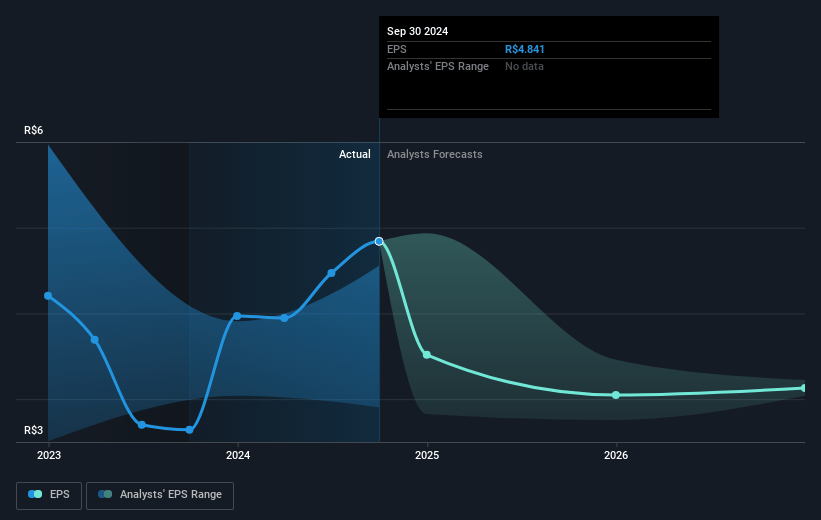

- Analysts expect earnings to reach R$1.4 billion (and earnings per share of R$2.25) by about May 2028, down from R$1.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.0x on those 2028 earnings, up from 7.4x today. This future PE is greater than the current PE for the BR Electric Utilities industry at 7.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.92%, as per the Simply Wall St company report.

Transmissora Aliança de Energia Elétrica Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Taesa's commitment to innovation and efficiency, including the creation of a shared services center and ongoing cost optimization with specialized consulting, suggests enhanced operational efficiency which may positively affect net margins and earnings.

- The company has made significant progress in energizing projects like Novatrans and Pitiguari ahead of schedule, indicating potential for increased revenue streams from these projects in the near future.

- Despite inflationary pressures, Taesa's operating costs showed a minimal increase, below the inflation rate, demonstrating effective cost management which could positively impact net margins and overall profitability.

- Taesa's maintained high credit rating (AAA by Fitch) and strong strategic financial management suggest continued ability to secure favorable financing, contributing positively to financial stability and possibly enhancing earnings.

- The macroeconomic outlook, including expected increases in IGP-M and IPCA, as well as expansion opportunities in the domestic market due to energy transition demands, presents potential for increased revenue and growth in the coming years.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$33.614 for Transmissora Aliança de Energia Elétrica based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$37.46, and the most bearish reporting a price target of just R$30.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$2.8 billion, earnings will come to R$1.4 billion, and it would be trading on a PE ratio of 13.0x, assuming you use a discount rate of 16.9%.

- Given the current share price of R$36.16, the analyst price target of R$33.61 is 7.6% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.