Key Takeaways

- Expansion through auctions and new projects aims to increase revenue and improve margins via efficiency and reliability gains.

- Focus on increasing consumer base and operational efficiency, with AI integration, is expected to boost earnings and reduce costs.

- Eletrobras's focus on hydroelectric generation and aggressive expansion poses financial risks and unpredictability, affecting revenue stability and net margins amid regulatory and geopolitical challenges.

Catalysts

About Centrais Elétricas Brasileiras - Eletrobrás- Through its subsidiaries, engages in the generation, transmission, and commercialization of electricity in Brazil.

- The company is implementing a trajectory of strong growth for generation and transmission by actively participating in auctions, which is expected to increase future revenue streams.

- The focus on adding thousands of new consumers in the free energy market and creating enhanced energy solutions suggests potential revenue growth from an expanding customer base.

- Investments in new projects such as wind farms and the connection of isolated regions are expected to bolster asset availability and reliability, likely leading to improved net margins through efficiency gains.

- The continuous reduction of liabilities, alongside prudent financial management and integration of new technologies, is expected to improve net margins by reducing financial costs.

- The strategic focus on operational efficiency and leveraging artificial intelligence for asset monitoring is anticipated to enhance earnings through better resource management and cost reduction.

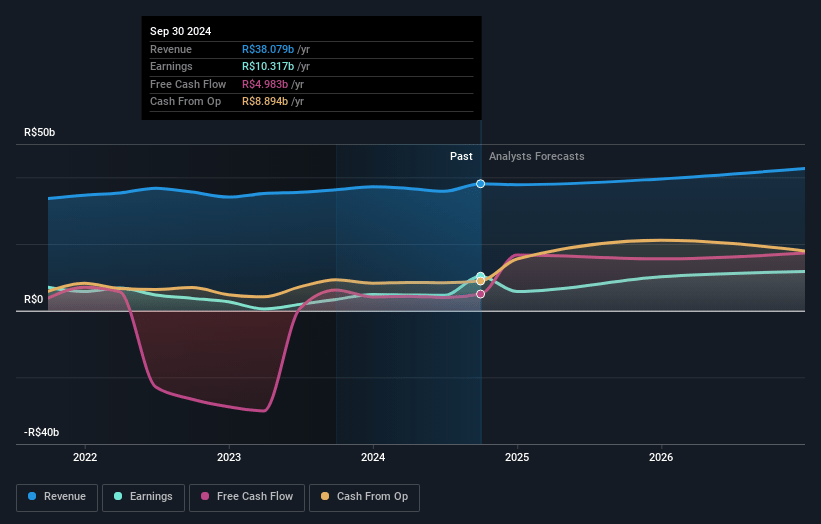

Centrais Elétricas Brasileiras - Eletrobrás Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Centrais Elétricas Brasileiras - Eletrobrás's revenue will grow by 1.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 25.8% today to 25.7% in 3 years time.

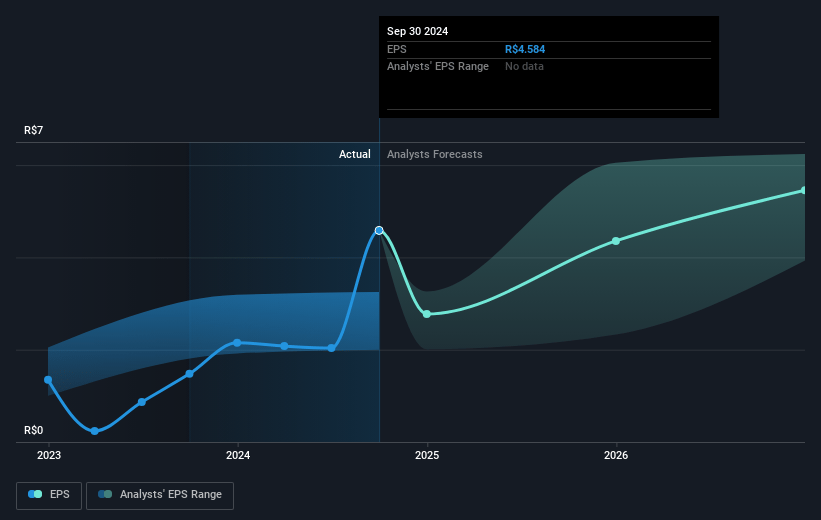

- Analysts expect earnings to reach R$10.8 billion (and earnings per share of R$5.67) by about March 2028, up from R$10.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.4x on those 2028 earnings, up from 7.6x today. This future PE is greater than the current PE for the US Electric Utilities industry at 7.8x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.92%, as per the Simply Wall St company report.

Centrais Elétricas Brasileiras - Eletrobrás Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Eletrobras faces risks associated with its significant involvement in hydroelectric generation, where volatility in energy prices due to weather patterns and intermittent renewable sources could impact revenue stability.

- The company's focus on aggressive expansion through auctions and greenfield investments without a clear execution track could expose it to financial risks, potentially affecting net margins if projects run over budget or face delays.

- Despite marked reductions, the substantial historical liabilities, including compulsory loans and CDE payments, still present potential financial strains, possibly impacting net earnings if not managed properly.

- Seasonal fluctuations in operating costs and the ongoing transformation of internal processes may lead to unpredictable expense patterns, influencing overall profitability and net margins.

- Regulatory and geopolitical risks, particularly in how reinvestments and improvements in transmission are received by regulators, could alter expected financial returns, impacting long-term revenue projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$54.182 for Centrais Elétricas Brasileiras - Eletrobrás based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$42.0 billion, earnings will come to R$10.8 billion, and it would be trading on a PE ratio of 11.4x, assuming you use a discount rate of 16.9%.

- Given the current share price of R$44.29, the analyst price target of R$54.18 is 18.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.